Basic Plan Preferred Provider Organization Evidence of Coverage

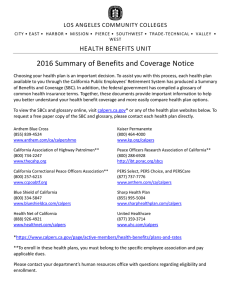

advertisement