C-(t4fr E5S • s= (;nki

advertisement

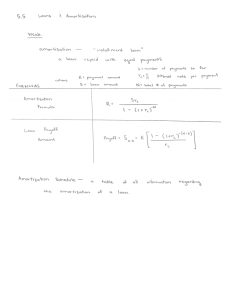

C-(t4fr E5S Mathematics of Finance Part 4: “Lets Borrow Some Money”: Description: Amortization Formulas: (1) Periodic Payment of an Amortized Loan: Equation: R=S ( 1—(l+r) -N) (2) Total Interest Paid: Equation: NR S — (3) Loan Payoff Amount: Equation: Payoff SN_kR( 1 (1+r) (N Variables: • ,yioLtfll R= • s= flLfll (;nki = • N= A • k= jufl pLfI • t= pr Pf) 7 4J 0 ’ 7 - h e 1 Co2J 7 C a. .4 0 12; II 1—• i.’ L II - —f —. 9, - C. C p Example 1: Katie works hard and saves her work and gift money during junior high and high school. She wants to buy a car for herself when she graduates from high school. Suppose she can save $4,000 by the time she graduates from high school and she wants to purchase a car valued at $15,000. If she can get a loan with special interest rate of 3.6%, compounded monthly, for 6 years, how much will her monthly payments be? //ttf pf7 -iS: ‘ji,j ,i_ f: odc F Pi? , VortS10003fl 03£ (/ +) 0 t=( Ii =J/oooL /—(/+2)_12(&) /.2_ X J Example 2: Scott found a lot of land to build his home on. It will cost $40,000, and he will amortize his loan over 8 years with yearly payments. Create an amortization schedule for his loan, and answer the following questions if the interest rate on his loan is 7.8% compounded annually. (a) What is his yearly payment? (b) What is the interest for the first payment? (c) How much principle is paid in the first payment? - M Example 3: Mike is buying a home for his family and has the choice of a 15-year, a 20 -year or a 30year amortized loan with monthly payments. The amount of his loan originally is $210,000, with an interest rate of 5.7% compounded monthly. C (a) Compute the fmance charge for each loan type. (b) How much savings is there if he goes with the 15-year loan? 30 LzL-r Vt’rt S c)0,00 n /2 ( 0L_ 21000( r__ ‘ —1 ? N / 210,000 0 1 .g2 ,1 Lj( ii- cizf: i 1 9 s IO, oOO &3C 2!0,00O 2-07 fl I 2)0,000 ,I (/(,)Iz.3o) -5 _/0O0 rc. 5 (I /+ fr:5:w ) C Example 4: A ski resort purchases a large piece of equipment for a chairlift for $300,000. Suppose the ski resort takes out a loan for this equipment, making quarterly payments with interest rate of 4.8% compounded quarterly for 10 years. (a) What are the quarterly payments? (b) How much interest does the resort pay during the first year? (c) Find the unpaid balance (loan payoff amount) after three years. (d) If the ski resort pays off the loan at the end of three years, how much money do they save by not making the rest of the payments? C