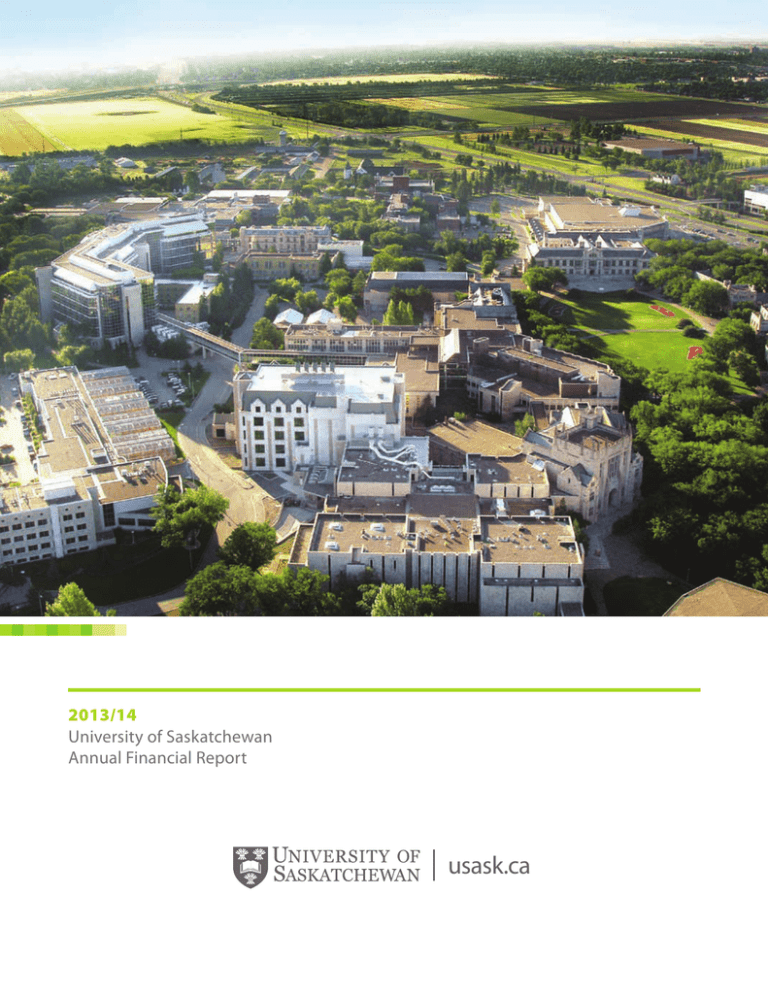

usask.ca 2013/14 University of Saskatchewan Annual Financial Report

advertisement