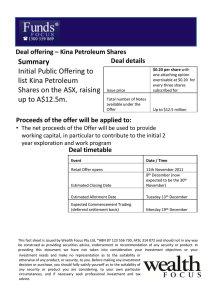

prospeCtus

advertisement