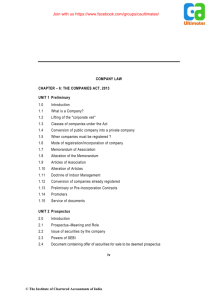

WAM Leaders Limited Prospectus

advertisement