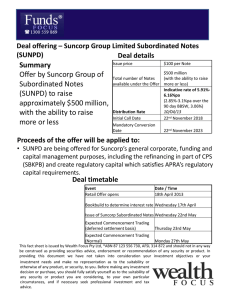

For personal use only Suncorp Convertible Preference Shares

advertisement