Guidelines

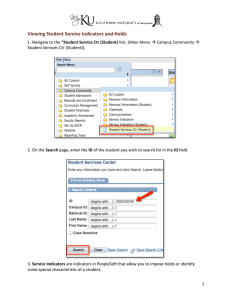

advertisement