Document 12148718

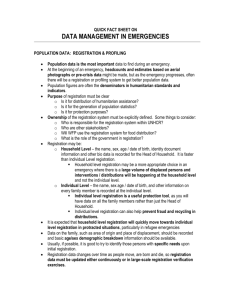

advertisement