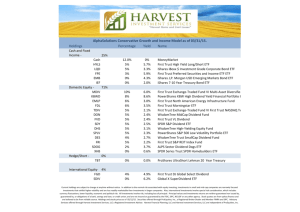

Accepted ASX Listed Equities as at 22 June 2015 Buffer - 5%

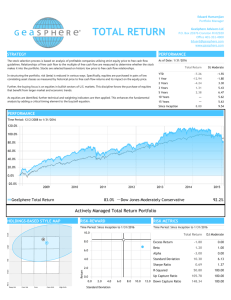

advertisement

Accepted ASX Listed Equities as at 22 June 2015 Subject to change at the discretion of CommSec Margin Lending ASX Code Security Name 1PG 1-PAGE LIMITED 3PL 3P LEARNING LIMITED.. AAA BETASHARES AUSTRALIAN HIGH INTEREST CASH ETF AAC AUSTRALIAN AGRICULTURAL COMPANY LIMITED. AAD ARDENT LEISURE GROUP AAX AUSENCO LIMITED ABA AUSWIDE BANK LTD ABC ADELAIDE BRIGHTON LIMITED ABP ABACUS PROPERTY GROUP ABU ABM RESOURCES NL ACR ACRUX LIMITED ADO ANTEO DIAGNOSTICS LIMITED AFG AUSTRALIAN FINANCE GROUP LTD AFI AUSTRALIAN FOUNDATION INVESTMENT COMPANY LIMITED AFIG AUSTRALIAN FOUNDATION INVESTMENT COMPANY LIMITED AFJ AFFINITY EDUCATION GROUP LIMITED AGF AMP CAPITAL CHINA GROWTH FUND AGI AINSWORTH GAME TECHNOLOGY LIMITED AGL AGL ENERGY LIMITED. AGLHA AGL ENERGY LIMITED. AHD AMALGAMATED HOLDINGS LIMITED AHG AUTOMOTIVE HOLDINGS GROUP LIMITED. AHY ASALEO CARE LIMITED AHZ ADMEDUS LTD AIA AUCKLAND INTERNATIONAL AIRPORT LIMITED AIO ASCIANO LIMITED AIZ AIR NEW ZEALAND LIMITED AJA ASTRO JAPAN PROPERTY GROUP AJD ASIA PACIFIC DATA CENTRE GROUP ALF AUSTRALIAN LEADERS FUND LIMITED ALK ALKANE RESOURCES LIMITED ALL ARISTOCRAT LEISURE LIMITED ALQ ALS LIMITED ALR ABERDEEN LEADERS LIMITED ALU ALTIUM LIMITED AMA AMA GROUP LIMITED AMC AMCOR LIMITED AMH AMCIL LIMITED AMM AMCOM TELECOMMUNICATIONS LIMITED AMP AMP LIMITED AMPHA AMP LIMITED ANN ANSELL LIMITED ANZ AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED ANZHA AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED ANZPA AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED ANZPC AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED ANZPD AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED ANZPE AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED ANZPF AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED AOG AVEO GROUP APA APA GROUP APE AP EAGERS LIMITED API AUSTRALIAN PHARMACEUTICAL INDUSTRIES LIMITED APN APN NEWS & MEDIA LIMITED APO APN OUTDOOR GROUP LIMITED APZ ASPEN GROUP AQG ALACER GOLD CORP. AQHHA APT PIPELINES LIMITED. ARB ARB CORPORATION LIMITED. ARF ARENA REIT. ARG ARGO INVESTMENTS LIMITED ARI ARRIUM LIMITED ASB AUSTAL LIMITED AST AUSNET SERVICES LIMITED ASTDA AUSNET SERVICES LIMITED ASX ASX LIMITED ASZ ASG GROUP LIMITED ATU ATRUM COAL NL AUB AUSTBROKERS HOLDINGS LIMITED AUI AUSTRALIAN UNITED INVESTMENT COMPANY LIMITED AVB AVANCO RESOURCES LIMITED AVG AUSTRALIAN VINTAGE LTD AWC ALUMINA LIMITED AWE AWE LIMITED AZJ AURIZON HOLDINGS LIMITED Portfolio LVR 40% 50% 85% 70% 70% 40% 45% 70% 65% 40% 40% 40% 45% 75% 75% 45% 60% 55% 75% 75% 65% 65% 60% 40% 60% 75% 40% 55% 40% 60% 40% 70% 60% 40% 45% 40% 80% 55% 55% 80% 80% 75% 80% 80% 80% 80% 80% 80% 80% 60% 75% 45% 50% 45% 50% 40% 45% 75% 65% 40% 75% 40% 45% 70% 70% 75% 40% 40% 60% 60% 40% 40% 70% 60% 80% Standard LVR 0% 45% 80% 65% 65% 0% 40% 65% 60% 0% 0% 0% 40% 70% 70% 40% 55% 50% 70% 70% 60% 60% 55% 0% 55% 70% 0% 50% 0% 55% 0% 65% 55% 0% 40% 35% 75% 50% 50% 75% 75% 70% 75% 75% 75% 75% 75% 75% 75% 55% 70% 40% 45% 40% 45% 0% 40% 70% 60% 0% 70% 0% 40% 65% 65% 70% 35% 0% 55% 55% 0% 0% 65% 55% 75% Single Stock LVR 0% 40% 75% 60% 60% 0% 35% 60% 55% 0% 0% 0% 35% 65% 65% 35% 50% 45% 65% 65% 55% 55% 50% 0% 50% 65% 0% 45% 0% 50% 0% 60% 50% 0% 35% 30% 70% 45% 45% 70% 70% 65% 70% 70% 70% 70% 70% 70% 70% 50% 65% 35% 40% 35% 40% 0% 35% 65% 55% 0% 65% 0% 35% 60% 60% 65% 30% 0% 50% 50% 0% 0% 60% 50% 70% Portfolio LVR (PLVR) is enabled in diversified portfolios with 5 or more securities with Standard LVR. Standard LVR applies if a security makes up more than 75% of the portfolio market value of lendable securities or is held through a Wrap Platform/Portfolio Service. Buffer - 5% Maximum Gearing Ratio - 90% ASX Code Security Name BAF BLUE SKY ALTERNATIVES ACCESS FUND LIMITED 40% 0% 0% BAL BELLAMY'S AUSTRALIA LIMITED 45% 40% 35% BAP BURSON GROUP LIMITED 50% 45% 40% BBG BILLABONG INTERNATIONAL LIMITED 40% 0% 0% BDR BEADELL RESOURCES LIMITED 40% 35% 30% BEAR BETASHARES AUSTRALIAN EQUITIES BEAR HEDGE FUND 40% 0% 0% BEN BENDIGO AND ADELAIDE BANK LIMITED 75% 70% 65% BENPD BENDIGO AND ADELAIDE BANK LIMITED 75% 70% 65% BENPE BENDIGO AND ADELAIDE BANK LIMITED 75% 70% 65% BENPF BENDIGO AND ADELAIDE BANK LIMITED 75% 70% 65% BGA BEGA CHEESE LIMITED 55% 50% 45% BGL BIGAIR GROUP LIMITED 45% 40% 35% BHP BHP BILLITON LIMITED 80% 75% 70% BKI BKI INVESTMENT COMPANY LIMITED 60% 55% 50% BKL BLACKMORES LIMITED 55% 50% 45% BKN BRADKEN LIMITED 50% 45% 40% BKW BRICKWORKS LIMITED 65% 60% 55% BLA BLUE SKY ALTERNATIVE INVESTMENTS LIMITED 40% 0% 0% BLD BORAL LIMITED. 75% 70% 65% BLX BEACON LIGHTING GROUP LIMITED 40% 0% 0% BNO BIONOMICS LIMITED 40% 0% 0% BOQ BANK OF QUEENSLAND LIMITED. 75% 70% 65% BOQPD BANK OF QUEENSLAND LIMITED. 75% 70% 65% BPT BEACH ENERGY LIMITED 65% 60% 55% BRG BREVILLE GROUP LIMITED 65% 60% 55% BRU BURU ENERGY LIMITED 40% 35% 30% BSL BLUESCOPE STEEL LIMITED 60% 55% 50% BTT BT INVESTMENT MANAGEMENT LIMITED 70% 65% 60% BWP BWP TRUST 70% 65% 60% BXB BRAMBLES LIMITED 80% 75% 70% CABCHARGE AUSTRALIA LIMITED 70% 65% 60% CAJ CAPITOL HEALTH LIMITED 45% 40% 35% CAM CLIME CAPITAL LIMITED 40% 0% 0% CAR CARSALES.COM LIMITED. 70% 65% 60% CBA COMMONWEALTH BANK OF AUSTRALIA. 80% 75% 70% CBAHA COMMONWEALTH BANK OF AUSTRALIA. 80% 75% 70% CBAPC COMMONWEALTH BANK OF AUSTRALIA. 80% 75% 70% CBAPD COMMONWEALTH BANK OF AUSTRALIA. 80% 75% 70% CCL COCA-COLA AMATIL LIMITED 80% 75% 70% CCP CREDIT CORP GROUP LIMITED 55% 50% 45% CCV CASH CONVERTERS INTERNATIONAL 50% 45% 40% CDA CODAN LIMITED 40% 0% 0% CDD CARDNO LIMITED 55% 50% 45% CDP CARINDALE PROPERTY TRUST 55% 50% 45% CGF CHALLENGER LIMITED 70% 65% 60% CGFPA CHALLENGER LIMITED 70% 65% 60% CGW COATS GROUP PLC 40% 0% 0% CHC CHARTER HALL GROUP 70% 65% 60% CIM CIMIC GROUP LIMITED 70% 65% 60% CIN CARLTON INVESTMENTS LIMITED 60% 55% 50% CKF COLLINS FOODS LIMITED 50% 45% 40% CLH COLLECTION HOUSE LIMITED 55% 50% 45% CMW CROMWELL PROPERTY GROUP 70% 65% 60% CNGHA COLONIAL HOLDING COMPANY LIMITED 75% 70% 65% CNU CHORUS LIMITED 50% 45% 40% COE COOPER ENERGY LIMITED 45% 40% 35% COH COCHLEAR LIMITED 75% 70% 65% CPU COMPUTERSHARE LIMITED. 70% 65% 60% CQR CHARTER HALL RETAIL REIT 70% 65% 60% CSL LIMITED 80% 75% 70% CSR CSR LIMITED 70% 65% 60% CSV CSG LIMITED 50% 45% 40% CTD CORPORATE TRAVEL MANAGEMENT LIMITED 60% 55% 50% CTN CONTANGO MICROCAP LIMITED 50% 45% 40% CTX CALTEX AUSTRALIA LIMITED 75% 70% 65% CTXHA CALTEX AUSTRALIA LIMITED 75% 70% 65% CUP COUNTPLUS LIMITED 40% 0% 0% CVN CARNARVON PETROLEUM LIMITED 40% 0% 0% CVO COVER-MORE GROUP LIMITED 55% 50% 45% CWE CARNEGIE WAVE ENERGY LIMITED 40% 0% 0% CWN CROWN RESORTS LIMITED 75% 70% 65% CWNHA CROWN RESORTS LIMITED 75% 70% 65% CWNHB CROWN RESORTS LIMITED 75% 70% 65% CWP CEDAR WOODS PROPERTIES LIMITED 45% 40% 35% CYA CENTURY AUSTRALIA INVESTMENTS LIMITED 55% 50% 45% CAB CSL Portfolio LVR Standard Single Stock LVR LVR Bold and Italics indicates Bonus Stocks (LVR is applicable for diversified Portfolio's only) Shading indicates changes since 1 June 2015 NB: Covered Call Options may be written against any stock with listed Exchange Traded Options (conditions apply) 1 Accepted ASX Listed Equities as at 22 June 2015 Subject to change at the discretion of CommSec Margin Lending ASX Code Security Name CYG COVENTRY GROUP LIMITED CZZ CAPILANO HONEY LIMITED DCG DECMIL GROUP LIMITED DJW DJERRIWARRH INVESTMENTS LIMITED DLS DRILLSEARCH ENERGY LIMITED DLX DULUXGROUP LIMITED DMP DOMINO'S PIZZA ENTERPRISES LIMITED DNA DONACO INTERNATIONAL LIMITED DOW DOWNER EDI LIMITED DRM DORAY MINERALS LIMITED DSH DICK SMITH HOLDINGS LIMITED DTL DATA#3 LIMITED DUE DUET GROUP DUI DIVERSIFIED UNITED INVESTMENT LIMITED DVN DEVINE LIMITED DWS DWS LIMITED DXS DEXUS PROPERTY GROUP EGP ECHO ENTERTAINMENT GROUP LIMITED EHE ESTIA HEALTH LIMITED ELD ELDERS LIMITED ENE ENERGY DEVELOPMENTS LIMITED EPD EMPIRED LTD EPW ERM POWER LIMITED EPX ETHANE PIPELINE INCOME FUND EQT EQUITY TRUSTEES LIMITED ESV ESERVGLOBAL LIMITED ETPMAG ETFS GROUP EVN EVOLUTION MINING LIMITED EWC ENERGY WORLD CORPORATION LTD FAR FAR LIMITED FBU FLETCHER BUILDING LIMITED FDC FEDERATION CENTRES FGX FUTURE GENERATION INVESTMENT COMPANY LIMITED FLK FOLKESTONE LIMITED FLN FREELANCER LIMITED FLT FLIGHT CENTRE TRAVEL GROUP LIMITED FMG FORTESCUE METALS GROUP LTD FNP FREEDOM FOODS GROUP LIMITED FPH FISHER & PAYKEL HEALTHCARE CORPORATION LIMITED FRI FINBAR GROUP LIMITED FSF FONTERRA SHAREHOLDERS' FUND FWD FLEETWOOD CORPORATION LIMITED FXJ FAIRFAX MEDIA LIMITED FXL FLEXIGROUP LIMITED GBT GBST HOLDINGS LIMITED GDI GDI PROPERTY GROUP GEM G8 EDUCATION LIMITED GFY GODFREYS GROUP LIMITED GHC GENERATION HEALTHCARE REIT GJT GALILEO JAPAN TRUST GMA GENWORTH MORTGAGE INSURANCE AUSTRALIA LIMITED GMF GPT METRO OFFICE FUND GMG GOODMAN GROUP GMPPA GOODMAN PLUS TRUST GNC GRAINCORP LIMITED GNE GENESIS ENERGY LIMITED GOLD ETFS METAL SECURITIES AUSTRALIA LIMITED. GOR GOLD ROAD RESOURCES LIMITED GOZ GROWTHPOINT PROPERTIES AUSTRALIA GPT GPT GROUP GRR GRANGE RESOURCES LIMITED. GRS GREENSTONE LIMITED GTY GATEWAY LIFESTYLE GROUP GUD G.U.D. HOLDINGS LIMITED GWA GWA GROUP LIMITED. GWADA GWA GROUP LIMITED. GXL GREENCROSS LIMITED HFA HFA HOLDINGS LIMITED HFR HIGHFIELD RESOURCES LIMITED HGG HENDERSON GROUP PLC. HHV HUNTER HALL GLOBAL VALUE LIMITED HIL HILLS LIMITED HPI HOTEL PROPERTY INVESTMENTS HSN HANSEN TECHNOLOGIES LIMITED HSO HEALTHSCOPE LIMITED. Portfolio LVR 40% 40% 50% 65% 55% 70% 65% 40% 65% 40% 60% 40% 70% 55% 40% 50% 75% 70% 65% 40% 50% 40% 50% 40% 45% 40% 50% 45% 40% 40% 70% 75% 40% 40% 40% 75% 55% 45% 65% 40% 55% 45% 65% 65% 50% 50% 65% 40% 40% 40% 65% 45% 75% 70% 70% 45% 65% 40% 60% 75% 40% 50% 50% 70% 65% 65% 55% 40% 40% 75% 60% 50% 50% 50% 70% Standard LVR 0% 0% 45% 60% 50% 65% 60% 0% 60% 0% 55% 0% 65% 50% 0% 45% 70% 65% 60% 0% 45% 0% 45% 0% 40% 0% 45% 40% 0% 0% 65% 70% 0% 0% 0% 70% 50% 40% 60% 0% 50% 40% 60% 60% 45% 45% 60% 0% 0% 0% 60% 40% 70% 65% 65% 40% 60% 0% 55% 70% 0% 45% 45% 65% 60% 60% 50% 0% 0% 70% 55% 45% 45% 45% 65% Single Stock LVR 0% 0% 40% 55% 45% 60% 55% 0% 55% 0% 50% 0% 60% 45% 0% 40% 65% 60% 55% 0% 40% 0% 40% 0% 35% 0% 40% 35% 0% 0% 60% 65% 0% 0% 0% 65% 45% 35% 55% 0% 45% 35% 55% 55% 40% 40% 55% 0% 0% 0% 55% 35% 65% 60% 60% 35% 55% 0% 50% 65% 0% 40% 40% 60% 55% 55% 45% 0% 0% 65% 50% 40% 40% 40% 60% Portfolio LVR (PLVR) is enabled in diversified portfolios with 5 or more securities with Standard LVR. Standard LVR applies if a security makes up more than 75% of the portfolio market value of lendable securities or is held through a Wrap Platform/Portfolio Service. Buffer - 5% Maximum Gearing Ratio - 90% ASX Code Security Name HUO HUON AQUACULTURE GROUP LIMITED 40% 0% 0% HVN HARVEY NORMAN HOLDINGS LIMITED 70% 65% 60% HVST BETASHARES AUSTRALIAN DIVIDEND HARVESTER FUND (MANAGED FUND) 50% 45% HORIZON OIL LIMITED 45% 40% 40% 35% 65% 60% HZN Portfolio LVR Standard Single Stock LVR LVR IAA ISHARES ASIA 50 ETF 70% IAF ISHARES COMPOSITE BOND ETF 80% 75% 70% IAG INSURANCE AUSTRALIA GROUP LIMITED 80% 75% 70% IAGPC INSURANCE AUSTRALIA GROUP LIMITED 80% 75% 70% IBK ISHARES MSCI BRIC ETF 60% 55% 50% ICN ICON ENERGY LIMITED 40% 0% ICQ ICAR ASIA LIMITED 40% 0% 0% IDR INDUSTRIA REIT 50% 45% 40% IEM ISHARES MSCI EMERGING MARKETS ETF 70% 65% 60% IEU ISHARES EUROPE ETF 70% 65% 60% IFL IOOF HOLDINGS LIMITED 65% 60% 55% IFM INFOMEDIA LTD 50% 45% 40% IFN INFIGEN ENERGY 40% 0% 0% IGO INDEPENDENCE GROUP NL 55% 50% 45% IHD ISHARES S&P/ASX DIVIDEND OPPORTUNITIES ETF 70% 65% 60% IHK ISHARES MSCI HONG KONG ETF 65% 60% 55% IJH ISHARES CORE S&P MID-CAP ETF 70% 65% 60% IJP ISHARES MSCI JAPAN ETF 70% 65% 60% IJR ISHARES CORE S&P SMALL-CAP ETF 70% 65% 60% IKO ISHARES MSCI SOUTH KOREA CAPPED ETF 65% 60% 55% ILC ISHARES S&P/ASX 20 ETF 70% 65% 60% ILU ILUKA RESOURCES LIMITED 70% 65% 60% IMD IMDEX LIMITED 40% 35% 30% IMF IMF BENTHAM LIMITED 55% 50% 45% INA INGENIA COMMUNITIES GROUP 50% 45% 40% IOF INVESTA OFFICE FUND 70% 65% 60% IOO ISHARES GLOBAL 100 ETF 70% 65% 60% IOZ ISHARES MSCI AUSTRALIA 200 ETF 70% 65% 60% IPD IMPEDIMED LIMITED 40% 0% 0% IPH IPH LIMITED 55% 50% 45% IPL INCITEC PIVOT LIMITED 75% 70% 65% IPP IPROPERTY GROUP LIMITED 40% 0% 0% IRE IRESS LIMITED 70% 65% 60% IRI INTEGRATED RESEARCH LIMITED 40% 0% 0% IRU ISHARES RUSSELL 2000 ETF 60% 55% 50% ISD ISENTIA GROUP LIMITED 45% 40% 35% ISG ISHARES MSCI SINGAPORE ETF 45% 40% 35% ISO ISHARES S&P/ASX SMALL ORDINARIES ETF 55% 50% 45% ISU ISELECT LIMITED. 45% 40% 35% ITW ISHARES MSCI TAIWAN ETF 40% 0% 0% IVC INVOCARE LIMITED 70% 65% 60% IVE ISHARES MSCI EAFE ETF 70% 65% 60% IVV ISHARES CORE S&P 500 ETF 70% 65% 60% IXI ISHARES GLOBAL CONSUMER STAPLES ETF 70% 65% 60% IXJ ISHARES GLOBAL HEALTHCARE ETF 65% 60% 55% IXP ISHARES GLOBAL TELECOM ETF 40% 0% 0% IZZ ISHARES CHINA LARGE-CAP ETF 70% 65% 60% JBH JB HI-FI LIMITED 70% 65% 60% JHC JAPARA HEALTHCARE LIMITED 50% 45% 40% JHX JAMES HARDIE INDUSTRIES PLC 70% 65% 60% KAM K2 ASSET MANAGEMENT HOLDINGS LTD 40% 0% 0% KAR KAROON GAS AUSTRALIA LIMITED 45% 40% 35% KCN KINGSGATE CONSOLIDATED LIMITED. 40% 0% 0% KMD KATHMANDU HOLDINGS LIMITED 45% 40% 35% KRM KINGSROSE MINING LIMITED 40% 0% 0% KSC K & S CORPORATION LIMITED 40% 0% 0% LEP ALE PROPERTY GROUP 60% 55% 50% LHC LIFEHEALTHCARE GROUP LIMITED 40% LIC LIFESTYLE COMMUNITIES LIMITED 40% 0% 0% LLC LEND LEASE GROUP 75% 70% 65% LNG LIQUEFIED NATURAL GAS LIMITED 40% 35% 30% LOV LOVISA HOLDINGS LIMITED 40% 0% 0% MAD MAVERICK DRILLING AND EXPLORATION LIMITED 40% 0% 0% MBE MOBILE EMBRACE LIMITED 40% 0% 0% MBLHB MACQUARIE BANK LIMITED 75% 70% 65% MBLPA MACQUARIE BANK LIMITED 75% 70% 65% MCE MATRIX COMPOSITES & ENGINEERING LIMITED 40% 0% 0% MCP MCPHERSON'S LIMITED 40% 0% 0% MDL MINERAL DEPOSITS LIMITED 40% 0% 0% MFF MAGELLAN FLAGSHIP FUND LIMITED 70% 65% 60% MFG MAGELLAN FINANCIAL GROUP LIMITED 65% 60% 55% 0% 0% 0% Bold and Italics indicates Bonus Stocks (LVR is applicable for diversified Portfolio's only) Shading indicates changes since 1 June 2015 NB: Covered Call Options may be written against any stock with listed Exchange Traded Options (conditions apply) 2 Accepted ASX Listed Equities as at 22 June 2015 Subject to change at the discretion of CommSec Margin Lending ASX Code Security Name MGE MAGELLAN GLOBAL EQUITIES FUND (MANAGED FUND) MGR MIRVAC GROUP MIN MINERAL RESOURCES LIMITED MIR MIRRABOOKA INVESTMENTS LIMITED MLB MELBOURNE IT LIMITED MLD MACA LIMITED MLT MILTON CORPORATION LIMITED MLX METALS X LIMITED MML MEDUSA MINING LIMITED MMS MCMILLAN SHAKESPEARE LIMITED MND MONADELPHOUS GROUP LIMITED MNF MY NET FONE LIMITED MNY MONEY3 CORPORATION LIMITED MOC MORTGAGE CHOICE LIMITED MPL MEDIBANK PRIVATE LIMITED MQA MACQUARIE ATLAS ROADS GROUP MQG MACQUARIE GROUP LIMITED MQGPA MACQUARIE GROUP LIMITED MRM MMA OFFSHORE LIMITED MSB MESOBLAST LIMITED MTR MANTRA GROUP LIMITED MTS METCASH LIMITED MTU M2 GROUP LTD MVF MONASH IVF GROUP LIMITED MVP MEDICAL DEVELOPMENTS INTERNATIONAL LIMITED MXI MAXITRANS INDUSTRIES LIMITED MYO MYOB GROUP LIMITED MYR MYER HOLDINGS LIMITED MYS MYSTATE LIMITED MYT MIGHTY RIVER POWER LIMITED MYX MAYNE PHARMA GROUP LIMITED NAB NATIONAL AUSTRALIA BANK LIMITED NABHA NATIONAL AUSTRALIA BANK LIMITED NABHB NATIONAL AUSTRALIA BANK LIMITED NABPA NATIONAL AUSTRALIA BANK LIMITED NABPB NATIONAL AUSTRALIA BANK LIMITED NABPC NATIONAL AUSTRALIA BANK LIMITED NAN NANOSONICS LIMITED NCM NEWCREST MINING LIMITED NEA NEARMAP LTD NEC NINE ENTERTAINMENT CO. HOLDINGS LIMITED NFNG NUFARM FINANCE (NZ) LIMITED NHC NEW HOPE CORPORATION LIMITED NHF NIB HOLDINGS LIMITED NSR NATIONAL STORAGE REIT NST NORTHERN STAR RESOURCES LTD NTC NETCOMM WIRELESS LIMITED NUF NUFARM LIMITED NVT NAVITAS LIMITED NWH NRW HOLDINGS LIMITED NWS NEWS CORPORATION.. NWSLV NEWS CORPORATION.. NXT NEXTDC LIMITED OEL OTTO ENERGY LIMITED OFX OZFOREX GROUP LIMITED OGC OCEANAGOLD CORPORATION OML OOH!MEDIA LIMITED ONT 1300 SMILES LIMITED ORA ORORA LIMITED ORE OROCOBRE LIMITED ORG ORIGIN ENERGY LIMITED ORGHA ORIGIN ENERGY LIMITED ORI ORICA LIMITED ORL OROTONGROUP LIMITED OSH OIL SEARCH LIMITED OZF SPDR S&P/ASX 200 FINANCIALS EX A-REIT FUND OZL OZ MINERALS LIMITED OZR SPDR S&P/ASX 200 RESOURCES FUND PAF PM CAPITAL ASIAN OPPORTUNITIES FUND LIMITED PAN PANORAMIC RESOURCES LIMITED PBG PACIFIC BRANDS LIMITED PCAPA PREFERRED CAPITAL LIMITED PFL PATTIES FOODS LTD PGF PM CAPITAL GLOBAL OPPORTUNITIES FUND LIMITED PGH PACT GROUP HOLDINGS LTD Portfolio LVR 55% 75% 60% 55% 50% 45% 65% 45% 45% 60% 60% 40% 40% 50% 75% 65% 75% 75% 60% 60% 45% 70% 65% 50% 40% 40% 65% 70% 55% 40% 50% 80% 80% 80% 80% 80% 80% 40% 75% 40% 65% 40% 60% 70% 45% 45% 40% 65% 60% 40% 70% 60% 50% 40% 65% 45% 40% 40% 70% 40% 80% 80% 75% 45% 75% 70% 55% 65% 40% 40% 60% 80% 45% 55% 65% Standard LVR 50% 70% 55% 50% 45% 40% 60% 40% 40% 55% 55% 0% 0% 45% 70% 60% 70% 70% 55% 55% 40% 65% 60% 45% 0% 0% 60% 65% 50% 0% 45% 75% 75% 75% 75% 75% 75% 0% 70% 0% 60% 0% 55% 65% 40% 40% 0% 60% 55% 0% 65% 55% 45% 0% 60% 40% 0% 0% 65% 0% 75% 75% 70% 40% 70% 65% 50% 60% 0% 0% 55% 75% 40% 50% 60% Single Stock LVR 45% 65% 50% 45% 40% 35% 55% 35% 35% 50% 50% 0% 0% 40% 65% 55% 65% 65% 50% 50% 35% 60% 55% 40% 0% 0% 55% 60% 45% 0% 40% 70% 70% 70% 70% 70% 70% 0% 65% 0% 55% 0% 50% 60% 35% 35% 0% 55% 50% 0% 60% 50% 40% 0% 55% 35% 0% 0% 60% 0% 70% 70% 65% 35% 65% 60% 45% 55% 0% 0% 50% 70% 35% 45% 55% Portfolio LVR (PLVR) is enabled in diversified portfolios with 5 or more securities with Standard LVR. Standard LVR applies if a security makes up more than 75% of the portfolio market value of lendable securities or is held through a Wrap Platform/Portfolio Service. Buffer - 5% Maximum Gearing Ratio - 90% ASX Code Security Name PGR THE PAS GROUP LIMITED PIC PERPETUAL EQUITY INVESTMENT COMPANY LIMITED PMC PLATINUM CAPITAL LIMITED PMV PREMIER INVESTMENTS LIMITED PPC PEET LIMITED PPS PRAEMIUM LIMITED PPT PERPETUAL LIMITED PRG PROGRAMMED MAINTENANCE SERVICES LIMITED PRT PRIME MEDIA GROUP LIMITED PRU PERSEUS MINING LIMITED PRY PRIMARY HEALTH CARE LIMITED PRYHA PRIMARY HEALTH CARE LIMITED PSQ PACIFIC SMILES GROUP LIMITED PTM PLATINUM ASSET MANAGEMENT LIMITED PVD PURA VIDA ENERGY NL QAN QANTAS AIRWAYS LIMITED QAU BETASHARES GOLD BULLION ETF - CURRENCY HEDGED QBE QBE INSURANCE GROUP LIMITED QFN BETASHARES S&P/ASX 200 FINANCIALS SECTOR ETF QHL QUICKSTEP HOLDINGS LIMITED QOZ BETASHARES FTSE RAFI AUSTRALIA 200 ETF QRE BETASHARES S&P/ASX 200 RESOURCES SECTOR ETF QUAL MARKET VECTORS MSCI WORLD EX AUSTRALIA QUALITY ETF QUB QUBE HOLDINGS LIMITED QVE QV EQUITIES LIMITED RCG RCG CORPORATION LIMITED RCR RCR TOMLINSON LIMITED RDV RUSSELL HIGH DIVIDEND AUSTRALIAN SHARES ETF REA REA GROUP LTD REC RECALL HOLDINGS LIMITED REG REGIS HEALTHCARE LIMITED REH REECE AUSTRALIA LIMITED RFF RURAL FUNDS GROUP RFG RETAIL FOOD GROUP LIMITED RFL RUBIK FINANCIAL LIMITED RHC RAMSAY HEALTH CARE LIMITED RHCPA RAMSAY HEALTH CARE LIMITED RHL RURALCO HOLDINGS LIMITED RHP RHIPE LIMITED RIC RIDLEY CORPORATION LIMITED RIO RIO TINTO LIMITED RKN RECKON LIMITED RMD RESMED INC RNY RNY PROPERTY TRUST RRL REGIS RESOURCES LIMITED RSG RESOLUTE MINING LIMITED RXP RXP SERVICES LIMITED S32 SOUTH32 LIMITED SAI SAI GLOBAL LIMITED SAR SARACEN MINERAL HOLDINGS LIMITED SBKHB SUNCORP-METWAY LIMITED . SCG SCENTRE GROUP SCP SHOPPING CENTRES AUSTRALASIA PROPERTY GROUP SDA SPEEDCAST INTERNATIONAL LIMITED SDF STEADFAST GROUP LIMITED SDG SUNLAND GROUP LIMITED SDM SEDGMAN LIMITED SEA SUNDANCE ENERGY AUSTRALIA LIMITED SEH SINO GAS & ENERGY HOLDINGS LIMITED SEK SEEK LIMITED SFH SPECIALTY FASHION GROUP LIMITED SFR SANDFIRE RESOURCES NL SFY SPDR S&P/ASX 50 FUND SGF SG FLEET GROUP LIMITED SGH SLATER & GORDON LIMITED SGM SIMS METAL MANAGEMENT LIMITED SGN STW COMMUNICATIONS GROUP LIMITED SGP STOCKLAND SHJ SHINE CORPORATE LTD SHL SONIC HEALTHCARE LIMITED SHV SELECT HARVESTS LIMITED SIP SIGMA PHARMACEUTICALS LIMITED SIQ SMARTGROUP CORPORATION LTD SIR SIRIUS RESOURCES NL SIV SILVER CHEF LIMITED Portfolio LVR 40% 45% 60% 70% 50% 40% 70% 55% 50% 40% 70% 70% 40% 70% 40% 70% 55% 75% 65% 40% 45% 60% 45% 70% 50% 45% 50% 65% 70% 65% 55% 40% 40% 65% 40% 75% 75% 45% 40% 55% 80% 50% 75% 40% 45% 45% 40% 75% 70% 40% 80% 75% 70% 40% 55% 50% 40% 40% 40% 70% 40% 60% 75% 55% 65% 70% 55% 75% 50% 75% 50% 65% 40% 40% 45% Standard Single Stock LVR LVR 0% 0% 40% 35% 55% 50% 65% 60% 45% 40% 0% 0% 65% 60% 50% 45% 45% 40% 35% 30% 65% 60% 65% 60% 0% 0% 65% 60% 0% 0% 65% 60% 50% 45% 70% 65% 60% 55% 0% 0% 40% 35% 55% 50% 40% 35% 65% 60% 45% 40% 40% 35% 45% 40% 60% 55% 65% 60% 60% 55% 50% 45% 0% 0% 0% 0% 60% 55% 0% 0% 70% 65% 70% 65% 40% 35% 0% 0% 50% 45% 75% 70% 45% 40% 70% 65% 0% 0% 40% 35% 40% 35% 0% 0% 70% 65% 65% 60% 0% 0% 75% 70% 70% 65% 65% 60% 0% 0% 50% 45% 45% 40% 35% 30% 35% 30% 0% 0% 65% 60% 0% 0% 55% 50% 70% 65% 50% 45% 60% 55% 65% 60% 50% 45% 70% 65% 45% 40% 70% 65% 45% 40% 60% 55% 0% 0% 0% 0% 40% 35% Bold and Italics indicates Bonus Stocks (LVR is applicable for diversified Portfolio's only) Shading indicates changes since 1 June 2015 NB: Covered Call Options may be written against any stock with listed Exchange Traded Options (conditions apply) 3 Accepted ASX Listed Equities as at 22 June 2015 Subject to change at the discretion of CommSec Margin Lending ASX Code SKC SKE SKI SKT SLF SLM SLR SLX SMX SOL SOM SPK SPL SPO SRF SRV SRX SSM SSO STO STW STX SUL SUN SUNPC SUNPD SUNPE SVW SVWPA SWL SWM SXL SXY SYD SYI SYR TAH TAHHB TAP TCL TEN TFC TGA TGG TGP TGR TIX TLS TME TNE TNG TOF TOP TOX TPI TPM TRG TRS TRY TSE TTS TTSHA TWE UGL UNS URF USD UXC VAH VAP VAS VED VEI VEU VHY Security Name SKYCITY ENTERTAINMENT GROUP LIMITED SKILLED GROUP LIMITED SPARK INFRASTRUCTURE GROUP SKY NETWORK TELEVISION LIMITED. SPDR S&P/ASX 200 LISTED PROPERTY FUND SALMAT LIMITED SILVER LAKE RESOURCES LIMITED SILEX SYSTEMS LIMITED SMS MANAGEMENT & TECHNOLOGY LIMITED. WASHINGTON H SOUL PATTINSON & COMPANY LIMITED SOMNOMED LIMITED SPARK NEW ZEALAND LIMITED STARPHARMA HOLDINGS LIMITED SPOTLESS GROUP HOLDINGS LIMITED SURFSTITCH GROUP LIMITED SERVCORP LIMITED SIRTEX MEDICAL LIMITED SERVICE STREAM LIMITED SPDR S&P/ASX SMALL ORDINARIES FUND SANTOS LIMITED SPDR S&P/ASX 200 FUND STRIKE ENERGY LIMITED SUPER RETAIL GROUP LIMITED SUNCORP GROUP LIMITED SUNCORP GROUP LIMITED SUNCORP GROUP LIMITED SUNCORP GROUP LIMITED SEVEN GROUP HOLDINGS LIMITED SEVEN GROUP HOLDINGS LIMITED SEYMOUR WHYTE LIMITED SEVEN WEST MEDIA LIMITED SOUTHERN CROSS MEDIA GROUP LIMITED SENEX ENERGY LIMITED SYDNEY AIRPORT SPDR MSCI AUSTRALIA SELECT HIGH DIVIDEND YIELD FUND SYRAH RESOURCES LIMITED TABCORP HOLDINGS LIMITED TABCORP HOLDINGS LIMITED TAP OIL LIMITED TRANSURBAN GROUP TEN NETWORK HOLDINGS LIMITED TFS CORPORATION LIMITED THORN GROUP LIMITED TEMPLETON GLOBAL GROWTH FUND LIMITED 360 CAPITAL GROUP TASSAL GROUP LIMITED 360 CAPITAL INDUSTRIAL FUND TELSTRA CORPORATION LIMITED. TRADE ME GROUP LIMITED TECHNOLOGY ONE LIMITED TNG LIMITED 360 CAPITAL OFFICE FUND THORNEY OPPORTUNITIES LTD TOX FREE SOLUTIONS LIMITED TRANSPACIFIC INDUSTRIES GROUP LTD TPG TELECOM LIMITED TREASURY GROUP LIMITED THE REJECT SHOP LIMITED TROY RESOURCES LIMITED TRANSFIELD SERVICES LIMITED TATTS GROUP LIMITED TATTS GROUP LIMITED TREASURY WINE ESTATES LIMITED UGL LIMITED UNILIFE CORPORATION US MASTERS RESIDENTIAL PROPERTY FUND BETASHARES U.S. DOLLAR ETF UXC LIMITED VIRGIN AUSTRALIA HOLDINGS LIMITED VANGUARD AUSTRALIAN PROPERTY SECURITIES INDEX ETF VANGUARD AUSTRALIAN SHARES INDEX ETF VEDA GROUP LIMITED VISION EYE INSTITUTE LIMITED VANGUARD ALL-WORLD EX-US SHARES INDEX ETF VANGUARD AUSTRALIAN SHARES HIGH YIELD ETF Portfolio LVR 70% 55% 70% 65% 65% 40% 40% 40% 55% 65% 40% 70% 40% 65% 40% 50% 55% 40% 40% 75% 75% 40% 70% 80% 80% 80% 80% 70% 70% 40% 65% 60% 55% 75% 75% 40% 75% 70% 50% 80% 55% 45% 60% 60% 40% 65% 55% 80% 70% 55% 40% 45% 40% 55% 65% 65% 50% 55% 40% 55% 75% 75% 70% 65% 40% 40% 80% 50% 55% 65% 75% 60% 40% 70% 75% Standard LVR 65% 50% 65% 60% 60% 0% 0% 0% 50% 60% 0% 65% 0% 60% 0% 45% 50% 0% 0% 70% 70% 0% 65% 75% 75% 75% 75% 65% 65% 0% 60% 55% 50% 70% 70% 0% 70% 65% 45% 75% 50% 40% 55% 55% 0% 60% 50% 75% 65% 50% 0% 40% 0% 50% 60% 60% 45% 50% 0% 50% 70% 70% 65% 60% 0% 0% 75% 45% 50% 60% 70% 55% 0% 65% 70% Single Stock LVR 60% 45% 60% 55% 55% 0% 0% 0% 45% 55% 0% 60% 0% 55% 0% 40% 45% 0% 0% 65% 65% 0% 60% 70% 70% 70% 70% 60% 60% 0% 55% 50% 45% 65% 65% 0% 65% 60% 40% 70% 45% 35% 50% 50% 0% 55% 45% 70% 60% 45% 0% 35% 0% 45% 55% 55% 40% 45% 0% 45% 65% 65% 60% 55% 0% 0% 70% 40% 45% 55% 65% 50% 0% 60% 65% Portfolio LVR (PLVR) is enabled in diversified portfolios with 5 or more securities with Standard LVR. Standard LVR applies if a security makes up more than 75% of the portfolio market value of lendable securities or is held through a Wrap Platform/Portfolio Service. ASX Code VLW VOC VRL VRT VSO VTG VTS WAM WAX WBA WBC WBCHA WBCHB WBCPC WBCPD WBCPE WCTPA WEB WES WFD WHC WHF WIC WOR WOW WOWHC WPL WTP WXOZ XRO YBR YMAX YOW Buffer - 5% Maximum Gearing Ratio - 90% Security Name VILLA WORLD LIMITED. VOCUS COMMUNICATIONS LIMITED VILLAGE ROADSHOW LIMITED VIRTUS HEALTH LIMITED VANGUARD MSCI AUSTRALIAN SMALL COMPANIES INDEX ETF VITA GROUP LIMITED VANGUARD US TOTAL MARKET SHARES INDEX ETF WAM CAPITAL LIMITED WAM RESEARCH LIMITED WEBSTER LIMITED WESTPAC BANKING CORPORATION WESTPAC BANKING CORPORATION WESTPAC BANKING CORPORATION WESTPAC BANKING CORPORATION WESTPAC BANKING CORPORATION WESTPAC BANKING CORPORATION WESTPAC TPS TRUST WEBJET LIMITED WESFARMERS LIMITED WESTFIELD CORPORATION WHITEHAVEN COAL LIMITED WHITEFIELD LIMITED WESTOZ INVESTMENT COMPANY LIMITED WORLEYPARSONS LIMITED WOOLWORTHS LIMITED WOOLWORTHS LIMITED WOODSIDE PETROLEUM LIMITED WATPAC LIMITED SPDR S&P WORLD EX AUSTRALIA FUND XERO LIMITED YELLOW BRICK ROAD HOLDINGS LIMITED BETASHARES AUS TOP20 EQUITY YIELD MAX FUND (MG FD) YOWIE GROUP LTD Portfolio LVR 50% 60% 65% 65% 40% 45% 70% 65% 45% 40% 80% 80% 80% 80% 80% 80% 80% 50% 80% 80% 55% 50% 40% 70% 80% 80% 80% 40% 55% 40% 40% 75% 40% Standard Single Stock LVR LVR 45% 40% 55% 50% 60% 55% 60% 55% 0% 0% 40% 35% 65% 60% 60% 55% 40% 35% 0% 0% 75% 70% 75% 70% 75% 70% 75% 70% 75% 70% 75% 70% 75% 70% 45% 40% 75% 70% 75% 70% 50% 45% 45% 40% 35% 30% 65% 60% 75% 70% 75% 70% 75% 70% 0% 0% 50% 45% 0% 0% 0% 0% 70% 65% 0% 0% Bold and Italics indicates Bonus Stocks (LVR is applicable for diversified Portfolio's only) Shading indicates changes since 1 June 2015 NB: Covered Call Options may be written against any stock with listed Exchange Traded Options (conditions apply) 4 Accepted Exchange Traded Funds Buffer - 5% Maximum Gearing Ratio - 90% as at 22 June 2015 Subject to change at the discretion of CommSec Margin Lending ASX Code HVST IAA IAF IBK IEM IEU IHD IHK IJH IJP IJR IKO ILC IOO IOZ IRU ISG ISO ITW IVE IVV Portfolio LVR 50% BETASHARES AUSTRALIAN DIVIDEND HARVESTER FUND (MANAGED FUND) 70% ISHARES ASIA 50 ETF 80% ISHARES COMPOSITE BOND ETF 60% ISHARES MSCI BRIC ETF 70% ISHARES MSCI EMERGING MARKETS ETF 70% ISHARES EUROPE ETF 70% ISHARES S&P/ASX DIVIDEND OPPORTUNITIES ETF 65% ISHARES MSCI HONG KONG ETF 70% ISHARES CORE S&P MID-CAP ETF 70% ISHARES MSCI JAPAN ETF 70% ISHARES CORE S&P SMALL-CAP ETF 65% ISHARES MSCI SOUTH KOREA CAPPED ETF 70% ISHARES S&P/ASX 20 ETF 70% ISHARES GLOBAL 100 ETF 70% ISHARES MSCI AUSTRALIA 200 ETF 60% ISHARES RUSSELL 2000 ETF 45% ISHARES MSCI SINGAPORE ETF 55% ISHARES S&P/ASX SMALL ORDINARIES ETF 40% ISHARES MSCI TAIWAN ETF 70% ISHARES MSCI EAFE ETF 70% ISHARES CORE S&P 500 ETF Security Name Standard LVR 45% 65% 75% 55% 65% 65% 65% 60% 65% 65% 65% 60% 65% 65% 65% 55% 40% 50% 0% 65% 65% Single Stock LVR 40% 60% 70% 50% 60% 60% 60% 55% 60% 60% 60% 55% 60% 60% 60% 50% 35% 45% 0% 60% 60% Portfolio LVR (PLVR) is enabled in diversified portfolios with 5 or more securities with Standard LVR. Standard LVR applies if a security makes up more than 75% of the portfolio market value of lendable securities or is held through a Wrap Platform/Portfolio Service. NB: Covered Call Options may be written against any stock with listed Exchange Traded Options (conditions apply) ASX Portfolio LVR Standard Single Stock LVR LVR Code Security Name IXI ISHARES GLOBAL CONSUMER STAPLES ETF 65% 60% 55% IXJ ISHARES GLOBAL HEALTHCARE ETF 65% 60% 55% IXP ISHARES GLOBAL TELECOM ETF 40% 0% 0% IZZ ISHARES CHINA LARGE-CAP ETF 70% 65% 60% QAU BETASHARES GOLD BULLION ETF - CURRENCY HEDGED 55% 50% 45% QFN BETASHARES S&P/ASX 200 FINANCIALS SECTOR ETF 65% 60% 55% QOZ BETASHARES FTSE RAFI AUSTRALIA 200 ETF 45% 40% 35% QRE BETASHARES S&P/ASX 200 RESOURCES SECTOR ETF 60% 55% 50% QUAL MARKET VECTORS MSCI WORLD EX AUSTRALIA QUALITY ETF 45% 40% 35% RDV RUSSELL HIGH DIVIDEND AUSTRALIAN SHARES ETF 65% 60% 55% SFY SPDR S&P/ASX 50 FUND 75% 70% 65% SLF SPDR S&P/ASX 200 LISTED PROPERTY FUND 65% 60% 55% STW SPDR S&P/ASX 200 FUND 75% 70% 65% USD BETASHARES U.S. DOLLAR ETF 80% 75% 70% VAP VANGUARD AUSTRALIAN PROPERTY SECURITIES INDEX ETF 65% 60% 55% VAS VANGUARD AUSTRALIAN SHARES INDEX ETF 75% 70% 65% VEU VANGUARD ALL-WORLD EX-US SHARES INDEX ETF 70% 65% 60% VHY VANGUARD AUSTRALIAN SHARES HIGH YIELD ETF 75% 70% 65% VSO VANGUARD MSCI AUSTRALIAN SMALL COMPANIES INDEX ETF 40% 0% 0% VTS VANGUARD US TOTAL MARKET SHARES INDEX ETF 70% 65% 60% Bold and Italics indicates Bonus Stocks (LVR is applicable for diversified Portfolio's only) Shading indicates changes since 1 June 2015 CommSec Margin Lending facilities are provided by the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 and administered by its wholly owned but non-guaranteed subsidiary Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 (CommSec), a Participant of the ASX Group. For the purpose of CommSec Margin Loans Commonwealth Bank of Australia reserves the right to vary the above list of securities and the lending ratios at any time without notice and at its total discretion. For the purposes of CommSec Term Short Selling each of Commonwealth Bank of Australia and CommSec reserves the right to vary the above list of securities and the lending ratios at any time without notice and at its total discretion. Commonwealth Bank of Australia or any member of the Group does not make any recommendations (express or implied) about any securities listed above or give any guarantee as to the payment of income or repayment of capital. This list has been prepared without taking account of the objectives, financial situation or needs of any particular individual. For this reason any individual should, before acting on the information, consider the appropriateness of the information having regard to the individual’s objectives, financial situation and needs and, if necessary, seek professional advice.The information in this document forms part of the CommSec Margin Loan Product Disclosure Statement (PDS) dated [1 Jan 2012]. The PDS, issued by the Bank, is available from our website commsec.com.au or by calling 13 17 09. Please be aware that a CommSec Margin Loan exposes you to unfavourable movements in the value of shares and units in managed funds, and possibly to margin calls. Please be aware that you are personally liable for any shortfall that occurs should your entire portfolio have to be sold to answer a margin call where there have been falls in the market value of your investments. Only investors who fully understand the risks associated with gearing into investments should consider a Margin Loan. All applications for a Margin Loan are subject to the Commonwealth Bank’s credit approval process. Fees and charges apply. 5