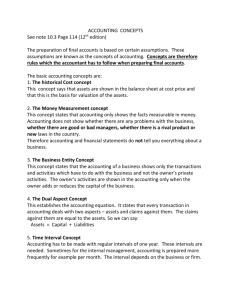

Keeping It Simple: Financial Literacy and Rules of Thumb Please share

advertisement