Document 12183546

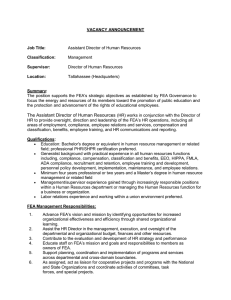

advertisement