9 ZEF Bonn Strengthening Social Security Systems in Rural

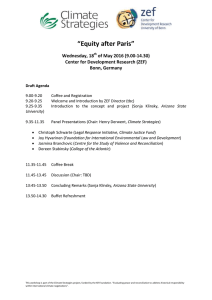

advertisement