BENEFITS MEDICARE YOUR This official government guide

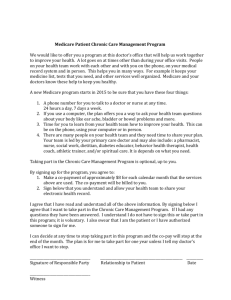

advertisement