2015-16 VERIFICATION: TAX FILING EXTENSION INSTRUCTIONS

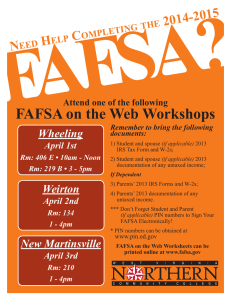

advertisement

2015-16 VERIFICATION: TAX FILING EXTENSION INSTRUCTIONS Approximately 30% of all FAFSA applications are randomly selected for the Verification process. As part of this process, students must verify income information before aid can be awarded. Students selected for Verification and who are only interested in receiving the Hope Scholarship can complete the Verification Opt-Out Form. Verification can still be completed at a later date. Here is a link to the Verification Opt-Out Form: http://www.mtsu.edu/financialaid/forms/Verification_Opt-Out.pdf To verify income, students/parents (if dependent) must verify their income by submitting a Tax Return Transcript obtained from the IRS or by correcting the FAFSA and utilizing the IRS Data Retrieval Tool to import tax information from the IRS into the FAFSA. Income information must be verified, even if the federal tax return has not been filed. Instructions for tax filers filing an extension are detailed below. I. Tentative Award Process MTSU has implemented a Verification process to award aid tentatively based on estimated income information. Submit the following seven items. Failure to submit all items will delay this process. 1. Submit the 2015-16 Verification: Tax Filing Extension form. Check each item in the REQUIRED INFORMATION section that is being submitted with this form. It is best to submit all documents at the same time. The student is required to initial all three statements in the AGREEMENT Section. 2. Submit a copy of IRS Form 4868, Application of Automatic Extension of Time to File a U.S. Individual Tax Return. 3. Submit copies of all W-2s and/or 1099s for each source of income in 2014 for the student, spouse or parent who has filed for a tax extension. 4. Submit the requested 2015-16 Verification Worksheet 5. Submit the 2015-16 Verification of Estimated 2014 Taxable and Non-taxable income form. Do not leave any section or items blank. Place a zero in items that do not apply. Use the 2013 federal tax return as a guide to complete this form, replacing the figures on each line with estimated 2014 figures 6. Submit a signed copy of the 2013 federal tax return, including all 2013 Schedules, 2013 W-2s and 2013 1099s used to prepare the return. 7. Submit the 2015-16 Asset Verification Worksheet. The Financial Aid Office will review the information submitted and make all necessary corrections. If the estimated income reported is extremely low, additional information may be requested to verify how the family meets the basic living expenses. Aid will be awarded based upon the Financial Aid Office’s normal awarding schedule. A hold will be placed on the following semester’s aid until the FAFSA has been updated to include the actual 2014 tax information. A deferment will not be granted based on these funds. II. Finalize Verification - Required Submit a copy of the 2014 Tax Return Transcript as soon as it is available. We will review and compare the FAFSA information with the actual 2014 tax return transcript and make all necessary corrections. The 2015-16 award will be adjusted if corrections change eligibility. The student is responsible to repay any funds he/she is no longer eligible to receive. Failure to submit the Tax Return Transcript will result in the cancellation of aid already paid and the cancellation of pending disbursements. The tax return should be submitted no later than November 15th to allow sufficient processing time to prevent the delay of future disbursements by the fee payment deadline. 2015-16 Verification: Tax Filing Extension Student’s Last Name: Student’s First Name: MTSU Student ID: M: MTSU Email: MI: Your FAFSA was selected for the Verification process by the FAFSA processing center. As part of this process, specific items included on the FASFA must be verified. The Financial Aid Office is required to verify information reported from the federal income tax return as part of this process. By completing this form, you are requesting that financial aid be initially awarded based upon estimated federal tax information. The information you submit must document that the estimates reported on the FAFSA are reasonable. If not, the Financial Aid Office reserves the right to make corrections to the estimated income. An example would be overstating tax paid, which impacts the EFC. Incomplete information will delay the processing of financial aid. REQUIRED INFORMATION ___ I, the student (spouse) have filed for an extension ___ I, the parent have field for an extension Place a check by each item being submitted with this form. Submitting the required signed copy of the 2013 federal tax return, including ALL schedules, W2s and 1099s. The 2013 federal tax return will be used to review estimated 2014 information reported on the FAFSA and to identify potential untaxed income, assets and investments that are required to be reported on the 2015-16 FAFSA. The tax filer who is filing an extension must submit the 2013 federal tax return, Schedules, and W-2s or the request is considered to be incomplete. Submitting a copy of IRS Form 4868, Application for Automatic Extension of Time to File U.S. Individual Tax Return with this form or the IRS’s approval of an extension beyond the automatic sixmonth extension. Submitting the requested 2015-16 Verification Worksheet (Dependent or Independent based on the FAFSA dependency status) Submitting the 2015-16 Verification of Estimated 2014 Taxable and Non-taxable Income form Submitting a copy of ALL 2014 W-2s and/or 1099s for each source of income received in 2014 for the student, spouse or parent who is filing an extension. Submitting the 2015-16 Asset Verification form. AGREEMENT - THE STUDENT MUST READ AND INITIAL EACH STATEMENT _____ initials _____ initials _____ initials After the 2014 tax return is filed, I agree to submit the 2014 Tax Return Transcript to the MT One Stop. Based on the information submitted, corrections to the FAFSA may be required. I understand that corrections may result in increased or decreased eligibility. I agree to repay any funds that I am no longer eligible to receive as a result of required corrections to the FAFSA or for failure to submit the 2014 Tax Return Transcript. I understand that a hold will be placed on future disbursements during the 2015-16 academic year until the FAFSA has been correctly updated with actual 2014 federal income tax information. Failure to comply may result in the cancellation of aid disbursed based on estimated income. Signature of both student and parent (if dependent) is required. I certify that the above information is correct. If I purposely give false or misleading information, I may be fined $20,000, sent to prison, or both. ____________________________________________ _________________________________________ Student signature/Date Parent signature/Date To submit the completed form: In person: MT One Stop Student Services and Admissions Center (SSAC) – Room 210; Mail: MTSU, MT One Stop, SSAC Room 260, 1301 East Main Street, Murfreesboro, TN 37132; Fax: (615) 898-5167 2015-16 Verification of Estimated 2014 Taxable and Non-taxable Income Student’s Last Name: MTSU Student ID: M: Student’s First Name: MTSU Email: MI: This form must be submitted with the 2015-16 Verification: Tax Filing Extension form to validate estimated 2014 income reported on the FAFSA for the student and/or parent who filed a tax extension (IRS Form 4868). (The 2013 federal tax return can be used as a guide to assist you with the completion of this form.) The information below is applicable to the ___student (spouse) or ___ parent, who filed a tax extension 1. 2014 Income: (IRS Form 1040 information) Wages, salaries, tips, etc. (total of all applicable W-2s): Taxable interest: (Submit Form 1099-INT)) Tax exempt interest: List amount here: $ Ordinary dividends: Qualified dividends: List amount here: $ Taxable refunds, credits, or offsets of state and local income taxes: Alimony received: Business income or (loss): Capital gain or (loss): Other gains or (losses): IRA distribution: Total amount of IRA distribution: $ Pensions and annuities: Total amount of pensions/annuities: $ Rental real estate, royalties, partnerships, S corporations, trusts, etc.: Farm income or (loss): Unemployment compensation: (Submit Form 1099-G) Social security benefits: Total amount: $ Other income: List type and amount: Total Income Taxable amount: Taxable amount: Taxable amount: $ $ XXXXXXXXXX $ XXXXXXXXXX $ $ $ $ $ $ $ $ $ $ $ $ $ 2. 2014 Adjusted Gross Income (IRS Form 1040 information) Educator expenses: Certain business expenses of reservists, performing arts and fee-basis government officials: Health savings account deduction: Moving expenses: Deductible part of self-employment tax: Self-employed SEP, SIMPLE, and qualified plans: Self-employed health insurance deduction: Penalty on early withdrawal of savings: Alimony paid: IRA deduction: Student loan interest deduction: Tuition and fees: Domestic production activities deduction: Total of Column 2: Adjusted Gross Income (Total Income in section 1 minus Total of Column 2): $ $ $ $ $ $ $ $ $ $ $ $ $ $ XXXXXXXXXXXX $ 3. 2014 Tax and Credits (IRS 1040 information) Adjusted Gross Income (AGI) from Section 2: Itemized deductions (estimated amount to be reported from Schedule A): Exemptions (Multiply $3,800 by # of exemptions to be claimed on tax return): Estimated Taxable Income: (AGI minus deductions and exemption total): Foreign tax credit: Credit for child and dependent care expenses: Education credits: Retirement savings contributions credit: Child tax credit: Residential energy credits: Other credits: Total Credits: Adjusted Gross Income minus Total Credits: XXXXXXXXXXXX $ $ XXXXXXXXXXXX $ $ $ $ $ $ $ $ XXXXXXXXXXXX $ XXXXXXXXXX XXXXXXXXXX $ XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX $ 4. 2014 Untaxed Income Child support received for ALL children included in the household on the FAFSA: Housing, food and other living allowances paid to members of the military, clergy and others (including cash payments and cash value of benefits). Don’t include the value of on-base military housing or the value of basic military allowance for housing. Veteran’s non-educational benefits, such as Disability Death Pension, or Dependency & Indemnity Compensation and/or VA Educational Work-Study allowances: Other untaxed income such as workers’ compensation, disability, first-time homebuyer tax credit: $ $ $ $ IMPORTANT: Do not leave any section blank. Place a zero in the item(s) that do not apply. Incomplete forms will delay the processing of Title IV aid. 5. Certification Signature of both student and parent (if dependent) is required. I certify that the above information is correct. If I purposely give false or misleading information, I may be fined $20,000, sent to prison, or both. ____________________________________________ Student signature/Date _________________________________________ Parent signature/Date To submit the completed form: In person: MT One Stop Student Services and Admissions Center (SSAC) – Room 210; Mail: MTSU, MT One Stop, SSAC Room 260, 1301 East Main Street, Murfreesboro, TN 37132; Fax: (615) 898-5167 2015-16 Asset Verification Worksheet Student’s Last Name: MTSU Student ID: M: Student’s First Name: MTSU Email: MI: This form must be submitted with the 2015-16 Verification: Tax Filing Extension form. It may also be required to resolve conflicting information discovered through the verification process. Fully complete the section below. Do not leave any section blank. Place a zero in the item(s) that do not apply. Incomplete forms will delay the processing of Title IV aid. Parental information is only required for dependent (as defined by the FAFSA) students. Parent Cash, savings and checking accounts. Enter your total balance as of the day the original FAFSA was signed. Real estate value: List the value of rental property, land, second or summer homes. Do not include the home you live in. Real estate debt: Amount owed on investment real estate. Do not include the amount you owe on the home you live in. Investments: Trust funds, UGMA and UTMA accounts (exclude if custodian and not owner of account), money market funds, mutual funds, certificates of deposit, stocks, stock options, bonds, other securities, commodities, installment and land contracts (including mortgages held). Qualified educational benefits or education savings accounts: Coverdell savings accounts, 529 college savings plans and the refund value of 529 prepaid tuition plans. Business value: Include the market value of land, buildings, machinery, equipment, inventory, etc. (value minus debt applicable to business only). Name of business:________________________________________________ Do not include the value of a small business if your family owns and controls more than 50% AND the business has 100 or fewer employees. Student $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ Farm value: Include the market value of land, buildings, machinery, equipment, inventory (value minus debt applicable to farm only). Do not include farm value, if the farm is the principal place of residence for the student and family (spouse, if applicable and parents of dependent student) AND the student (or parents of a dependent student) materially participated in the farming operation. Small business value: (100 or fewer employees) Percentage of family ownership: _________ Number of employees: _________ Name of business: _________________________________________________ Signature of both student and parent (if dependent) is required. I certify that the above information is correct. If I purposely give false or misleading information, I may be fined $20,000, sent to prison, or both. ____________________________________________ _________________________________________ Student signature/Date Parent signature/Date To submit the completed form: In person: MT One Stop Student Services and Admissions Center (SSAC) – Room 210; Mail: MTSU, MT One Stop, SSAC Room 260, 1301 East Main Street, Murfreesboro, TN 37132; Fax: (615) 898-5167