FEA Plantations Project 2009 INDEPENDENT ASSESSMENT

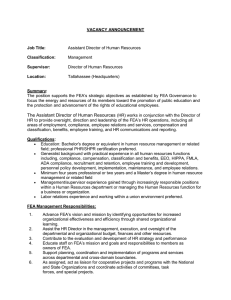

advertisement