FEA PLANTATIONS PROJECT 2008 INDEPENDENT ASSESSMENT

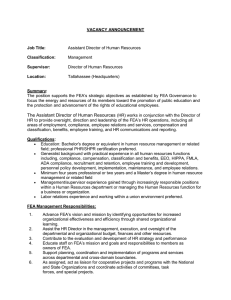

advertisement