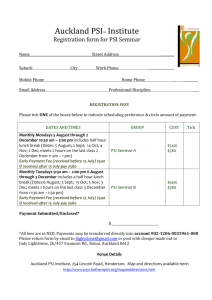

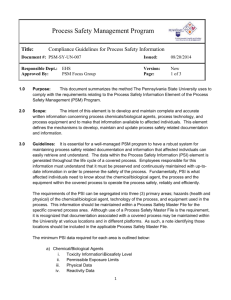

W P

advertisement