UNOFFICIAL TRANSLATION MINISTRY OF FINANCE Decree-Law No. 228/2000

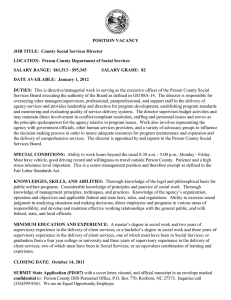

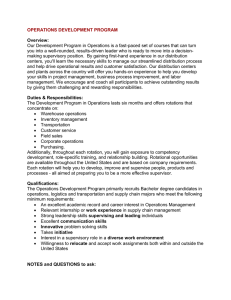

advertisement

UNOFFICIAL TRANSLATION MINISTRY OF FINANCE Decree-Law No. 228/2000 of 23 September The supervision of the national financial system is the responsibility of three specific independent authorities: Banco de Portugal, Comissão do Mercado de Valores Mobiliários (Securities Market Commission) and Instituto de Seguros de Portugal (Portuguese Insurance Institute). The elimination of the borders across the various sectors of financial activity, of which the financial conglomerates are a corollary, reinforces the need for the various supervisory authorities to strengthen their cooperation, to create efficient channels for reporting relevant information and to coordinate their action with the objective of eliminating, inter alia, conflicts of responsibility, gaps in regulations and the multiple use of own resources. Against this background, the government has decided to set up the National Council of Financial Supervisors (Conselho Nacional de Supervisores Financeiros). The Council shall be chaired by the governor of Banco de Portugal, which is the main entity responsible for the stability of the financial system. In addition to its chairman, representatives of the three supervisory authorities will also be permanent members of the Council. Other public or private entities may also be called upon to participate in the meetings, in particular, representatives of the Deposit Guarantee Fund, the Mutual Agricultural Credit Guarantee Fund, the Investor-Compensation Scheme and entities managing regulated markets. Without prejudice to the responsibility and autonomy of the different authorities, the creation of the National Council of Financial Supervisors aims to institutionalise and organise cooperation among the former, creating a forum to coordinate the supervision of the financial system, thus facilitating the mutual exchange of information. 1 The members of the Council, as well as every person cooperating with it, are under the obligation of professional secrecy, and the information to which the different authorities have access in the Council shall be used from the public interest perspective, this being one of the objectives safeguarded by this Council. Banco de Portugal and Comissão do Mercado de Valores Mobiliários have been heard. Thus, pursuant to the provisions laid down in subparagraph a) of paragraph 1 of article 198 of the Constitution, the government provides for the following: Article 1 Creation The National Council of Financial Supervisors, hereinafter referred to as Council, is hereby set up, having the purposes set forth below, without prejudice to the responsibilities and autonomy of the different authorities comprising it. Article 2 Responsibility 1 – The Council has the following responsibilities: a) To coordinate the action undertaken by the financial system’s supervisory authorities (supervisory authorities); b) To coordinate the exchange of information between supervisory authorities; c) To coordinate the joint conduct of on-site inspections of supervised entities; d) To develop supervisory rules and mechanisms of financial conglomerates; e) To formulate proposals for the regulation of matters related to the scope of activity of more than one supervisory authority; f) To issue opinions and specific recommendations pertaining to their sphere of competence, pursuant to the provisions of Article 7; g) To coordinate joint action undertaken by the supervisory authorities with domestic and foreign entities or international organisations; 2 h) To monitor and assess financial stability developments, to ensure the exchange of relevant information in this field among supervisory authorities by setting up the proper mechanisms, and to decide on joint action pertaining to their sphere of competence; i) To carry on any activities, which its members, by consensual agreement, deem adequate for the purposes indicated in the foregoing subparagraphs and which fall within the area of competence of any of the supervisory authorities; j) To lay down strategic guidelines for the Council’s activity. 2 – Within the field of competence envisaged in subparagraph (h) of the foregoing paragraph, the Council shall provide the member of government responsible for finance all relevant information on financial stability, even if it falls under the legal obligation of secrecy. 3 – Information exchanged pursuant to the provisions of the foregoing paragraphs falls under the obligation of secrecy legally binding the persons and entities identified therein. 4 – The Council shall also submit an annual report to the member of government responsible for finance, which shall be published by 31 March the following year. Article 3 Definitions For the purposes of this Decree-Law: a) Supervisory authorities of the financial system shall be those who in Portugal are responsible for the prudential supervision of: i) Credit institutions and financial companies, including investment firms, in accordance with the Legal Framework of Credit Institutions and Financial Companies; ii) Insurance, reinsurance and insurance intermediation of companies related or complementary to these activities and of pension fund activities; iii) The securities market; 3 b) Financial conglomerates shall be the groups of companies which simultaneously cover entities subject to the prudential supervision of Banco de Portugal and of Instituto de Seguros de Portugal. Article 4 Composition 1 – The following shall be permanent members of the Council: a) The governor of Banco de Portugal, as chairman; b) The member of the Board of Directors of Banco de Portugal responsible for the supervision of credit institutions and financial companies; c) The chairman of Instituto de Seguros de Portugal; d) The chairman of Comissão do Mercado de Valores Mobiliários. 2 – In case of duly justified absence, the permanent members referred to in subparagraphs b), c) and d) of the foregoing paragraph may be represented by their legal or statutory substitutes, who will have all the rights and obligations of those they are representing. 3 – Other public or private entities can be invited to participate in the Council works, especially representatives of the Deposit Guarantee Fund, the Mutual Agricultural Credit Guarantee Fund, the Investor-Compensation Scheme, the entities managing regulated markets and the associations representing any type of institution subject to prudential supervision. Article 5 Coordination 1 – If the President is absent or unable to attend to his duties, the works shall be coordinated by one of the other members of the Council, acting as an alternate. 2 – The tasks of the alternate referred to in the foregoing paragraph are performed on a rotating basis, for 1-year periods coinciding with the calendar year. 4 Article 6 Decisions 1 – The conclusions of the Council meetings shall be summarised and presented in the board meetings of each authority represented. 2 – The conclusions reached by consensual agreement, which do not include particulars which, pursuant to the law, are subject to professional secrecy, may be disclosed to the Minister of Finance, any entities of the public or private sector, as well as the general public, if deemed convenient by consensual agreement of all members. Article 7 Opinions and recommendations 1 – The member of government responsible for finance and the governor of Banco de Portugal, the latter representing the Bank as the entity responsible for the stability of the national financial system, may request opinions from the Council or report to it on any matters under its responsibility. 2 – The Council may on its own initiative issue opinions or specific recommendations on any matters under its responsibility. Article 8 Meetings 1 – The meetings shall take place at least every two months and shall be called by the chairman with at least 15 days’ notice. 2 – Extraordinary meetings may be called at any moment by the chairman or upon request of any other permanent Council member without the aforementioned 15 days’ notice. Article 9 Technical assistance Provided there is a previous agreement among the members of the Council, they may be accompanied by collaborators with an observer status, or determine that 5 working groups be created for the analysis of issues common to the authorities comprising the Council. Article 10 Obligation of professional secrecy The members of the Council, as well as all other persons cooperating with it, are under the obligation of professional secrecy, with respect to the facts and particulars covered by this obligation, under the terms of the law applicable to each case. Article 11 Entry into force This Decree-Law shall enter into force on the day immediately after its publication. Examined and approved by the Council of Ministers of 10 August 2000. – Jaime José Matos da Gama – Fernando Manuel dos Santos Vigário Pacheco. Promulgated on 31 August 2000. Let it be published. The President of the Republic, JORGE SAMPAIO. Countersigned on 14 September 2000. The Prime Minister, António Manuel de Oliveira Guterres. 6