University of North Carolina Finance Improvement & Transformation Contracts and Grants Standards

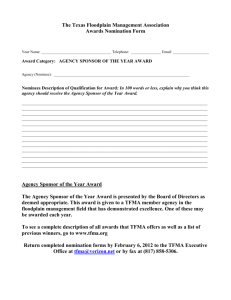

advertisement