Goldman Sachs JBWere Resources Fund Quarter to 31 December 2007 Investment commentary

advertisement

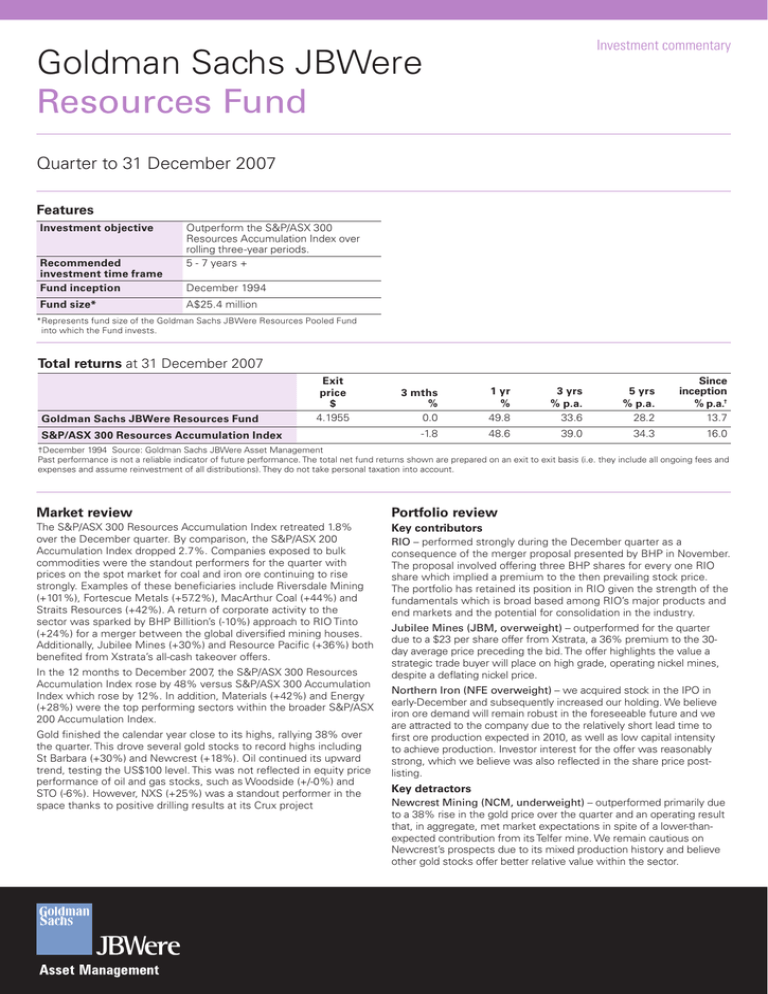

Investment commentary Goldman Sachs JBWere Resources Fund Quarter to 31 December 2007 Features Investment objective Recommended investment time frame Fund inception Fund size* Outperform the S&P/ASX 300 Resources Accumulation Index over rolling three-year periods. 5 - 7 years + December 1994 A$25.4 million *Represents fund size of the Goldman Sachs JBWere Resources Pooled Fund into which the Fund invests. Total returns at 31 December 2007 Goldman Sachs JBWere Resources Fund Exit price $ 4.1955 S&P/ASX 300 Resources Accumulation Index 3 mths % 0.0 1 yr % 49.8 3 yrs % p.a. 33.6 5 yrs % p.a. 28.2 Since inception % p.a.† 13.7 -1.8 48.6 39.0 34.3 16.0 †December 1994 Source: Goldman Sachs JBWere Asset Management Past performance is not a reliable indicator of future performance. The total net fund returns shown are prepared on an exit to exit basis (i.e. they include all ongoing fees and expenses and assume reinvestment of all distributions). They do not take personal taxation into account. Market review Portfolio review The S&P/ASX 300 Resources Accumulation Index retreated 1.8% over the December quarter. By comparison, the S&P/ASX 200 Accumulation Index dropped 2.7%. Companies exposed to bulk commodities were the standout performers for the quarter with prices on the spot market for coal and iron ore continuing to rise strongly. Examples of these beneficiaries include Riversdale Mining (+101%), Fortescue Metals (+57.2%), MacArthur Coal (+44%) and Straits Resources (+42%). A return of corporate activity to the sector was sparked by BHP Billition’s (-10%) approach to RIO Tinto (+24%) for a merger between the global diversified mining houses. Additionally, Jubilee Mines (+30%) and Resource Pacific (+36%) both benefited from Xstrata’s all-cash takeover offers. Key contributors In the 12 months to December 2007, the S&P/ASX 300 Resources Accumulation Index rose by 48% versus S&P/ASX 300 Accumulation Index which rose by 12%. In addition, Materials (+42%) and Energy (+28%) were the top performing sectors within the broader S&P/ASX 200 Accumulation Index. Gold finished the calendar year close to its highs, rallying 38% over the quarter. This drove several gold stocks to record highs including St Barbara (+30%) and Newcrest (+18%). Oil continued its upward trend, testing the US$100 level. This was not reflected in equity price performance of oil and gas stocks, such as Woodside (+/-0%) and STO (-6%). However, NXS (+25%) was a standout performer in the space thanks to positive drilling results at its Crux project RIO – performed strongly during the December quarter as a consequence of the merger proposal presented by BHP in November. The proposal involved offering three BHP shares for every one RIO share which implied a premium to the then prevailing stock price. The portfolio has retained its position in RIO given the strength of the fundamentals which is broad based among RIO’s major products and end markets and the potential for consolidation in the industry. Jubilee Mines (JBM, overweight) – outperformed for the quarter due to a $23 per share offer from Xstrata, a 36% premium to the 30day average price preceding the bid. The offer highlights the value a strategic trade buyer will place on high grade, operating nickel mines, despite a deflating nickel price. Northern Iron (NFE overweight) – we acquired stock in the IPO in early-December and subsequently increased our holding. We believe iron ore demand will remain robust in the foreseeable future and we are attracted to the company due to the relatively short lead time to first ore production expected in 2010, as well as low capital intensity to achieve production. Investor interest for the offer was reasonably strong, which we believe was also reflected in the share price postlisting. Key detractors Newcrest Mining (NCM, underweight) – outperformed primarily due to a 38% rise in the gold price over the quarter and an operating result that, in aggregate, met market expectations in spite of a lower-thanexpected contribution from its Telfer mine. We remain cautious on Newcrest’s prospects due to its mixed production history and believe other gold stocks offer better relative value within the sector. % 100.00 GSJBW Resources Pooled Fund 80.00 60.00 40.00 20.00 0.00 Oil & Gas Key purchases Sino Gold (SGX, overweight) – during the quarter the Fund participated in a capital raising by SGX to fund a pre-production tenement acquisition. We continue to believe SGX represents an attractive investment in the gold sector due to its superior production growth profile, low cash costs and further acquisitive growth opportunities in China. S&P/ASX 300 Resources Acc. Index Energy Equipment & Services Worley Parsons (WOR, underweight) – outperformed during the quarter on the back of a number of significant contract announcements in the petrochemical and power markets. We do not currently hold any WOR stock in our portfolio, as we prefer to gain direct exposure to explorers and producers whose earnings are more directly leveraged to high oil prices. Sector allocation at 31 December 2007 Metals & Mining Riversdale Mining (RIV, underweight) – outperformed following announcement of drilling results defining a large coal resource within its Benga licence in Mozambique and subsequent JV alliance with Tata Steel, whereby Tata will acquire 35% equity in tenements in Mozambique for A$100m. The Fund has elected to gain exposure to coal markets through other active stock positions. Source: Goldman Sachs JBWere Asset Management Top 10 holdings* at 31 December 2007 Portfolio % Index % Key sales BHP Billiton 39.1 39.1 Jubilee Mining (JBM, underweight) – as a result of the $23 cash takeover offer from Xstrata during the quarter the Fund no longer owns JBM. RIO Tinto 16.2 11.0 4.2 2.9 Market outlook and portfolio strategy The demand outlook for resources in 2008 is likely to remain strong, driven primarily by growth of construction and industrial production in North Asia, as well as solid global GDP growth. Concerns over economic activity in North America, and the potential for a US housing-led recession, appear to be growing. Hence, the likely impact on global resources demand needs to be monitored, though the weakness seen in metals prices and equity prices for mining and material stocks more generally overstates the likely negative impacts. While stock volatility is likely to persist, with a healthy commodity demand outlook and persistent supply-related bottlenecks, we believe strong commodity prices will feature in 2008. In particular, energy and bulk commodities will continue to be well supported, while metal prices should recover from price deflation seen in 2007. We view the Fund as being well-positioned to capture these trends, while maintaining an underweight exposure to uranium and gold stocks due to an absence of fundamental value drivers. We also maintain our exposure to larger, diversified companies with growing production profiles, and expect industry consolidation, driven in particular by the proposed merger of BHP Billiton and Rio Tinto, will enable greater transparency and crystallise value for the sector generally. Fortescue Metals Group OneSteel 4.0 1.3 Northern Iron 3.5 0.0 Kagara 3.5 0.4 Oxiana 3.4 1.6 Straits Resources 3.3 0.3 Origin Energy 3.1 2.2 Sino Gold Mining 3.0 0.3 Key active positions* at 31 December 2007 Active overweights RIO Tinto Portfolio % Index % Active % 16.2 11.0 5.2 Northern Iron 3.5 0.0 3.5 Kagara 3.5 0.4 3.1 Active underweights Portfolio % Index % Active % Woodside Petroleum 2.6 6.6 -4.0 Newcrest Mining 0.9 4.3 -3.4 WorleyParsons 0.0 2.4 -2.4 *Note: Holdings may change by the time you receive this report. Future portfolio holdings may not be profitable. The information should not be deemed representative of future characteristics for the strategy. Website www.gsjbw.com/assetmanagement Adviser Service team 1800 670 556 adviserservices@gsjbw.com Investor Service team 1800 034 494 investorservices@gsjbw.com Units in the Goldman Sachs JBWere Resources Fund are issued by Goldman Sachs JBWere Managed Funds Limited ABN 63 005 885 567 AFSL 230251 (‘GSJBWMFL’). Prior to investing in the Fund you should obtain and consider the product disclosure statement (‘PDS’) for the Fund, available by contacting our Investor Service team on 1800 034 494 or from our website www.gsjbw.com. Anyone wishing to apply for units will need to complete the application form attached to or accompanying the PDS. This document contains general financial product advice only. In preparing this document, GSJBWMFL did not take into account the investment objectives, financial situation and particular needs (‘financial circumstances’) of any particular person. Accordingly, before acting on any advice contained in this document, you should assess whether the advice is appropriate in light of your own financial circumstances or contact your financial adviser. GSJBWMFL manages the Fund and will receive fees as set out in the PDS. A once off contribution fee of up to 4% is payable in connection with all applications for units in the Fund. For applications lodged through a Goldman Sachs JBWere Pty Limited (GSJBW) adviser, GSJBWMFL may pay to GSJBW up to 90% of the contribution fee, and a trailing commission of up to 0.55%p.a. while the investment remains in existence. GSJBW may pay up to 50% of this amount to your adviser. This document has been prepared by GSJBWMFL. It is not a product of the Goldman Sachs JBWere Investment Research Department. To the extent that this document discusses general market activity, industry or sector trends, or other broad based economic or political conditions, it should not be construed as research or investment advice. To the extent it includes references to specific securities, those references do not constitute a recommendation to buy, sell or hold such security, and the information may not be current. GSJBWMFL believes that the information contained in this document is correct and that any estimates, opinions, conclusions or recommendations contained in this document are reasonably held or made as at the time of compilation. However, no warranty is made as to the accuracy or reliability of any estimates, opinions, conclusions, recommendations (which may change without notice) and, to the maximum extent permitted by law, GSJBWMFL disclaims all liability and responsibility for any direct or indirect loss or damage which may be suffered by any recipient through relying on anything contained in or omitted from this document. Goldman Sachs is a registered trade mark of Goldman, Sachs & Co.