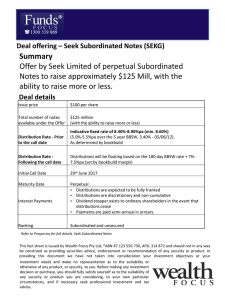

SEEK Subordinated Notes

advertisement

SEEK Subordinated Notes SEEK Limited has just announced the launch of a new income offer: SEEK Subordinated Notes. The first round of access is through a broker firm allocation, prior to shareholder and general offers and listing at the end of this month. The Notes will pay a semi‐annual distribution fixed for the first 5 years at a minimum of 8.60% pa. Indicative range of 8.40%‐8.90% pa (5.0%‐5.50% over the 5 year bank bill swap rate (BBSW), 3.40% as of 5th June. The Notes are a perpetual security and if not repaid at the initial call date become a floating rate based on the 180 day BBSW with a 2% step up on the margin. ie an indicative rate of 10.42%‐10.92%pa (180 day BBSW ‐ 3.42% as of 5th June). The Notes will be traded on the ASX. SEEK Subordinated Notes Offer Details Issuer Security Name Initial Call Date Maturity Date Margin Margin ater the initial call date Size Minimum Parcel SEEK Limited SEEK Subordinated Notes 29th June 2017 Perpetual 5 year BBSW + 5.00%‐5.50% (fixed rate) 180 day BBSW + 7.00%‐7.50% (floating rate) $125m+ $5,000 (Wealth Focus minimum is $10,000) Source: SEEK Subordinated Notes prospectus This issue will be used to refinance existing debt. Background to SEEK With a market cap of $2.2bn, SEEK is one of the world’s largest online employment classifieds business, as well as a provider of education via online and classroom education and training. We consider SEEK to have a strong domestic and growing international business. Earnings growth has been very strong and the 1st Half of 2012 shows an impressive 43.7% increase in EBITDA over the same period in 2011. Unlike many of the other offers we’ve seen, SEEK has low levels of debt and is generating substantial free cash flow. www.fundsfocus.com.au. This information has been prepared for distribution over the internet on a general advice basis and without taking into account the investment objectives, financial situation and particular needs of any particular person. Wealth Focus Pty Ltd makes no recommendations as to the merits of any investment opportunity referred to in this website. All indications of performance returns are historical and cannot be relied upon as an indicator for future performance. Please read our Financial Services Guide and Disclaimer for full details of our services and level of advice provided. 06/06/12 Key features A small offering of just $125 Million SEEK is a very profitable company with a high 7 * interest cover There is very little debt held by the company An initial fixed rate (min. 8.6%) is likely to be very attractive to retail investors Distributions are discretionary and non‐cumulative Distributions paid are expected to be fully franked Although these are perpetual, they are expected to be repaid at the first opportunity in 5 years The 2% step up resulting in a margin of 7%‐7.5% over the BBSW and a dividend stopper to ordinary shareholders is a strong deterrent to not calling this at the first opportunity in 2017. Our View For investors trying to understand why SEEK have structured the Notes in this format, it may help to understand that they hold a large amount of franking credits. By structuring a perpetual security with discretionary payments, SEEK should be able to distribute franking credits, allowing them to fund a loan at 6.02% (plus franking) rather than 8.6% or more that it would cost without franking. Our view is that investors need to be very careful with this issue. As unlikely as it may seem when things are going well, a company falling on hard times, such as Paperlinx, may feel a step up is a cheap (if not only!) source of lending. Supporters of this issue are likely to point out the strong growth, cash flow and highly profitable business as support that this would never happen, but these are also our concerns. What we don’t like Successful internet businesses are very quick to attract new customers, typically have a low cost base without the need to hold costly assets, and high margins. Unfortunately, internet businesses are also more susceptible to losing customers when the next successful idea materialises, you only need to look at MySpace as a prime example. www.fundsfocus.com.au. This information has been prepared for distribution over the internet on a general advice basis and without taking into account the investment objectives, financial situation and particular needs of any particular person. Wealth Focus Pty Ltd makes no recommendations as to the merits of any investment opportunity referred to in this website. All indications of performance returns are historical and cannot be relied upon as an indicator for future performance. Please read our Financial Services Guide and Disclaimer for full details of our services and level of advice provided. 06/06/12 Relative to traditional companies, their lack of hard assets means there is little or no security should the company go into administration. You may find it odd, but their lack of debt is a concern. We’ve made the point on a number of our previous reviews that reputational risk of not repaying debt at the first call date impacts on a company’s ability to borrow money is the big stick ensuring investors will get a return of capital. As unlikely a scenario as it is, SEEK’s lack of debt means they have little fear of the reputational risk stick. Distributions are discretionary and non‐cumulative. SEEK could theoretically stop payments for an interest free loan and need only make up two missed distributions before resuming dividends. You may argue that this isn’t very likely, there’s the reputational risk that would increase the cost of borrowing on future issues however we say – there’s hardly any debt and they’re hugely profitable so they should be offering investors surety of distributions. You may argue that if they stop distributions, they can’t pay ordinary shareholders. Sure, unlikely as long as they’re making profits. What happens if they start making a loss? You may argue that they can’t pay any dividends to ordinary shareholders if they don’t repay the Notes at the first call date in 5 years, they have to repay them to keep their shareholders happy. We say ‐ What happens if they start making a loss? You may argue that as distributions step up 2%pa after the initial call date, they become an expensive cost of borrowing. We say – If SEEK are struggling, 2%pa may be a cheap source of funding especially when you have the right to cancel distributions. We should add, it’s not that we dislike SEEK as an internet play, it’s just that by its very nature, this sector offers fixed income investors a greater investment risk due to the absence of tangible assets. Either way, we think there’ll be a lot of investors attracted to the 8.6%pa fixed rate and SEEK will raise the funds they’re SEEKing(!). Our view is its equity risk for fixed income returns. Note: SEEK Subordinated Notes will be listed on the ASX and as such the price of the Notes will be subject to market movements. Investor’s selling on market may receive a price lower (or higher) than the issue price. www.fundsfocus.com.au. This information has been prepared for distribution over the internet on a general advice basis and without taking into account the investment objectives, financial situation and particular needs of any particular person. Wealth Focus Pty Ltd makes no recommendations as to the merits of any investment opportunity referred to in this website. All indications of performance returns are historical and cannot be relied upon as an indicator for future performance. Please read our Financial Services Guide and Disclaimer for full details of our services and level of advice provided. 06/06/12