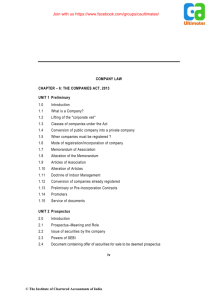

Sandon Capital Investments Limited PROSPECTUS (ACN 107 772 467)

advertisement