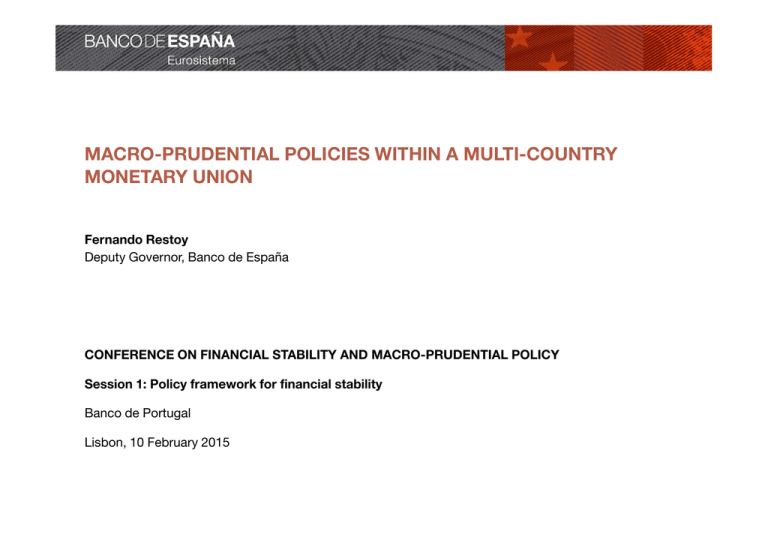

MACRO-PRUDENTIAL POLICIES WITHIN A MULTI-COUNTRY MONETARY UNION

advertisement

MACRO-PRUDENTIAL POLICIES WITHIN A MULTI-COUNTRY MONETARY UNION Fernando Restoy Deputy Governor, Banco de España CONFERENCE ON FINANCIAL STABILITY AND MACRO-PRUDENTIAL POLICY Session 1: Policy framework for financial stability Banco de Portugal Lisbon, 10 February 2015 INTRODUCTION The beauty of macro-prudential (macro–pru) policies Squaring the number of policy objectives with the policy instruments available. Especially relevant in a multi-country monetary union. But caution. Two main messages of this presentation: Be clear on macro-pru objectives. Pru should probably predominate. Do not overplay the separation principle: policy coordination is a must. 2 ON OBJECTIVES (1) The macro dimension vs. the pru dimension Macro-pru is conceived as actions aimed at addressing risks stemming from macro-financial developments by employing (mostly although not exclusively) prudential tools. Ambiguity as to the objective: MACRO OBJECTIVE: Mitigating macro-financial imbalances and/or PRU OBJECTIVE: Strengthening banks’ ability to cope with macro-financial risks 3 ON OBJECTIVES (2) The challenges of the macro objective Macro objective is much more challenging: • Limited ability to affect banks’ strategies (e.g. credit standards) • Even if individual banks’ strategies could be affected, less constrained banks and non-banks could take over [see Basten and Koch (2014) and Jiménez et al (2013)] Better aim at making banks more resilient to macrofinancial shocks. 4 ON POLICY COORDINATION (1) Conflicts of interest have had substantial influence on the design of policy frameworks Monetary policy (MP) vs. micro-prudential policies Micro-prudential vs. macro-prudential Micro and macro-prudential vs. resolution In Europe, wide array of financial authorities: ECB – MP, ECB – BS, ESRB, EBA, SRB,… plus a constellation of national agencies. Conflicts of interests exist BUT are they always so relevant? Wise to ignore financial stability for pure MP decisions? Wise to deal separately with instruments (micro-pru, macropru, resolution, …) that do actually share an ultimate financial stability objective? 5 ON POLICY COORDINATION (2) Moreover, are synergies properly taken into account? Macro view relevant for identifying and addressing risks at firm-level. Supervisory analysis key to assessing aggregate financial risks and adequate macro actions. Micro-pru and resolution policies clearly complementary. System’s liquidity management cannot be dissociated from pru analysis. And little evidence that conflicts of interest were the problem Excessively narrow policy focus arguably much more relevant: • MP did not care sufficiently about financial imbalances • Micro-pru policies lacked sufficient macro perspective • Central Banks’ liquidity management, at times, insufficiently coordinated with pru policies 6 ON POLICY COORDINATION (3) Therefore, to fully exploit new macro-pru tools, need to frame them within a comprehensive and a consistent policy set-up The role of Central Banks is key to ensuring the desired comprehensiveness and consistency: take the separation principle as given, but apply it pragmatically 7 AN ILLUSTRATION: EXPERIENCE IN SPAIN WITH DYNAMIC PROVISIONS (1) The facts: huge lending expansion … and lending bust 1999Q1=100 1.000 Credit to construction and real estate sectors Credit to the non-financial private sector Nominal GDP 700 House prices 400 100 1999QI 2001QI 2003QI 2005QI Source: INE, BE and own calculations 2007QI 2009QI 2011QI 2013QI 8 AN ILLUSTRATION: EXPERIENCE IN SPAIN WITH DYNAMIC PROVISIONS (2) The causes: inadequate policy mix Excessively lax monetary policy Insufficient fiscal adjustment interest rate % GDP 10 6 8 3 6 0 4 -3 2 -6 Taylor rule average SPAIN 0 -2 Taylor rule average EMU -4 ECB official rate 1999 2001 2003 2005 -9 Public balance Structural primary public balance -12 2007 2009 2011 Source: ECB, Eurostat and Estrada and Saurina (mimeo) 2013 1999 2001 2003 2005 2007 2009 2011 2013 Source: AMECO 9 AN ILLUSTRATION: EXPERIENCE IN SPAIN WITH DYNAMIC PROVISIONS (3) The role of dynamic provisions: -Help smooth the provisioning effort (albeit moderately) -But little impact on credit developments (at least during the expansion) million € 140.000 120.000 million € 2.000.000 1.800.000 Total provisions 1.600.000 100.000 1.400.000 80.000 1.200.000 1.000.000 60.000 800.000 40.000 600.000 400.000 20.000 0 200.000 Specific provisions General Provisions Credit to the nonfinancial private sector (right) 0 Source: BE 10 AN ILLUSTRATION: EXPERIENCE IN SPAIN WITH DYNAMIC PROVISIONS (4) The limits of macro-pru: working with averages while aggregate developments embed a relevant dispersion of risk management policies across banks % 35 NPL ratio in the non-financial private sector by credit institution 30 25 20 Average: 14% 15 10 Average: 4.9% 5 Average: 0.6% 0 December 2006 December 2009 December 2013 Source: BE and own calculations Need to work hand-in-hand with micro-supervision 11 AN ILLUSTRATION: EXPERIENCE IN SPAIN WITH DYNAMIC PROVISIONS (5) As a conclusion, countercyclical provisions: Useful device that together with stringent micro-policies increased resilience of the Spanish financial sector. Unable however to moderate huge credit expansion… …as other policies were significantly pushing in the opposite direction (no policy coordination). With the benefit of hindsight: an even more proactive macro and micro-prudential action would have been helpful. Macro-pru not a substitute of adequate policy coordination. 12 THANK YOU FOR YOUR ATTENTION