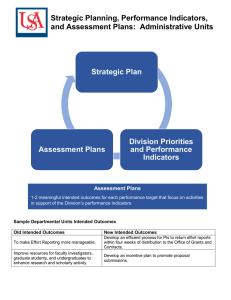

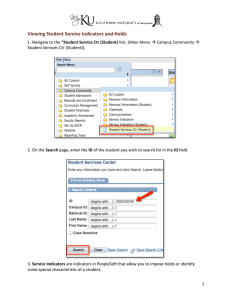

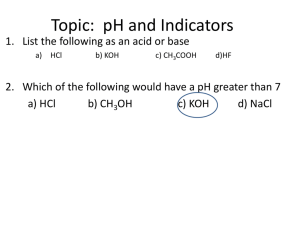

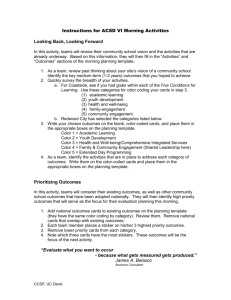

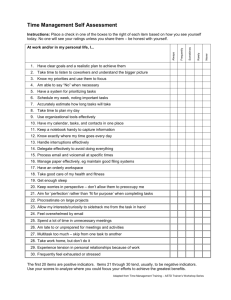

Guidelines

advertisement