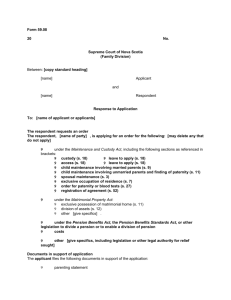

Document 12182261

advertisement