Dr. Booth’s Responses to Dr. Michael J. Vilbert and Dr.... Information Resquest No.1

advertisement

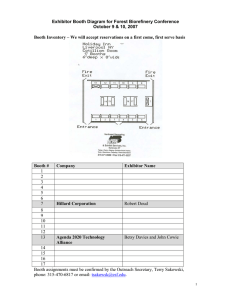

Dr. Booth’s Responses to Dr. Michael J. Vilbert and Dr. A. Lawrence Kolbe’s Information Resquest No.1 Answer 1.1 On page 58 of Dr. Vilbert’s testimony he states that he uses Bloomberg betas for the Canadian LDcs over what would normally be regarded as nonstandard weekly returns. These betas are adjusted towards one. In a seeming contradiction Dr. Vilbert does not adjust his US sample’s betas and Dr. Booth notes this at line 11 where he references the beta adjustment for Dr. Vilbert’s Canadian sample. Answer 2.1 The following is a graph of the actual quarterly GDP from 1978Q1 through 1983Q4. The drop in GDP started in 1980Q2 and the economy recovered slightly and then the real drop was in 1981Q3 and lasted through 1982Q4 or six quarters. GDP did not get back to its level of 1981Q3 until 1983Q3. R-3690-2009 ACIG-6 – Doc. 6 Page 1 of 49 Quarterly GDP 680000000000 660000000000 640000000000 620000000000 600000000000 580000000000 560000000000 19 78 Q 19 1 78 Q 19 2 78 Q 19 3 78 Q 19 4 79 Q 19 1 79 Q 19 2 79 Q 19 3 79 Q 19 4 80 Q 19 1 80 Q 19 2 80 Q 19 3 80 Q 19 4 81 Q 19 1 81 Q 19 2 81 Q 19 3 81 Q 19 4 82 Q 19 1 82 Q 19 2 82 Q 19 3 82 Q 19 4 83 Q 19 1 83 Q 19 2 83 Q 19 3 83 Q 4 540000000000 Answers 3.1, 2 & 3 Dr. Booth has made no reference to the effective tax rates of these UHCs since they are not the regulated utility to which the ATWACC would be applied. Dr. Booth would assume that their statutory tax rates would only diverge based on their provincial filing status. Further the point of the referenced passage was not to Dr. Vilbert’s estimates but the fact that differences in tax rate assumptions and estimates can lead to unfair and unreasonable ROEs. This is particularly true if some form of ATWACC adjustment mechanism is attempted to avoid frequent repetitive rate hearings, since differences in tax rates has the same sort of impact as differences in embedded interest costs. R-3690-2009 ACIG-6 – Doc. 6 Page 2 of 49 . Answer 4.1 Confirmed that risk aversion is time varying and there is circumstantial evidence that it increased in the Fall of 2008. Evidentiary support (journal articles etc) for what happened is unlikely to be forthcoming for many years. Further expectations of the future cash flows also fall making it difficult to work out how much is due to one factor versus another. This is clear from the significant downward revisions in both EPS and DPS estimates during the first half of 2009. Answer 4.2 Not true, as the huge volume of trading indicates. No “peer reviewed” journal articles or books are needed for the obvious fact that for every seller there is a buyer and lots of people are now entering the market hunting for bargains as the stock market is on a 50% off sale. Also see the RBC article provided by Dr. Booth in response to Regie IR 2/1 indicating that the market’s risk appetite has increased: R-3690-2009 ACIG-6 – Doc. 6 Page 3 of 49 Answer 5.1 Academic research on a crisis that is barely over is a tall order and support may not be forthcoming in any substantial way for many years. Of note is the following paper from a Ph.d student on the job market last year who was quick off the mark. It does not entirely address the issue but indicates that 2/3 of the spread increase was liquidity and only 1/3 credit related: R-3690-2009 ACIG-6 – Doc. 6 Page 4 of 49 Answer 5.2 The table on page 73 is from a published paper and was not produced for this hearing. However, the following table includes data on the total value of trading over the last two years.1 In all cases the value is in terms of $ million. The total value of shares traded on the TSX in December 2008 was $111,339 million, whereas the total bond market trading in Canada was $85,170 million or 76% of the equity market. A month by month comparison indicates that the overall value of trades is about the same, but the transaction size in the bond market is much larger, so the number of trades in the equity market is much greater. Further the bond market is broken up into many different types of bonds, whereas the equity market is more homogeneous since most firms only have one or two types of shares outstanding. The total also includes all parts of the bond market. The second table is of the major parts of the bond market relative to the equity market, that is, the Canada bond market, the provincial bond market and the corporate bond market. What this shows is the vast majority of the bond trading is for 1 The data is from Tables F3 and F12 of the Bank of Canada’s Banking and Financial Statistics. R-3690-2009 ACIG-6 – Doc. 6 Page 5 of 49 Canada bonds, the corporate bond market is barely 1-2% of the trading in the equity market and this is scattered over many different issues sometimes by the same issuer. The table also shows the relative drop in trading corporate bonds from 3% to 1%. 2006 D 2007 J F M A M J J A S O N D 2008 J F M A M J J A S O N D R-3690-2009 Crowns Provincials Corporates 14,007 10,243 3,078 5,476 12,268 3,085 7,018 12,068 3,358 14,713 10,883 4,330 7,355 11,877 4,076 7,991 10,628 3,619 17,319 14,499 4,093 5,631 8,597 3,114 7,506 11,945 2,839 19,138 12,250 3,754 9,872 10,708 4,103 10,342 10,270 2,215 14,094 11,704 2,311 8,954 11,315 1,875 9,487 9,177 2,613 18,040 9,340 2,290 11,886 12,522 2,706 8,824 9,271 2,934 16,708 11,891 3,174 9,738 8,991 1,741 10,450 7,262 1,686 19,319 11,380 1,985 12,603 7,450 1,653 11,834 10,398 2,360 10,967 8,203 1,580 $ Millions Muni 216 139 148 141 170 233 321 191 88 153 430 306 200 112 143 130 300 164 360 124 108 228 196 349 209 Banks 2,522 1,389 1,569 1,645 1,354 1,657 2,976 2,674 2,489 3,093 3,147 2,759 2,466 1,690 2,936 2,621 2,973 2,130 2,982 1,992 1,491 2,450 1,984 1,922 1,731 AB 1,747 766 1,048 805 1,718 1,278 1,876 944 1,117 967 1,250 788 1,305 660 668 931 870 649 1,181 1,005 692 873 1,226 2,281 620 Maple 557 804 799 1,010 798 1,088 967 627 910 511 716 587 338 338 367 367 420 520 343 381 283 409 282 567 494 Domestic 140,410 123,823 133,144 156,609 122,545 138,057 190,583 113,684 144,176 168,062 129,787 132,226 128,316 124,137 133,482 154,015 127,347 114,307 142,846 99,021 88,809 140,494 112,714 119,799 85,170 TSX 103,614 128,941 122,599 134,644 124,158 155,025 152,561 152,257 157,511 129,817 162,881 157,161 119,631 171,669 137,618 163,821 153,035 163,202 166,809 176,626 122,205 194,572 173,718 118,551 111,339 ACIG-6 – Doc. 6 Page 6 of 49 2006 D 2007 J F M A M J J A S O N D 2008 J F M A M J J A S O N D R-3690-2009 Canadas Provincials Corporates 104% 10% 3% 77% 10% 2% 87% 10% 3% 91% 8% 3% 77% 10% 3% 72% 7% 2% 97% 10% 3% 60% 6% 2% 74% 8% 2% 99% 9% 3% 61% 7% 3% 67% 7% 1% 80% 10% 2% 58% 7% 1% 79% 7% 2% 73% 6% 1% 63% 8% 2% 55% 6% 2% 64% 7% 2% 42% 5% 1% 55% 6% 1% 53% 6% 1% 50% 4% 1% 76% 9% 2% 55% 7% 1% ACIG-6 – Doc. 6 Page 7 of 49 Answer 6.1 Dr. Booth does not state that illiquidity is the main factor driving credit spreads. Although the article provided in response to IR #5 indicates it is. Dr. Booth states that there are a variety of factors that affect default (credit) spreads and disentangling them is extremely difficult. Further the critical feature of this recession has been the financial crisis and liquidity in the capital market has been a major concern, which is why the US Fed has had to introduce so many special programs. It has even had to divert billions to encourage bond funds to invest in distressed mortgage related debt instruments to try and generate liquidity and transparent market prices. This is not typical of a recession and would not be captured in any empirical studies published prior to 2008. Answer 6.2 Dr. Booth has not relied on any specific article. Instead he has relied on the seminars and conferences he has attended in his 31 years as a University of Toronto faculty member and the fact that liquidity is a key component of market microstructure. In an effort to be helpful, Dr. Booth has included an elementary review paper (das et al.pdf) since the citations are relatively recent. As the authors note “Theoretical models of liquidity have been prevalent in the market microstructure literature for almost three decades.” Even before the current crisis they estimated the liquidity component of the credit spread at 20-35% of the total spread and during the current financial crisis it was obviously much greater. Answer 7.1 Analysts certainly provide research reports and Dr. Booth has found them to be useful. He would assume that others do so as well. However, if the sell-side analysts reports were really useful there would be little need for buy-side analyst reports, which also exist. After all why would it be necessary to repeat what sell side analysts are doing if they were perfect? R-3690-2009 ACIG-6 – Doc. 6 Page 8 of 49 Answer 7.2 Stock markets react to analyst reports, whether the reaction is significant depends on the definition of significant. The reaction also depends on whether the analyst is a “star” or not and the number of competing analysts. Any stock market reaction also has to be judged over the time horizon, like many financial events there is both a short and long run effect. Answer 7.3 Not confirmed as there is no definition of “relies on.” It is true that since IBES made analyst forecasts easily available for analysis there has been an explosion in analyst research. Most of this is concerned with the bias and the short run market reaction. However some of the research uses the growth rates to estimate equity costs as the sources referenced in Dr. Booth’s testimony do. However, these sources also note the bias and in the case of Easton and Summers document and analyze the bias. These papers would be regarded as research that relies on analyst growth forecasts. However these papers do not accepts analyst forecasts without adjusting for the bias. Answers 8.1 and 8.2 Dr. Booth is not aware of any research that has been done on the optimism bias among Canadian analysts for the simple reason that the main source of the data is IBES, which is US centric. Dr. Booth would note that despite Canadian companies being followed by large numbers of analysts in Canada very few of them are in the IBES data base. Dr. Vilbert has implicitly acknowledged this in his estimation procedures since he points out how few estimates he has for some Canadian stocks. Further it has to be emphasized that Dr. Booth does not rely on analyst growth forecasts, since they have been shown to be biased. It is up to those who use these forecasts to show that their estimates are not biased not Dr. Booth. R-3690-2009 ACIG-6 – Doc. 6 Page 9 of 49 Answer 9.1 The preamble is argument, which Dr. Booth does not accept. A conflict of interest is an economic phenomenon that does not go away simply because of regulation. In the same way speeding is illegal but Dr. Booth notes that it is impossible to drive from Toronto to Montreal without noticing that the majority of the traffic is speeding. The referenced examples came from the New York Times which did not mention the dates and references of the individual occurrences, which in any event are not relevant to Dr. Booth’s testimony. Answer 9.2 No. As Dr. Booth has pointed out there are cultural and other differences between the US and Canada. Answer 9.3 Yes, there are also regulatory actions against insider trading, option backdating and other examples of corporate malfeasance. Dr. Booth would also note that these conflicts of interest have always existed, which is why there have always been barriers or “Chinese walls” across various parts of an investment bank for regulatory reasons. The size and scope of the Global Settlement and the penalties meted out to those who admitted fraud indicate the fact that these conflicts of interest were illegal prior to 2002, but that personal interest still led some individuals to commit fraud. While fraud is the extreme it underlines the basic tension. Optimism does not imply fraud but optimism is well documented and reflects human nature. Answer 9.4 Dr. Booth is not a policeman and has no idea how many investigations are currently under way as a result of conflicts of interest in Canadian investment banks. R-3690-2009 ACIG-6 – Doc. 6 Page 10 of 49 Answer 10.1 True. Dr. Booth accepts that there are many incentives for firms to produce unbiased accurate research. However, there are incentives to do the opposite and the record in the US with the Global Settlement and the academic evidence on the optimistic (biased) nature of analyst forecasts means there are grounds for believing that the conflict of interest is real. Dr. Booth therefore believes that those who use analyst forecasts should either show that they are unbiased or indicate how the forecasts have been adjusted for the bias, as the forerunner of the AUC, the AEUB, has previously indicated Answers 11.1 & 11.2 Dr. Booth estimates betas over 60 months on a rolling basis so for example for the first 6 years of data there are 12 estimates. For the full sample of both sub index and firm betas there are thus hundreds of beta estimates since the estimates use data going back in some cases to 1956. The efficient way that Dr. Booth uses to estimate these betas is through the standard definition of the regression coefficient as the covariance of the dependent and independent variable divided by the R-3690-2009 ACIG-6 – Doc. 6 Page 11 of 49 population variance of the independent variable. No “statistics” are calculated and goodness of fit statistics (Chi square) are not relevant to least squares regression procedures. The beta data for schedule 13 is attached as old index beta data sked 13.pdf and the new ones as new subindex beta data skeds 14 and 17.pdf Answer 12.1 The specific references to the Alberta EUB decisions are on page 2 of Dr. Booth’s main testimony where the Alberta EUB stated they would be derelict in the exercise of their statutory responsibilities to accept the premise of ATWACC and in Appendix B page 17 where they stated that to accept it would produce estimates that violated the fair return standard. The Alberta EUB used much stringer works than suspect to reject ATWACC. R-3690-2009 ACIG-6 – Doc. 6 Page 12 of 49 Answers 13.1 & 13.2 Both are correct in showing that either using ATWACC directly or indirectly using the flat ATWACC assumption you can make a recommendation for an EBIT of $17.6 million and an ROE of 12.6%, which from the construction of the example is unfair and unreasonable. This is because the example was constructed where the fair ROE was 12% and EBIT $`17 million to start out with. The above examples illustrate why the Alberta EUB stated that they could not accept ATWACC since it implies leverage adjustments (ROE estimates) that are so large as to violate the fair return standard. R-3690-2009 ACIG-6 – Doc. 6 Page 13 of 49 Answer 14.1 Dr. Booth fails to see the link between this question and his testimony, which could be a pagination problem. However, without referencing his testimony he would state that risk is exogenous, that is external to the firm, whereas debt financing is endogenous, ie., a reaction by the firm. In reaction to higher business risk we would expect the equilibrium debt ratio to go down due to bankruptcy and distress costs. This is standard financial theory and practice. Answer 14.2 business risk. A lower debt ratio is not a sufficient condition for anything; it is a corporate reaction to Answer 15.1 The accounting definition is that net income equals (EBIT-interest costs)* (1-tax rate) R-3690-2009 ACIG-6 – Doc. 6 Page 14 of 49 Answer 15.2 Reported equity returns are after tax Answer 16.1 The ATWACC formula is on page 13 where it is the market valued equity weight times the equity cost plus the market valued debt weight times the after tax debt cost . In this case ATWACC = 0.677 * 0.14 + 0.323* .098*(1-.5) = 11.1% Answer 16.2 Similarly ATWACC = 0.677* 0.15 + 0.323* 0.98*(1-.5) = 11.7% R-3690-2009 ACIG-6 – Doc. 6 Page 15 of 49 Answer 17.1 This is the interpretation of Dr. Kolbe or Dr. Vilbert; it is not what Dr. Booth states. Only the NEB knows what lead it to believe that an ATWACC of 6.4% was fair for TQM. However, in footnote 38 on page 81 the NEB states Clearly the NEB felt the need to justify the ATWACC by converting it into a conventional ROE & Capital structure award. Whether they started with the footnote and came up with the ATWACC or started with the ATWACC and came up with the footnote is unknown but what is certain is that the NEB was very aware of the implications of its decision for traditional rate making purposes. No, Dr. Booth does not state that. Going into the hearing TQM was looking for a 36% common equity ratio and the NEB formula ROE as they clearly stated in their Annual Report. What the NEB gave TQM was significantly more than TQM could have expected. Dr. Booth’s remarks are simply directed at the fact that what became clear in RH-1-2008 was that the NEB regarded TQM as fully integrated into the Mainline and deserved the same 40% common equity ratio that the Mainline was operating with. Answer 17.2 Answer 18.1 Provided as Fernandes.pdf. R-3690-2009 ACIG-6 – Doc. 6 Page 16 of 49 Answer 19.1 Dr. Booth collected the following data. He has not included Gaz Metro or Fort Chicago since they are partnerships paying out the bulk of their income or Canadian Utilities Ltd, where data was not available. Otherwise all of these large utilities have increased their dividend during the current financial crisis, even little crisis prone PNG. Fortis 2/4/2009 11/5/2008 8/6/2008 5/7/2008 2/6/2008 11/7/2007 8/8/2007 5/2/2007 1/31/2007 11/1/2006 8/2/2006 2/1/2006 11/2/2005 R-3690-2009 Emera 0.26 0.25 0.25 0.25 0.25 0.21 0.21 0.21 0.19 0.19 0.16 0.16 0.16 0.253 0.253 0.238 0.238 0.238 0.228 0.228 0.223 0.223 0.223 0.223 0.223 0.223 TCPL 0.36 0.36 0.36 0.36 0.34 0.34 0.34 0.34 0.32 0.32 0.32 0.32 0.305 Enbridge 0.37 0.33 0.33 0.33 0.33 0.308 0.308 0.308 0.308 0.288 0.288 0.288 0.288 PNG 0.23 0.22 0.22 0.22 0.22 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 ACIG-6 – Doc. 6 Page 17 of 49 Answer 20.1 Dr Booth can not respond to such a blanket request. If there is a specific request then Dr. Booth will respond with both the data and example calculations as he has done to other such information requests in this hearing. Note that most of the data has already been provided and cansim numerics are provided for most series in schedule 1. In order to be helpful Dr. Booth has provided a series of machine readable data files relevant to his schedules. These are listed as Kolbe IR 20. R-3690-2009 ACIG-6 – Doc. 6 Page 18 of 49 Answer 21.1 Dr Booth can not respond to such a blanket request. If there is a specific request then Dr. Booth will respond with both the data and example calculations as he has done to other such information requests in this hearing. Note that most of the data has already been provided and cansim numerics are provided for most series in schedule 1. In order to be helpful Dr. Booth has provided a series of machine readable data files relevant to his schedules. These are listed as Kolbe IR 21. R-3690-2009 ACIG-6 – Doc. 6 Page 19 of 49 Answer 22.1 Drs Kolbe and Vilbert similarly requested an ATWACC in their NGTL testimony and the reference was not deleted as it should have been. Answer 23.1 Dr. Booth does not follow US regulatory decisions or hearings since they are not relevant to Canadian utilities given the different cultural, economic and political factors that Dr. Booth mentions in his testimony. As far as Dr. Booth is aware apart from the TransCanada group of corporations and Gaz Metro, Union Gas is the only other Canadian utility that has adopted ATWACC testimony. R-3690-2009 ACIG-6 – Doc. 6 Page 20 of 49 Answer 24.1 The information is on the BC Utilities Commission web site at http://www.bcuc.com/ApplicationView.aspx?ApplicationId=67 R-3690-2009 ACIG-6 – Doc. 6 Page 21 of 49 R-3690-2009 ACIG-6 – Doc. 6 Page 22 of 49 Answer 25.1 Correct, Dr. Vilbert seems to rely totally on the judgment of Dr. Kolbe and provides no checks in support of his own estimates. As Dr. Vilbert answered in IR #1.1 to IGUA his role was not to do any business risk analysis of Gaz Metro. Answer 25.2 Confirmed that Dr. Kolbe’s evidence includes a relatively high level theoretical discussion, but does not provide empirical or practical support for that high level discussion. Answer 25.3 Dr. Booth would confirm that Dr. Kolbe made some minor comments and referenced the Frank and Goyal book, but would not regard said references as material or substantial. Answer 25.4 This is misleading Dr. Kolbe states that but the equations that he uses are linear and no constraints are imposed on their use and nowhere is there any internally consistent parameters that cause the ATWACC to either increase or decrease. Unfortunately for Dr. Kolbe his math is not consistent with his discussion. Answer 25.5 That is correct the normal usage is WACC, until Dr. Booth became aware of Dr. Kolbe’s testimony he had never come across the term ATWACC. Answer 25.6 If by the question Dr. Kolbe means that at any minimum of a quadratic equation there is a horizontal tangent, then the answer is obviously yes. This is basic math not finance Answer 25.7 There is no graph or anything else in Dr. Booth’s testimony that suggests that the optimal debt ratio for a Canadian utility is 99% debt, such a proposition is absurd. Answer 25.8 Of course this is the static trade-off model of capital structure that Dr. Booth discusses at length in his testimony as one of the main models of capital structure taught in any introductory finance textbook. Answer 25.9 Of course that is why the figure is drawn like that. Answer 25.10 For a firm with a WACC drawn like that in Appendix B page 21, there is a clearly defined minimum WACC. Answer 25.11 Dr. Booth does not provide any empirical support for the diagram on page 21; it is there simply to illustrate the tradeoff between the tax advantages and the distress disadvantages of debt and the static tradeoff model it produces. This is the standard model discussed in every introductory finance R-3690-2009 ACIG-6 – Doc. 6 Page 23 of 49 textbook and is in stark contrast to the model used by Dr. Kolbe, which he claims is the “modern” financial economics. If Dr. Kolbe wishes to understand Dr. Booth’s view on real world capital structures he is advised to read Dr. Booth’s Appendix H, where he presents the results of survey data on actual real world factors that determine capital structures rather than the theoretically limited discussion provided by Dr. Kolbe and the similarly limited discussion in Dr. Booth’s Appendix B where he is forced to put the discussion within an ATWACC framework. In practice the vast majority of firms as indicated by the Deutsche Bank survey have a target or optimal capital structure which would not be the case if the world operated according to Dr. Kolbe’s flat ATWACC. R-3690-2009 ACIG-6 – Doc. 6 Page 24 of 49 R-3690-2009 ACIG-6 – Doc. 6 Page 25 of 49 Answer 26.1 Dr. Booth will confirm that he does not keep copies of reply evidence but he does read it and this is what Dr. Kolbe has previously stated. However, he categorically rejects the assertions made by Dr. Kolbe and the “high ground” that he claims by saying that his is the “modern economic understanding,” when it is rooted in a 1958 article which had three errors in it and has long since been extended. The modern approach to capital structure includes signaling models, agency problems, incentive mechanisms, dynamic adjustments in the face of transactions costs, market timing models and moral hazard problems, as well as the classic tax advantages versus distress disadvantages of debt. All of this makes the discussion of the extremely simple model in Dr. Kolbe’s testimony of little relevance to real world finance. Dr. Booth has contributed to this literature with contributions that have been blind peer reviewed and passed the objective test. As far as Dr. Booth is aware Dr. Kolbe has not published any articles in first tier academic articles or elsewhere that have passed the peer review test. The fact is that if Dr. Kolbe’s views had any validity they would have shown up elsewhere in the finance literature, and they have not. Dr. Kolbe’s views are based on an all seeing rational expectations equilibrium where the firm faces no uncertainty or anything else that makes finance a real subject. Dr. Booth has pointed this out in previous information responses but Dr. Kolbe has not substantially changed his testimony, which remains aberrant and outside the mainstream of finance. Dr. Booth sees no reason why he should change his testimony to include things that are neither correct nor have any following in finance. The fact that Dr. Kolbe is forced to reply does not mean to say that in that reply he says anything of any substance that causes Dr. Booth to change his understanding of the modern theory of finance, which he teaches in his graduate courses at the University of Toronto. R-3690-2009 ACIG-6 – Doc. 6 Page 26 of 49 Further the referenced passage about Dr. Booth not changing his testimony in response is absolutely incorrect. In response to Dr. Kolbe’s flat ATWACAC testimony Dr. Booth has progressively First: produced the references that are now in his Appendix H (pages 8-9) from the Brealey and Myers textbook showing that Myers introduced the adjusted present value (APV) model and emphasized the tax advantages of debt financing. Dr. Kolbe has never addressed the fact that the textbook that he normally extols specifically points out the tax advantages of debt financing and that utilities rely heavily on debt financing. Nor has Dr. Kolbe ever produced any major finance textbook that argues that financing doesn’t matter in the real world or that the ATWACC is flat. Second: produced the empirical observation on page 5 of Appendix H that the prices of income trusts fell when the GOC decided to tax income trusts. In the type of instantaneous, perfect foresight, rational expectations model envisaged by Dr. Kolbe this shouldn’t have happened, since for competitive firms the shareholders should have recognized that the tax burden would be pushed forward and not affect them! As a result the prices should not have changed. Third: introduced the survey results from Deutsche Bank and Graham and Harvey that are now in Appendix H. These surveys show what factors motivate Chief Financial Officers (CFOs) to decide their debt levels. Obviously if the ATWACC is flat, there is no magic in debt and the CFOs should all have answered “nothing affects my debt decision since there is no optimal amount of debt and it is an irrelevance.” Of course in practice they didn’t say that, instead 85% indicated they had a target capital structure, which means they feel at some point their ATWACC is minimized. So what we have are: No peer reviewed contributions by Dr. Kolbe indicating that his view of the world has passed the blind review test; An absence of finance textbooks that discuss the arguments advanced by Dr. Kolbe, and none that indicate that financing is irrelevant. The opinions of 85% of the CFOs of North American companies that flatly contradict Dr. Kolbe’s view of the world. Despite the fact that Dr. Kolbe has not addressed any of these points he expects people to agree with him. Answer 26.2 Dr. Booth will confirm that Dr. Kolbe has offered a defence of his evidence in previous reply evidence. Dr. Booth does not confirm that he accepts that Dr. Kolbe has addressed the critical flat ATWACC assumption. R-3690-2009 ACIG-6 – Doc. 6 Page 27 of 49 Answer 26.3 Dr. Booth will confirm that Dr. Kolbe repeats the same points from previous reply evidence, but repetition does not make any such assertions any the more correct. R-3690-2009 ACIG-6 – Doc. 6 Page 28 of 49 R-3690-2009 ACIG-6 – Doc. 6 Page 29 of 49 Answer 27.1 Correct there would be a problem with Dr. Booth’s arithmetic if it didn’t. Answer 27.2 Correct there would be a problem with Dr. Booth’s arithmetic if it didn’t. Answer 27.3 There are no flaws in either Dr. Booth’s arguments or his example calculations. Dr. Kolbe has the habit of describing financial theory with which he disagrees as “flawed,” in the same way he describes his own theory as “modern”. Such statements say more about Dr. Kolbe than anything else. R-3690-2009 ACIG-6 – Doc. 6 Page 30 of 49 R-3690-2009 ACIG-6 – Doc. 6 Page 31 of 49 Answer 28.1 Correct Answer 28.2 The point is simply that the use of ATWACC magnifies any over estimation in the cost of equity regardless of whether that over estimation is by an intervener, a company witness or the Board. It is very important to note that Dr. Vilbert’s direct equity cost estimates are not outside of the top end of a reasonable range, what is outside of a reasonable range, as the Alberta EUB also pointed out, is the way that a flat ATWACC is used to magnify the impact on the ROE. As the Alberta EUB stated the result is leverage adjustments that violate the fair return standard. Answer 28.3 Confirmed. Answer 28.4 Correct the point made by Dr. Booth is ATWACC magnifies errors and introduces needless problem in efficient rate making. Answer 28.5 Absolutely incorrect. Using ATWACC produces ROE estimates that violate the fair return standard as even this example indicates, since the 9% direct equity cost estimate becomes 11% by the use of the flat ATWACC assumption. Recognizing the fact that ATWACC increases an ROE estimate means that people should not use it regardless of whether they believe that it is lower or higher than it really is. R-3690-2009 ACIG-6 – Doc. 6 Page 32 of 49 R-3690-2009 ACIG-6 – Doc. 6 Page 33 of 49 R-3690-2009 ACIG-6 – Doc. 6 Page 34 of 49 R-3690-2009 ACIG-6 – Doc. 6 Page 35 of 49 Answer 29.1 Correct and that was the context in which the quotation was used in Dr. Booth’s testimony as Dr. Booth’s examples all start with a delay in lowering allowed ROE by the regulator, that is a change not caused by a recapitalization. Answer 29.2 That was Dr. Booth’s interpretation of the last line of Dr. Kolbe’s statement, which seems to be straightforward. If Dr. Kolbe disagrees with this interpretation then Dr. Booth will retract that reference. Answer 29.3 answer. Dr. Booth agrees that the referenced passage is a correct description of Dr. Kolbe’s Answer 29.4 Dr. Booth will confirm that this is a restatement of Dr, Kolbe’s flat ATWACC assumption, that if the market value changes somehow the equity cost also changes so that the ATWACC is constant. Answer 29.5 Dr. Booth confirms that if the ATWACC is assumed to be constant then mathematically that must happen. Dr. Booth would also point out that with a higher equity market value it is logical to expect the equity cost to increase rather than decrease as implied by Dr. Kolbe, since the investor will now carry revaluation risk in the sense theta there is a greater risk that the allowed ROE will be cut and for them to suffer a capital loss. Answer 29.6 Yes that is the standard definition of the WACC Answer 29.7 Yes that is a simple algebraic manipulation but Dr. Booth would point out that assuming that the ATWACC is constant is not an algebraic manipulation it is an assumption of Dr. Kolbe’s. Furthermore many of these parameters change as one of them changes not just the one that Dr. Kolbe focuses on. Answer 29.8 Correct an algebraic rearrangement by itself is not finance some assumptions have to be imposed to make it useful and that is where Dr. Booth disagrees with Dr. Kolbe. Answer 29.9 Correct as Dr. Booth shows in his example on pages 11-12 if the equity cost is estimated correctly the ATWACC does fall, in his example from 10% to 8.46%. However, the problem is that it should fall to 8.0% and doesn’t since the higher equity value delays the adjustment. Answer 29.10 Correct which is why Dr. Booth pointed out that the use of 6.4% by the NEB for TQM’s ATWACC is not by itself the problem, since you can get fair and reasonable results with ATWACC. Answer 29.11 Correct and if the cost of debt increased to 9% due to an increase in spreads caused by liquidity problems in the bond market the equity cost would fall to 9%. So with ATWACC it is possible for increasing debt costs to lower the equity cost given that the overall ATWACC is assumed constant at 9% in the example. Answer 29.12 Confirmed that algebraic manipulation can get desired results, but the important insight is the economic logic that goes into the parameters. As the numbers in 29.09 and 29.10 show R-3690-2009 ACIG-6 – Doc. 6 Page 36 of 49 with the constant 9% ATWACC increasing the debt cost causes the equity cost estimate to fall. This is what often happens with risky debt as firms face distress costs as the example e of GM debt yielding almost 100% in Dr. Booth’s testimony indicates. The problem is that some people will then say this is illogical since equity and debt costs are varying in the wrong way and yet Dr. Kolbe’s examples indicate that this can happen. R-3690-2009 ACIG-6 – Doc. 6 Page 37 of 49 Answer 30.1 Again Dr. Kolbe starts out the passage with argument. Dr. Booth would agree with Dr. Kolbe’s recent conversion to the idea that equity markets are not as rational as he previously believed. If equity investors completely understood exactly what was going on they would never increase the market value in the first place, since they would know that an omniscient and omnipotent regulator R-3690-2009 ACIG-6 – Doc. 6 Page 38 of 49 would immediately cut the allowed ROE. Obviously this is not how the real world works. However Dr. Booth fails to see the logic in investors thinking that a stock is less risky as it increases in price. In this Dr. Booth agrees with Warren Buffet that investors should treat stocks like hamburgers: they should buy more when their price goes down and less when their price goes up. Answer 30.2 Correct, they have first gained an unexpected capital gain and then an unexpected capital loss. This is what makes the equity market risky. Answer 30.3 Obviously they don’t, if they are as clever as Dr. Kolbe assumes they are, nothing would ever happen and share prices would always be at book value. However, Dr. Kolbe recanted on this view and now believes that markets are not completely efficient a view that Dr. Booth also holds. Answer 30.4 Sooner or later simply means that there are equilibrating forces at work, but there is no dynamic theory in finance that indicates how long these adjustments take. Answer 30.5 Dr. Booth fails to see this example in his testimony and confirming someone else’s example is not an information request. However, without replicating all the cash flows the estimate looks correct. Answer 30.6 No and nowhere in Dr. Booth’s testimony has he ever stated such a thing. However, Dr. Booth does believe that investors earn negative rates of return due to unexpected actions as the performance of the equity market this past year has reminded us. What this indicates is that Dr. Kolbe is confusing investor required rates of return (cost of capital) with expected rates of return and actual rates of return. The fact that investors earn negative rates of return and they are not as clever as Dr. Kolbe assumes and did not see this coming does not mean that their required rate of return is negative. Answer 30.7 R-3690-2009 Dr. Booth has no such discussion in his evidence. ACIG-6 – Doc. 6 Page 39 of 49 Answer 31.1 Correct and Dr. Booth paraphrased this answer on page 25 where he mentions that the IR answer did not reflect the uncertainty generated by the recent financial crisis. Dr. Booth uses this example simply to indicate what the rigid application of the TQM decision means for Gaz Metro’s ROE as is clear from the context. R-3690-2009 ACIG-6 – Doc. 6 Page 40 of 49 R-3690-2009 ACIG-6 – Doc. 6 Page 41 of 49 Answer 32.1 Correct Decision U99099) was a TransAlta decision. Answer 32.2 Dr. Booth has not done any research into the use of ATWACC evidence in Canada , but to the best of his knowledge this was the first time he was aware of it. Answer 32.3 Correct but NGTL withdrew its sponsorship of ATWACC and indicated it was looking for an award based on traditional rate making so whether or not the AEUB should rule on ATWACC again was moot. Answer 32.4 Correct and it rejected ATWACC in RH-4-2001 and RH-2-2004 which is why the NEB panel’s decision in RH-1-2008 was a complete shock. Answer 32.5 hearings. Correct Dr. Booth hopes that he has not misquoted the Alberta EUB in any of these Answer 32.6 Correct, but misleading and a misinterpretation of both the NEB and AEUB decisions. The AEUB specifically ruled on the flat ATWACC assumption since it resulted in ROE adjustments that violated the fair return standard. This was because of the way that ATWACC was used by Dr. Kolbe and R-3690-2009 ACIG-6 – Doc. 6 Page 42 of 49 Vilbert. In contrast the NEB chose 6.4% as an ATWACC and showed why it was consistent with standard rate making in Canada. There is no indication as far as Dr. Booth is aware that the NEB accepted that the ATWACC was flat or that the leverage adjustments implied by a flat ATWACC did not violate the fair return standard. That is the NEB did not specifically contradict the AEUB. Further as Dr. Booth shows in his testimony it is possible to get a fair ROE by using ATWACC. For example the NEB produced a table that stated that Dr. Booth’s recommendation for TQM meant an ATWACC of 5.6%, rather than the 6.4% that they allowed (Table page 90 of decision). As a result the implication that the NEB reached an opposite conclusion to the AEUB is incorrect. 33. Référence: ACIG-6, Document 1, Written evidence of Dr. Laurence Booth, pages 22-23 Préambule: Dr. Booth asserts that the use of the statutory tax rate in calculation of the ATWACC assumes that taxes are normalized, and that use of ATWACC might be “a backdoor way of introducing a change in tax methodology in Canada.” He also asserts that if someone were to use the ATWACC with different effective tax rates it would get two different costs of equity for otherwise identical utilities. Demandes: 33.1 Please confirm that the impact on a regulated revenue requirement of regulatory policy regarding the use of tax flow through versus tax normalization is due primarily to differences between tax depreciation and accounting depreciation. R-3690-2009 ACIG-6 – Doc. 6 Page 43 of 49 R-3690-2009 ACIG-6 – Doc. 6 Page 44 of 49 Answer 33.1 Primarily yes which is why Dr. Booth uses the example of a growing versus a stable or declining utility. Answer 33.2 Dr. Booth would assume so but he has no evidence to this effect. Answer 33.3 Correct. Answer 33.4 Correct as long as a firm pays tax as Dr. Booth indicated the tax shield value is at the marginal tax rate this would hold even f the firm pays no tax if at that point the entire interest payments generated a tax shield. Answer 33.5 Correct the ATWACC is based solely on the debt and equity parameters and the firm’s tax rate which may be affected by flow through versus normalization. Answer 33.6 tax situation. Yes but it is done on a company specific basis taking into account each utility’s individual Answer 33.7 Correct. Answer 33.8 Correct, this is the point of the example: that like differences in embedded debt costs the ATWACC is specific to each company even if the fair ROE is the same. As a result it can produce unfair and unreasonable ROEs. Answer 33.9 Correct but Dr. Booth is worried about the problems in applying an ATWACC methodology across many companies or across time as is currently done with most ROE adjustment formulae. As Dr. Kolbe indicates using ATWACC is company specific and opens the door to Dr. Booth having to debate these same issues every year with Dr. Kolbe, since it is so difficult to implement ATWACC in a mechanical manner. Answer 33.10 Correct. Answer 33.11 The statutory rate is by definition the rate used for the tax books. Answer 33.12 Correct and Dr. Booth does not say anything to the contrary. R-3690-2009 ACIG-6 – Doc. 6 Page 45 of 49 R-3690-2009 ACIG-6 – Doc. 6 Page 46 of 49 R-3690-2009 ACIG-6 – Doc. 6 Page 47 of 49 Answer 34.1 Again Dr. Kolbe is engaging in argument via the IR process. Dr Booth meant the reference to say that it was appropriate to apply a market based opportunity cost like ATWACC to a book value rate base. This is important since as derived in financial theory the ATWACC conceptually should be applied to the market value of the firm’s total capitalization. This is why it is consistent with shareholder value maximisation. The statement is there simply as part of the logical thread. Answer 34.2 Correct see 34.1 above. Answer 34.3 Correct and Dr. Booth agrees 100% with that quotation. Answer 34.4 Correct. Answer 34.5 Dr. Booth would hope they do since that is the basis of rate of return regulation. However other witnesses have argued that the equity cost estimate needs to be increased to take into account that it is being applied to a book valued rate base and this is effectively what Dr. Kolbe does with his leverage adjustments since he does not apply the equity cost estimates of Dr. Vilbert directly to the book valued equity component of rate base. Answer 34.6 Dr. Booth disagrees with the statement that he is using a misleading reference; the series of statements should be read as the development of a logical argument. In fact the passage from Dr. Kolbe is mischievous to say the least. Rate of return regulation applies the estimated equity cost to the book value rate base. Shareholder value maximisation applies the market valued ATWACC to the market value of the firm’s securities, which is what Dr. Booth states it does. What Dr. Kolbe does is take the market equity cost and make a leverage adjustment to apply it to the book value rate base. He does not apply Dr. Vilbert’s estimated equity cost directly to the book value rate base. This does not mean abandoning traditional rate making and nowhere does Dr. Booth say that it does. What it does do is make adjustments to the market equity cost that the AEUB stated violates the fair return standard. Answer 34.7 Correct. Answer 34.8 Correct. Answer 34.9 No, since the essence of ATWACC is the flat ATWACC assumption and the changing value of the debt ratio as the market value of the firm increases. It is the leverage adjustment that violates the fair return standard and neither of the examples in 34.7 and 34.8 incorporate the changing leverage ratio and this assumption. As Dr. Booth has stated repeatedly it is possible for the application R-3690-2009 ACIG-6 – Doc. 6 Page 48 of 49 of an estimated ATWACC to a book value rate base to produce fair and reasonable returns. In fact as he shows in his testimony on page 24 it is possible for ATWACC to result in lower allowed ROEs as well as higher allowed ROEs than conventional rate making. However, the way that it is used by Dr. Kolbe makes this unlikely as a recommendation of 12.39% on Gaz Metro’s deemed equity ratio is clearly outside of any reasonable range of estimate. HBdocs - 6862888v1 R-3690-2009 ACIG-6 – Doc. 6 Page 49 of 49