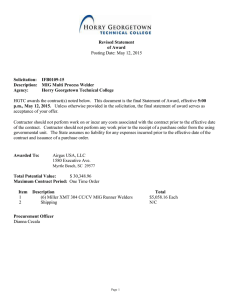

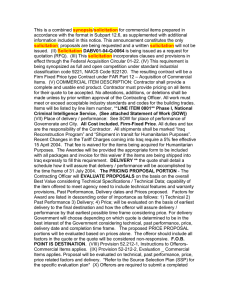

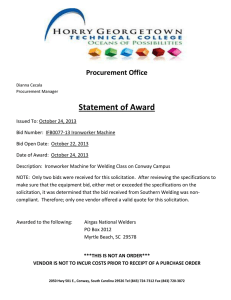

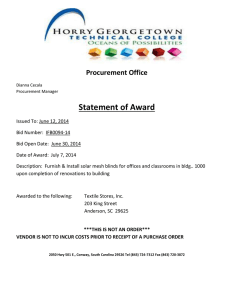

Horry-Georgetown Technical College

advertisement