How far do shocks move across borders? agricultural futures markets

advertisement

How far do shocks move across borders?

Examining volatility transmission in major

agricultural futures markets

Manuel A. Hernandez, Raul Ibarra, and Danilo R. Trupkin

IFPRI, Banco de Mexico, and Universidad de Montevideo

Workshop on Food Price Volatility and Food Security

Bonn, January 31, 2013

Introduction

Model

Data

Results

Conclusions

Motivation

Objective

Motivation

In recent years, we have been witness to dramatic increases in both

the level and volatility of international agricultural prices.

This has raised concern about unexpected price spikes as a major threat to

food security, particularly in less developed countries.

Similarly, (1) the important development of futures markets and (2)

their major informational role, have contributed to the increasing

interdependence of agricultural markets.

E.g., the average daily volume of corn futures traded on a regular session in

CBOT is around 80-90k (compared to 20k 25 years ago).

Lead-lag relationships suggest that spot prices move toward futures prices

(Garbade & Silver, 1983; Crain & Lee, 1996; Hernandez & Torero, 2010).

Hernandez, Ibarra and Trupkin

Volatility transmission in agricultural futures markets

Introduction

Model

Data

Results

Conclusions

Motivation

Objective

Motivation (2)

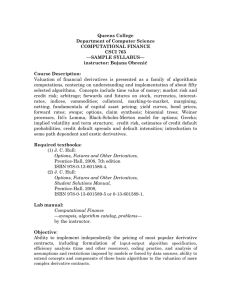

Identifying the ways in which international futures markets interact

can provide important insights for further understanding global food

price volatility.

The analysis can also provide additional information to the ongoing

debate about the potential regulation of futures exchanges.

a

Shock

Exchange B

Exchange A

Shock

b

Hernandez, Ibarra and Trupkin

Volatility transmission in agricultural futures markets

Introduction

Model

Data

Results

Conclusions

Motivation

Objective

Objectives

We evaluate the level of interdependence and volatility transmission

between leading agricultural futures exchanges (volume).

United States (Chicago)

Europe (France, UK)

Asia (China, Japan)

Focus on three key commodities:

Corn

Wheat

Soybeans

Hernandez, Ibarra and Trupkin

Volatility transmission in agricultural futures markets

Introduction

Model

Data

Results

Conclusions

Motivation

Objective

Objectives (2)

Estimate two Multivariate GARCH (MGARCH) models to explore

futures markets interactions in terms of the conditional second

moment (better insight about dynamic price relationship).

BEKK, Engle and Kroner (1995)

Dynamic Conditional Correlation (DCC), Engle (2002)

We want to address the following specific questions:

Is there volatility transmission across markets?

What is the magnitude and source of interdependence between markets?

How does a shock (innovation) in a market affects volatility in other

markets?

Has the level of interdependence changed across time?

Hernandez, Ibarra and Trupkin

Volatility transmission in agricultural futures markets

Introduction

Model

Data

Results

Conclusions

Conditional Mean

Conditional Variance

Conditional Mean Equation

yt

=

Θ0 +

p

X

Θj yt−j + εt ,

j=1

εt |It−1

∼ (0, Ht )

{yt } 3 × 1 vector of daily returns at time t for each market n, i.e.,

yt = log(Pt /Pt−1 ).

Θ0 3 × 1 vector of long-term drift coefficients.

Θj 3 × 3 matrix of parameters.

εt 3 × 1 vector of errors conditional on past information It−1 .

Ht 3 × 3 matrix of conditional variances and covariances.

Hernandez, Ibarra and Trupkin

Volatility transmission in agricultural futures markets

Introduction

Model

Data

Results

Conclusions

Conditional Mean

Conditional Variance

BEKK Model

Suitable to characterize volatility transmission across markets since

flexible enough to account for own- and cross-volatility spillovers and

persistence.

Ht = C 0 C + A0 εt−1 ε0t−1 A + B 0 Ht−1 B

cij Elements of upper triangular matrix of constants C .

aij Measure the degree of innovation from market i to market j.

bij Measure the persistence in conditional volatility between markets i y

j.

By construction, Ht is positive definite.

Hernandez, Ibarra and Trupkin

Volatility transmission in agricultural futures markets

Introduction

Model

Data

Results

Conclusions

Conditional Mean

Conditional Variance

BEKK Model (2)

Conditional Variance Equation for Market 1:

2

2 2

2 2

2 2

h11,t = c11

+ a11

ε1,t−1 + a21

ε2,t−1 + a31

ε3,t−1

+ 2a11 a21 ε1,t−1 ε2,t−1 + 2a11 a31 ε1,t−1 ε3,t−1 + 2a21 a31 ε2,t−1 ε3,t−1

2

2

2

+ b11

h11,t−1 + b21

h22,t−1 + b31

h33,t−1

+ 2b11 b21 h12,t−1 + 2b11 b31 h13,t−1 + 2b21 b31 h23,t−1 .

Markets are both directly and indirectly related through spillovers and

persistence.

Hernandez, Ibarra and Trupkin

Volatility transmission in agricultural futures markets

Introduction

Model

Data

Results

Conclusions

Conditional Mean

Conditional Variance

DCC Model

Suitable to evaluate if the degree of interdependence between markets,

measured through a conditional correlation matrix Rt , has changed across

time.

H t = D t R t Dt

−1/2

Rt = (ρij,t ) = diag (qii,t

Qt = (1 − α − β)Q̄ +

1/2

−1/2

)Qt diag (qii,t

0

αut−1 ut−1

).

√

+ βQt−1 , uit = εit / hiit .

1/2

Dt = diag (h11t ...hNNt ).

hiit GARCH(1,1) specification, i.e. hiit = ωi + αi ε2i,t−1 + βi hii,t−1 .

Q̄ N × N unconditional variance matrix of ut .

α, β non-negative scalar parameters satisfying α + β < 1.

Essentially Qt is a VMA process that captures short-term deviations in the correlation

around its LR level. Rt sheds light on how markets are interrelated in the SR and LR.

Hernandez, Ibarra and Trupkin

Volatility transmission in agricultural futures markets

Introduction

Model

Data

Results

Conclusions

Data

The Asynchronous Problem

Data

Daily closing prices 2004-2009 (Commodity Research Bureau,

Futures database).

Corn: Chicago (CBOT), France (MATIF), China (DCE).

Wheat: Chicago (CBOT), UK (LIFFE), China (ZCE).

Soybeans: Chicago (CBOT), China (DCE), Japan (TGE).

Hernandez, Ibarra and Trupkin

Volatility transmission in agricultural futures markets

Introduction

Model

Data

Results

Conclusions

Data

The Asynchronous Problem

Data (2)

We work with the nearby contract (Crain & Lee, 1996).

Are the most active, liquid contracts and contain more information.

Consider only those days where all markets were open.

All prices are standardized to US dollars per MT (account for

exchange rate).

We work with daily returns, y = log (Pt /Pt−1 ), to obtain a

convenience support for the distribution of error terms.

Hernandez, Ibarra and Trupkin

Volatility transmission in agricultural futures markets

Introduction

Model

Data

Results

Conclusions

Data

The Asynchronous Problem

Daily returns

Corn

Wheat

Soybeans

Hernandez, Ibarra and Trupkin

Volatility transmission in agricultural futures markets

Introduction

Model

Data

Results

Conclusions

Data

The Asynchronous Problem

The Asynchronous Problem (corn)

Period t-1 (Day 1)

Period t (Day 2)

GMT

(World time) 24:00

DCE

(local time in 9:00

China)

24:00

ydu,t

15:00

24:00

9:00

15:00

Price Return

in DCE

MATIF

(local time in

France)

10:45

yfu,t

18:30

9:30

18:30

Price Return

in MATIF

ξf,t-1

CBOT

(local time in the

United States)

10:45

13:15

ycu,t

9:30

ξf,t

13:15

Price Return

in CBOT

We need to account for potential bias when considering exchanges with different closing times

(synchronize data by exploiting information from markets that are open to derive estimates for

prices when markets are closed).

Hernandez, Ibarra and Trupkin

Volatility transmission in agricultural futures markets

Introduction

Model

Data

Results

Conclusions

Data

The Asynchronous Problem

Synchronizing the returns (Engle and Rangel, 2009)

1

The asynchronous returns, yt = log(Pt ) − log(Pt−1 ), are modeled as

a VMA(1):

yt = νt + Mνt−1 , Vt−1 (νt ) = Hν,t

M Moving average matrix.

νt Unpredictable component of the return, i.e., Et (yt+1 ) = Mνt .

2

If P̂t = Et (Pt+1 ), the synchronized returns ŷt can be defined:

ŷt = Et (log(Pt+1 )) − Et−1 (log(Pt ))

= νt + Mνt .

The synchronized returns and covariance matrix are, then, estimated:

ŷt

=

(I + M̂)νt ,

Vt−1 (ŷt )

=

(I + M̂)Ĥν,t (I + M̂)0

Hernandez, Ibarra and Trupkin

Volatility transmission in agricultural futures markets

Introduction

Model

Data

Results

Conclusions

Full sample

Variation across time

Robustness

T-BEKK Results

Coefficient

ci1

Corn

DCE

(i=3)

CBOT

(i=1)

LIFFE

(i=2)

ZCE

(i=3)

CBOT

(i=1)

DCE

(i=2)

TGE

(i=3)

0.377

(0.107)

-0.036

(0.163)

-0.037

(0.083)

0.040

(0.245)

-0.119

(0.048)

0.036

(0.238)

0.115

(0.421)

0.430

(0.152)

-0.018

(0.028)

0.204

(0.030)

0.065

(0.166)

0.011

(0.009)

0.983

(0.012)

-0.086

(0.111)

0.135

(0.048)

0.081

(0.183)

-0.072

(0.104)

0.995

(0.008)

-0.017

(0.041)

-0.058

(0.254)

0.043

(0.026)

0.199

(0.068)

-0.066

(0.108)

0.001

(0.003)

0.976

(0.014)

-0.066

(0.334)

-0.333

(1.029)

0.360

(0.640)

0.410

(1.149)

0.055

(0.042)

-0.125

(0.068)

0.526

(0.086)

0.004

(0.031)

0.037

(0.033)

-0.398

(0.402)

-0.001

(0.026)

0.156

(0.048)

0.091

(0.067)

0.098

(0.071)

0.971

(0.014)

-0.003

(0.013)

0.009

(0.032)

0.085

(0.542)

-0.070

(0.860)

0.367

(0.269)

0.041

(0.035)

-0.025

(0.041)

0.638

(0.092)

0.004

(0.043)

0.029

(0.023)

0.608

(0.072)

0.129

(0.042)

-0.182

(0.070)

0.026

(0.021)

0.918

(0.025)

0.186

(0.062)

0.005

(0.007)

0.198

(0.084)

0.232

(0.121)

-0.033

(0.021)

0.047

(0.025)

0.759

(0.066)

0.003

(0.009)

0.140

(0.525)

0.079

(0.104)

0.229

(0.305)

0.073

(0.079)

-0.194

(0.126)

0.206

(0.048)

-0.055

(0.044)

0.088

(0.095)

0.979

(0.013)

ci3

ai2

ai3

bi1

bi2

bi3

Soybeans

MATIF

(i=2)

ci2

ai1

Wheat

CBOT

(i=1)

Wald joint test for cross-volatility coefficients on each commodity (H0 : aij = bij = 0, ∀i 6= j)

Chi-sq

31.600

63.060

p-value

0.002

0.000

Wald test for non causality in variance on each market (H0 : aij = bij = 0, ∀j, i 6= j)

Chi-sq

3.497

3.831

8.192

6.182

9.142

14.479

8.396

p-value

0.478

0.429

0.085

0.186

0.058

0.006

0.078

Log likelihood

# observations

-5,169.3

1,105

Hernandez, Ibarra and Trupkin

40.479

0.000

12.154

0.016

6.931

0.140

-4,857.0

-6,696.7

960

1,227

Volatility transmission in agricultural futures markets

Introduction

Model

Data

Results

Conclusions

Full sample

Variation across time

Robustness

Corn: IR analysis

The responses are the result of a 1%-innovation in the own conditional volatility of the market

where the innovation first occurs. The responses are normalized by the size of the original shock.

CBOT Shock

1.0%

0.8%

0.6%

0.4%

0.2%

0.0%

-10

0

10

20

30

h11 (CBOT)

40

50

60

h22 (MATIF)

70

80

90

h33 (DCE)

MATIF Shock

1.0%

0.8%

0.6%

0.4%

0.2%

0.0%

-10

0

10

20

30

h11 (CBOT)

40

50

60

h22 (MATIF)

70

80

90

h33 (DCE)

DCE Shock

1.0%

0.8%

0.6%

0.4%

0.2%

0.0%

-10

0

10

20

30

h11 (CBOT)

40

50

60

h22 (MATIF)

Hernandez, Ibarra and Trupkin

70

80

90

h33 (DCE)

Volatility transmission in agricultural futures markets

Introduction

Model

Data

Results

Conclusions

Full sample

Variation across time

Robustness

Wheat: IR analysis

The responses are the result of a 1%-innovation in the own conditional volatility of the market

where the innovation first occurs. The responses are normalized by the size of the original shock.

CBOT Shock

1.0%

0.8%

0.6%

0.4%

0.2%

0.0%

-20

0

20

40

h11 (CBOT)

60

80

100

h22 (LIFFE)

120

140

160

180

h33(ZCE)

LIFFE Shock

1.0%

0.8%

0.6%

0.4%

0.2%

0.0%

-20

0

20

40

h11 (CBOT)

60

80

100

h22 (LIFFE)

120

140

160

180

h33(ZCE)

ZCE Shock

1.0%

0.8%

0.6%

0.4%

0.2%

0.0%

-20

0

20

40

h11 (CBOT)

60

80

100

h22 (LIFFE)

Hernandez, Ibarra and Trupkin

120

140

160

180

h33(ZCE)

Volatility transmission in agricultural futures markets

Introduction

Model

Data

Results

Conclusions

Full sample

Variation across time

Robustness

Soybeans: IR analysis

The responses are the result of a 1%-innovation in the own conditional volatility of the market

where the innovation first occurs. The responses are normalized by the size of the original shock.

CBOT Shock

2.0%

1.5%

1.0%

0.5%

0.0%

-10

0

10

20

30

40

h11 (CBOT)

50

60

70

80

70

80

h22 (DCE)

DCE Shock

1.0%

0.8%

0.6%

0.4%

0.2%

0.0%

-10

0

10

20

h11 (CBOT)

30

40

50

60

h22 (DCE)

h33 (TGE)

TGE Shock

1.0%

0.8%

0.6%

0.4%

0.2%

0.0%

-10

0

10

20

h11 (CBOT)

30

40

h22 (DCE)

Hernandez, Ibarra and Trupkin

50

60

70

80

h33 (TGE)

Volatility transmission in agricultural futures markets

Introduction

Model

Data

Results

Conclusions

Full sample

Variation across time

Robustness

T-BEKK Results (Summary)

The results confirm the importance of Chicago in global agricultural markets,

despite the increase in the production of corn-based ethanol and regulations &

trade policies governing agricultural products.

It is interesting to observe that CBOT has spillover effects over China, a closed,

highly regulated market; China also has spillover effects over other exchanges (at

least for soybeans).

The fast adjustment process after own- and cross innovations in Chinese markets

further support the robustness of our estimations.

Now, is there a higher market interdependence?

Hernandez, Ibarra and Trupkin

Volatility transmission in agricultural futures markets

Introduction

Model

Data

Results

Conclusions

Full sample

Variation across time

Robustness

Dynamic Conditional Correlations (T-DCC Model)

Corn

Correlation CBOT-DCE

Correlation MATIF-DCE

0.5

0.5

0.4

0.4

0.4

0.3

0.3

0.3

0.2

0.2

0.2

0.1

0.1

0.0

0.0

-0.1

0.1

0.0

Sep-04

Mar-05

Sep-05

Mar-06

Sep-06

Mar-07

Sep-07

Mar-08

Sep-08

Mar-09

Sep-08

Mar-09

0.5

Sep-07

Mar-08

0.6

Sep-06

Mar-07

0.6

Sep-05

Mar-06

0.7

0.6

Sep-04

Mar-05

0.7

-0.1

Sep-04

Mar-05

Sep-05

Mar-06

Sep-06

Mar-07

Sep-07

Mar-08

Sep-08

Mar-09

Correlation CBOT-MATIF

0.7

Wheat

Correlation CBOT-LIFFE

Correlation CBOT-ZCE

Correlation LIFFE-ZCE

0.7

0.7

0.7

0.6

0.6

0.6

0.5

0.5

0.5

0.4

0.4

0.4

0.3

0.3

0.3

0.2

0.2

0.1

0.1

0.0

0.0

0.0

-0.1

-0.1

-0.1

0.2

May-05

Oct-05

Mar-06

Aug-06

Jan-07

Jun-07

Nov-07

Apr-08

Sep-08

Feb-09

May-05

Oct-05

Mar-06

Aug-06

Jan-07

Jun-07

Nov-07

Apr-08

Sep-08

Feb-09

May-05

Oct-05

Mar-06

Aug-06

Jan-07

Jun-07

Nov-07

Apr-08

Sep-08

Feb-09

0.1

Soybeans

Hernandez, Ibarra and Trupkin

Feb-08

Sep-08

Apr-09

Dec-06

Jul-07

Jul-07

Apr-09

Feb-08

Sep-08

Dec-06

May-06

Oct-05

Jan-04

Mar-05

Aug-04

Apr-09

Sep-08

Jul-07

0.2

Feb-08

0.3

0.2

Dec-06

0.3

0.2

May-06

0.4

0.3

Oct-05

0.5

0.4

Jan-04

0.6

0.5

0.4

Mar-05

0.6

0.5

Aug-04

0.6

Jan-04

Correlation DCE-TGE

0.7

Aug-04

Mar-05

Correlation CBOT-TGE

0.7

Oct-05

May-06

Correlation CBOT-DCE

0.7

Volatility transmission in agricultural futures markets

Introduction

Model

Data

Results

Conclusions

Full sample

Variation across time

Robustness

Sensitivity

1

Segmented our sample based on structural break tests for volatility

(1st half 2008): pre- and post-crisis.

Cross-effects stronger for corn and slightly weaker for wheat in post-crisis;

no major change in soybeans (resemble DCC results).

2

In wheat, we find very similar results when considering Kansas

(KCBT) instead of Chicago (CBOT).

3

Evaluated robustness of results when excluding China (regulated

market with lower time-varying conditional volatility).

Both the BEKK and DCC results are qualitatively similar to the base

results.

Hernandez, Ibarra and Trupkin

Volatility transmission in agricultural futures markets

Introduction

Model

Data

Results

Conclusions

Summary

Wrapping up

The agricultural markets analyzed are highly interrelated.

Higher interaction between Chicago and both Europe and Asia than

between the latter.

Chicago plays a major role in terms of spillover effects, particularly

for corn and wheat (no decoupling of U.S. corn market).

The degree of interdependence across exchanges has not necessarily

increased in recent years for all commodities.

The results provide additional information for policymakers should

they consider regulating futures markets.

E.g., a local regulatory initiative will probably have limited effects given

that agricultural exchanges are highly interrelated and there are volatility

spillovers.

Hernandez, Ibarra and Trupkin

Volatility transmission in agricultural futures markets

Thank you!

![[These nine clues] are noteworthy not so much because they foretell](http://s3.studylib.net/store/data/007474937_1-e53aa8c533cc905a5dc2eeb5aef2d7bb-300x300.png)