University of California - Budget Overview

advertisement

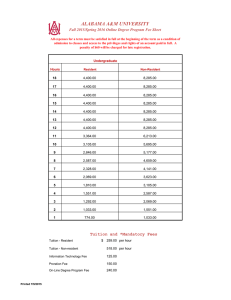

University of California, San Diego 2011/12 Final Resource Allocations University of California - Budget Overview The Governor signed the 2011/12 Budget Act on June 30, making it only the sixth on-time budget in the last 20 years. The signed budget closes a $26.6 billion budget gap and makes substantial progress in addressing the state’s long-term structural budget deficit. The budget assumes that revenues will be $4 billion above previously forecast levels in March and includes a set of “trigger reductions” that will cut spending further if revenues do not reach anticipated levels. For 2011/12, the University requested $596.1 million from the state in order to restore previous reductions, fund the state’s obligations to UC retirees, and use additional state funding for recent enrollment growth and initiatives, as well as new revenue from student fee increases. Part of this funding request, $106 million, is to restore a reduction in 2010/11 that was funded on a one-time basis with federal ARRA funds. The Governor honored this restoration and provided $7.1 million in funding for Retiree Annuitant Benefits (health and dental benefits); however, included a $500 million reduction to the University in budget actions approved back in March. The final June adopted State Budget Act further reduces University funding by an additional $150 million, resulting in an overall reduction of $650 million, a 21.3% decrease in state support relative to prior 2010/2011 fiscal year. No funding is provided for the state General Fund obligation for student enrollment, retirement contributions nor other mandatory costs. In addition to base budget reductions, in 2011/12 the University must absorb $362.5 million in unfunded mandatory cost increases consisting of unfunded contributions to the employee retirement plan, rising benefits costs, and other non-salary price increases, leaving the university with a one-year state budget gap exceeding $1 billion. This shortfall is addressed with additional campus revenues, student tuition increases and budget cuts across the system. The student tuition increase previously approved by The Regents of 8% will generate $116 million – a significant portion, but much less than needed to address the initial $500 million state budget reduction and the state unfunded mandatory cost increases of $362.5 million. A more recent and additional tuition increase of 9.6% that The Regents approved earlier this month, after the State increased the budget reduction by an additional $150 million, will generate most of the funding needed to address this reduction increase. The State Budget does include funding to Cal Grant program so eligible low-income students will receive enough money from the program to cover these tuition increases. The grants, along with UC’s return to aid program, help stabilize UC's Blue and Gold Opportunity Plan, which ensures that aid is available to pay the systemwide tuition and fees for financially-needy California resident undergraduates whose family income falls below $80,000. As noted above, potentially worsening the situation is the trigger language contained in the Budget Act that would impose an additional $100 million cut if the state does not generate an additional $3 billion in revenues by December. After four consecutive years of wholesale state Page 1 - 1 University of California, San Diego 2011/12 Final Resource Allocations cutbacks, if additional cuts are imposed on UC, tuition would need to be raised, however, action would most likely be deferred to 2012/13. On the capital budget, funding for capital outlay is limited to only $45.7 million to complete existing state projects and includes two appropriations for UC San Diego: $5.7 million in state lease revenue bonds for construction – SIO Research Support Facilities $947,000 in 2006 General Obligation bonds for the second equipment phase – Structural and Materials Engineering Building. University of California, San Diego - Summary of Campus Allocations For several months, the campus has been planning and preparing for another round of budget cuts. The 2011/12 projected budget shortfall for UCSD is $98.1 million: $70.5 million from state reductions and $27.6 million from salary, benefits and UCRP needs. The campus will address the $70.5 million in budget cuts as follows: – $27.6 million in budget reductions allocated to campus operating units; – $25 million in reductions offset by campus resources; and – $18 million offset through fee increases. To recap, from 2008/09 through 2011/12, the campus will have absorbed a permanent state budget shortfall of over $188 million. Specifically, San Diego will have addressed: - $110.5M in permanent state budget reductions (or 37% of the 2007/08 state educational appropriation), in addition to - $78.2M in permanent mandatory cost increases on state programs, but not funded by the state due to the continuing state fiscal crisis. State Budget's Multi-Year Cut and Underfunding Impact to UCSD ($ Millions) 2008/09 Perm State Budget Reductions (1,2) Mandatory Cost Increases Total State Funding Shortfall Fee Increase Income (4) Net State Funding Gap 1 2 3 4 $ (3) - $ 12.1 $ 12.1 $ (7.7) $ 4.4 2009/10 1-time 12.0 Perm $ $ $ 12.0 12.0 20.0 $ 14.4 $ 34.4 $ (13.5) $ 20.9 2010/11 1-time 64.2 Perm $ $ 64.2 64.2 $ - Perm $ 24.1 $ $ $ 20.0 2011/12 -est. 1-time $ 44.1 $ 27.6 $ (21.0) $ 23.1 70.5 $ - $ 98.1 (22.2) $ (42.3) (22.2) $ 55.8 $ Perm - $ 110.5 - 78.2 - $ 188.7 $ $ - UCSD share of State budget cuts directed to UC, per annual State Budget Act. In 2007/08, UCSD's State Education Appropriation was $301M, eroding 36.7% by 2011/12. State's share of mandatory costs that were not funded. Student Fee Income used to address annual State Funding Gap, including income in 2011/12 from the 9.6% fee increase used to fully offset UCSD's share of the additional $150M state cut. Page 1 - 2 Total 1-time (84.5) $ 104.2 University of California, San Diego 2011/12 Final Resource Allocations As described on the prior page, these cuts could increase if the state does not reach expected revenue projections included in the State Budget Act – potentially triggering an additional $12 million in mid-year budget cuts to the campus. The campus continues to address its budget cuts and state funding shortfalls with a varied approach that includes cost savings, cost avoidance, and new revenue sources including additional income from increases in nonresident enrollment. The Office of the President (OP) has not yet made formal allocations to campuses. However, UCSD is proceeding with its budget proposal to make preliminary allocations to Vice Chancellors (VC) based on the best information available and several critical planning assumptions on the resources OP will provide to the campus. Specifically, these allocations are outlined in the following section, and detailed allocations to each VC are contained within the body of this proposed package. A. Directed Allocations Directed Allocations include funding adjustments that are directed to specific programs within Vice Chancellor (VC) units. General Campus 1. A permanent allocation of $203,200 for Rady School of Management, derived from a Professional School Fee increase of 15.8% for resident students and a 10.6% increase for non-resident students, and a corresponding permanent allocation of $100,000 for student financial aid. 2. A permanent allocation of $81,600 for the Graduate School of International Relations and Pacific Studies, derived from a Professional School Fee increase of 11.5% for resident and 6.8% for nonresident students, and a corresponding permanent allocation of $40,100 for student financial aid. 3. A permanent allocation of $1,640,900 and a temporary allocation of $400,000 for Graduate and Professional University Student Aid Program (USAP). These allocations represent the OP’s estimated minimum USAP commitment for San Diego under the systemwide Funding Streams Initiative. The permanent allocation is derived from the return-to-aid component of income from fee increases generated by budgeted graduate and professional student enrollment. In addition to need-based financial aid, campuses may use designated portions of the graduate USAP allocation for Teaching Assistant fee remissions, Research Assistant fee remissions, and non-need-based fellowships. Health Sciences 4. A permanent allocation of $204,700 for the Skaggs School of Pharmacy and Pharmaceutical Sciences, derived from a Professional School Fee increase of 7.5% for resident and non-resident students, and a corresponding permanent allocation of $100,800 for student financial aid. 5. A permanent allocation of $394,700 for the School of Medicine derived from a Professional School Fee increase of 6.8% for resident and non-resident students, and a corresponding allocation of $194,400 for Page 1 - 3 University of California, San Diego 2011/12 Final Resource Allocations financial aid. Student Affairs 6. A permanent allocation of $5,358,800 and a temporary allocation of $11,037,000 for Undergraduate University Student Aid Program (USAP). The permanent allocation includes an increase of $4,085,400, the campus’ share of the systemwide USAP allocations derived from the UC Education Financing Model for need-based financial aid. Also included is a permanent increase of $1,273,400 from the return-to -aid component of summer fee income. 7. A temporary allocation of $682,500 from the increase in the Undergraduate Application Fee intended to support Comprehensive Review in Admissions. Resource Management and Planning 8. A permanent allocation of $736,000 and a temporary allocation of $535,400 for basic Operation and Maintenance of Plant (O&MP). O&MP is funded with income from resident and non-resident enrollment. B. Components for Campus Allocation Components for Campus Allocation include funding adjustments that are to be distributed across various Vice Chancellor units. San Diego’s approved budgeted student enrollment for the General Campus remains at the 2010/11 level of 27,015. As a result, no additional faculty positions are budgeted. 9. A temporary allocation of $10,172,300 is provided from student tuition income only for Resident Overenrollment for 1,435 student FTE. 10. A permanent allocation of $6,296,800 is provided for Non-resident Student Enrollment Growth based on the second year of a five-year campus-approved non-resident student enrollment growth plan of 1,500 FTE. Funds provided in this allocation are from the Non-resident Tuition (NRT) income and the additional student fee income generated based on the second year growth target of 250 undergraduate FTE. Additionally, a permanent allocation of $1,669,000 is provided based on remaining unallocated resources related to 2010/11 non-resident over-enrollment of 390 FTE. 11. An estimated permanent allocation of $4,011,300 in Research Indirect Cost Recovery (ICR) Funds attributed to growth in total federal recovery of 6.4% and growth in total private/local recovery of 2.6%. There is also a one-year cash availability of $9,217,600 due to an OP restructuring of some debt. 12. A temporary allocation of $23,411,000 in Research Indirect Cost Recovery (ICR) Funds, of which $5,641,000 is generated from the recovery of grants issued by the California Institute for Regenerative Medicine (CIRM), and $17,770,000 generated from recovery of grants issued by the American Recovery and Reinvestment Act (ARRA). 13. A permanent allocation of $5,000,000 and an estimated temporary allocation of $22,600,000 in Indirect Cost Recovery (ICR) Funds generated from Auxiliary & Self-Supporting Activities (ASSA). Page 1 - 4 University of California, San Diego 2011/12 Final Resource Allocations 14. A permanent state Undesignated Budget Reduction of $52,550,000. This is based on campus share of $500M state budget reduction. 15. Other income sources available for campus priorities include $20,000,000 in permanent and $18,512,700 in temporary funds from various campus sources. 16. An estimated $27,610,000 available for Mandatory Inflationary Cost increases. Funds are intended to support: Employee benefits cost increases, including UCRP contributions, and Salary increases for filled positions permanently budgeted on General Funds and Student Services Fee Funds to include collective bargaining agreements, continuation costs, and academic merit program increases previously funded at 1.78% and now increased to 2.5% to more appropriately reflect the actual cost of the annual program. 17. The budget bill requires no Student Academic Preparation and Educational Partnership (SAPEP) program be cut more than the overall budget reduction to the campuses. C. Funding Streams Initiative 18. The systemwide Funding Streams Initiative stipulates that all campus-generated funds currently used to fund UCOP will be retained or returned to the source campus. In return, UC will establish a broad-based assessment on campus expenses that will provide funding for UC central operations. This new funding model goes into effect in 2011/12. The approximate amount of funding returned to the campus is $43,800,000 with an expected revenue-neutral impact to the campus in this year only, and will change annually with changes in total campus expenditures. Consequently, campuses will see significant shifts in the fund color of net budgetary resources. Although the Initiative dictates the specific revenue funds that will be returned to the campus or swapped from 19900, it does not indicate the source of funding for the Center Tax. Therefore, in 2011/12 the campus will need to determine the funding source and assessment model for the tax and will also need to identify the impact of Funding Streams on existing Budget Models. Page 1 - 5 Schedule 2 2011/12 FUNDS AVAILABLE FOR CAMPUS ALLOCATION (000's) Funds available for campus allocation represents a summary of additional core resources (or reductions) to be allocated to Vice Chancellor operating budgets. Some funds are directed to specific programs as intended by the funding source or as designated by the campus. Funding Streams Initiative is a new model to fund UCOP beginning 2011/12, however, expected to be revenue neutral and with no funding impact to Vice Chancellor budgets until 2012/13. A. Directed Allocations Academic Affairs Rady School of Management Allocation Professional School - Tuition Increase(1) Professional School - Financial Aid International Relations and Pacific Studies (IRPS) Professional School - Tuition Increase(1) Professional School - Financial Aid Graduate/Professional Aid (USAP) - Tuition and Summer Fee(2,3) Subtotal Health Sciences Skaggs School of Pharmacy and Pharmaceutical Sciences Professional School - Tuition Increase(1) Professional School - Financial Aid School of Medicine Professional School - Tuition Increase(1) Professional School - Financial Aid Subtotal Student Affairs Permanent $ Undergraduate Aid (USAP) - Tuition and Summer Fee(3,4) Undergraduate Application Fee Income Subtotal Resource Management & Planning Operation and Maintenance of Plant(5) Subtotal Total Directed Allocations B. Components for Campus Allocation Enrollment Growth: GF, NRT and Student Tuition Income Research Indirect Cost Recovery Estimated Auxiliary & Self-Supporting Activities (ASSA) Recovery(6) State GF Budget Reduction(7) Other Income Sources(8) Total for Campus Allocation One-Time 203 $ 100 - 82 - 40 1,641 400 2,066 400 205 101 - 395 194 895 - 5,359 11,037 - 683 5,359 11,720 736 535 736 535 $ 9,055 $ 12,655 $ 7,966 4,011 5,000 (52,550) 20,000 (15,573) $ 10,172 32,629 22,600 18,513 83,914 $ (9) C. Funding Streams Initiative Total Funding Reimbursed by UCOP Taxation required to fund UCOP Subtotal $ 43,800 (43,800) - Total Allocations Available for Distribution Inflationary Cost Block Funds(10) TOTAL ALLOCATIONS - $ $ (6,518) 27,610 21,092 - - - $ $ 96,569 96,569 Footnotes: 1. Professional School allocations reflect the following tuition increases: Rady - Residents 15.8% and Non-Residents 10.6%; IRPS - Residents 11.5% and Non-Residents 6.8%; Medicine - Residents and Non-Residents 6.8%; Pharmacy - Residents and Non-Residents 7.5%. Tuition differentials are eliminated in 2011/12. The changes are accompanied by adjustments to Nonresident Supplement Tuition levels and Professional Degree Supplemental Tuition levels such that changes are cost-neutral to students and revenue-neutral to campuses. 2. Preliminary minimum Graduate/Professional USAP allocation required per Funding Streams Initiative. 3. Funding includes associated Return to Aid derived from the $60 Temporary Surcharge. 4. Preliminary Undergraduate USAP allocation based on the Education Financing Model. 5. O&MP is funded with income from General Campus non-resident enrollment growth and resident over-enrollment. 6. Estimated Auxiliary & Self-Supporting Activities (ASSA) Recovery from differential income and administrative overhead based on 2009/10 financial statement; actual allocations will be based on 2010/11 financial statement. 7. Estimated reduction of $52.6M permanent from 2011/12 State budget reduction of $500M to UC. Expected share of additional $150M permanent reduction will be offset with 9.6% tuition increase and other temporary campus sources as reflected in Schedule 7. 8. Includes "other income" as reflected in "Sources" on Schedule 7. 9. The $43.8M is the taxation required to fund UCOP under the Funding Streams Initiative and is revenue-neutral to the campus. 10. The $27.6M Inflationary Cost Block Funds are allocated centrally and intended for mandatory inflation costs (health benefits, faculty merits which increase from 1.78% to ~2.5% annually, bargaining units negotiations, UCRP). Includes salary increases for filled positions permanently budgeted on General Funds and Student Services Fee. Page 2 - 1