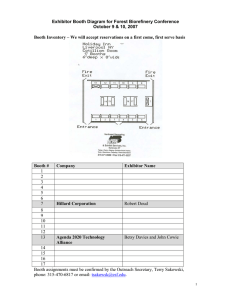

August 7, 2007 File no: R-3630-2007 I

advertisement