Mac

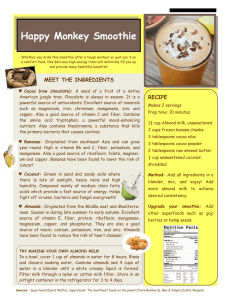

advertisement