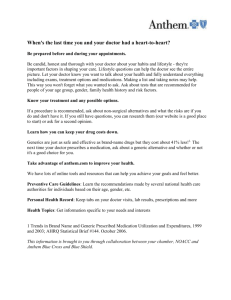

1 A Health Maintenance Organization (HMO) Anthem Blue Cross Select

advertisement