Colonial Group Subordinated Notes Prospectus

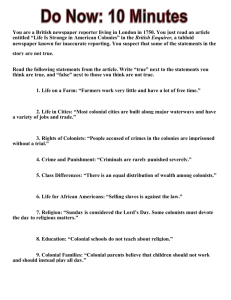

advertisement