2 BOX 2.1 | INTERCONNECTEDNESS WITHIN THE RESIDENT FINANCIAL SYSTEM

advertisement

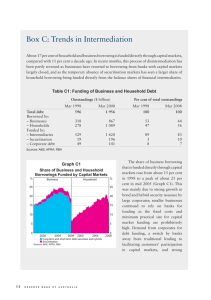

BOX 2.1 | INTERCONNECTEDNESS WITHIN THE RESIDENT FINANCIAL SYSTEM importance for the system’s stability. Although links within the financial sector are an important element, as they give some flexibility to the definition of the business model, they require constant monitoring in order to mitigate possible contagion and regulatory arbitrage risks. This interconnectedness may have two types of effects. If on the one hand it can be a contagion mechanism, on the other hand, it may also be useful to absorb shocks, which has been proven by the fall in external demand for domestic securities, that lead to an increase in investment in those securities by the resident financial sector. In effect, considering that a significant group of relevant countries for the Portuguese economy are also conditional on structural adjustment processes at the economic and financial level, and against the background of a decline in external financing to the Portuguese economy, resident agents have also reduced their investments abroad. Therefore, similarly to developments at the international level, the financial sector has adopted a more domestic perspective, enabling resident banking groups to adjust within their own economic group. Interconnectedness within the financial system may be due to: (i) bilateral exposures, i.e. the most direct contagion channel; (ii) exposure to common risks; (iii) reputational risks. In addition, it is important to mention existing indirect exposures, in particular stakeholder relationships broadly based across the financial industry. In effect, in many cases, main national banks control major insurance corporations and pension fund management companies, as well as investment fund management companies operating in the national financial system, significantly influencing the business models defined by those entities. In the recent past, exposures among national financial entities have increased considerably. In fact, exposure to the resident financial sector (measured as a percentage of total assets) grew from 17 per cent1 at the end of 2007 to 26 per cent in June 2013, which corresponds to an important share of total assets and illustrates the relevance of existing links, as well as their recent developments. As expected, due to its weight in the domestic economy, the banking sector concentrates the largest share of assets on national financial entities. Exposure to this sector rose from around €49 billion in December 2007 to approximately €117 billion in June 2013, mainly explained by an increase in inter- Table 1 EXPOSURE TO THE FINANCIAL SECTOR | % OF TOTAL ASSETS Banks and Money Market Funds Insurance C. and Securitisation Funds Investment funds Pension Funds Dec. 2007 Jun. 2013 Exposure to the financial sector Source: Banco de Portugal. 1 For the purpose of this analysis, it has been purged of the effect of claims on the central bank. Total 2 69 Risks to Financial Stability The recent financial crisis has highlighted the interdependencies within the financial sector, as well as their -bank exposures. As a percentage of total assets, there was an increase of 11 percentage points (from 11 per cent to 22 per cent). Moreover, in June 2013, around 62 per cent of debt securities issued by banks II BANCO DE PORTUGAL | FINANCIAL STABILITY REPORT • November 2013 70 were held in the portfolio of the resident financial sector, compared with 23 per cent in December 2007. In addition, considering that, after the financial crisis, the interbank market and in particular non-collateralised financing ceased to be an alternative for bank funding, the physical assets held by the sector could be expected to increase. In recent years, the amount of loans granted by banks to the financial sector has declined while funding in the form of securities has increased substantially, which was related to the purchase of securities held by financial vehicle corporations and the purchase of banks’ securities. This behaviour is partly explained by the need to obtain collateral for ECB funding. In this respect, repo and reverse repo operations, intended to obtain collateral for Eurosystem monetary policy operations within the scope of some financial groups should also be mentioned. The absolute value of the banking sector claims on OFIs (other than insurance corporations and pension funds) increased by 81 per cent since late 2007, which was exclusively due to the 237 per cent rise in securitised assets. Even though the concentration of securitisation corporations and funds’ claims on the national financial system has remained virtually unchanged, there is a sizeable increase in the absolute value of these investments (22 per cent), which was due to growth of credit securitisation activity during this period and also to the fact that these operations cannot be derecognised from the balance sheet. Although the overall value of the assets held by the insurance and pension funds sector represents a rather lower amount than in other segments of the financial industry, it is important to highlight the predominance of the remaining national financial sector in the investment portfolio of these players. In fact, those investments represented 28 per cent of the total assets of the sector at the end of the first half of 2013, corresponding to a 9 percentage point increase since December 2007. The behaviour of investment funds (excluding money market or securitisation funds) has been contrary to that observed in the other activity segments, as a result of their decreasing exposure to other entities in the national financial sector, which may be explained by changes in the investment policy of certain funds. In spite of the risks to the financial system that may emerge from these links, reference should be made to the recent adoption of a set of measures intended to mitigate any potential systemic risks. For instance, new regulatory instruments have been introduced which consider, in a more explicit and integrated manner, the systemic risk resulting from interlinks within the financial system. These instruments shall materialise in the definition of ceilings to intra-financial sector funding (including banks, credit institutions, investment corporations, insurance corporations, funds, unregulated financial entities) which will make it possible to mitigate the concentration and liquidity risk, inter alia. Reference should also be made to the existence of concentration limits in investment portfolios, or provisions that desincentivate excessive concentration, which aim at promoting risk diversification. In short, an increase in the interconnectedness of the national financial system has been apparent in the recent past. Although this has been more evident at the balance sheet level, it is interesting to stress the existence of other sources of possible contagion, such as reputational risk or the exposure to common risk factors. Also in this respect, reference should be made to exposures to other sectors and, in particular, to sovereign risk, which has shown considerable correlation with securities issued by the financial sector. Without prejudice to the above, against the background of a sharp reduction in external financing sources available to national entities, it is interesting to also emphasise the positive role played by these mechanisms, facilitating the adjustment process of the national economy.