Willmott Forests Premium Forestry Blend 2010 INDEPENDENT ASSESSMENT

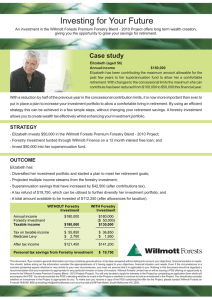

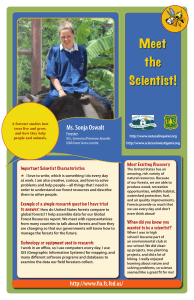

advertisement