university of puget sound 2013 fin ancial report

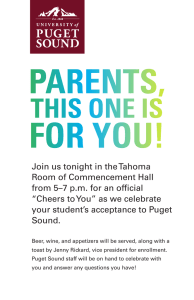

advertisement