116 FERC ¶ 61,057 UNITED STATES OF AMERICA FEDERAL ENERGY REGULATORY COMMISSION

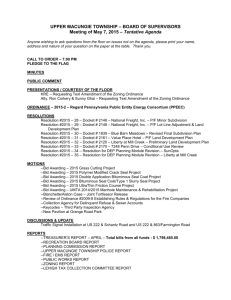

advertisement