UNIVERSITY OF PUGET SOUND 2014–15 FINANCIAL REPORT

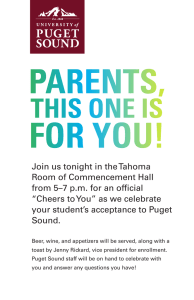

advertisement