Quantifying Confidence George-Marios Angeletos Fabrice Collard Harris Dellas

advertisement

Quantifying Confidence

George-Marios Angeletos

Fabrice Collard

Harris Dellas

Bank of Portugal, June 11, 2015

Angeletos, Collard, Dellas

Quantifying Confidence

1 / 29

Standard approach

coordination failure = multiple equilibria

aggregate demand = gaps from flex prices, NKPC

Angeletos, Collard, Dellas

Quantifying Confidence

2 / 29

An alternative

coordination failure

aggregate demand

Angeletos, Collard, Dellas

= strategic uncertainty / beliefs

Quantifying Confidence

3 / 29

An alternative

coordination failure

aggregate demand

= strategic uncertainty / beliefs

This Paper

1. tractable formalization

2. quantitative evaluation

Angeletos, Collard, Dellas

Quantifying Confidence

3 / 29

Contribution

1

explore observable implications of

I

imperfect coordination

I

relaxed solution concept

2

accommodate fluctuations in “confidence”

3

decouple AD from sticky prices

4

I

bypass empirical failures of old and NK Philips curves

I

great recessions 6= great deflations

explain multiple salient features of the data

Angeletos, Collard, Dellas

Quantifying Confidence

4 / 29

Roadmap

Baseline Model and Methodological Contribution

Quantitative Evaluation

Extension to Medium-Scale DSGE & Estimation

Complementary Empirical Work

Angeletos, Collard, Dellas

Quantifying Confidence

5 / 29

Baseline Model

belief-enrichment of textbook RBC model

geography

I

islands: differentiated intermediate goods, local L and K markets

I

mainland: final good (→ consumption and investment)

I

heterogeneous beliefs across islands

sources of volatility

I

permanent shock to technology: At

I

transitory shock to HOB, or “confidence”: ξt

Angeletos, Collard, Dellas

Quantifying Confidence

6 / 29

Modeling Beliefs

Stage 1

Stage 2

observe xit = log At + εit

observe (At , Yt , prices)

form beliefs about (Yt , Yt+1 , ...)

update beliefs

make production choices

consume and invest

t

Angeletos, Collard, Dellas

Quantifying Confidence

t +1

7 / 29

Modeling Beliefs

Stage 1

Stage 2

observe xit = log At + εit

observe (At , Yt , prices)

form beliefs about (Yt , Yt+1 , ...)

update beliefs

make production choices

consume and invest

t

t +1

heterogeneous priors:

εit

∼ N (0, σ)

εjt

∼ N (ξt , σ)

ξt → aggregate variation in HOB → “confidence” or “AD”

Angeletos, Collard, Dellas

Quantifying Confidence

7 / 29

ξt as a proxy for strategic uncertainty

standard:

Yt = Ēt [Yt ] = YtRBC ≡ χ At

strategic uncertainty:

Yt 6= Ēt [Yt ] = YtRBC + “belief wedge”

Angeletos, Collard, Dellas

Quantifying Confidence

8 / 29

ξt as a proxy for strategic uncertainty

standard:

Yt = Ēt [Yt ] = YtRBC ≡ χ At

strategic uncertainty:

Yt 6= Ēt [Yt ] = YtRBC + “belief wedge”

Angeletos and La’O (Ecma 2013)

I

impose common prior (no biases)

I

abstract from capital, add market segmentation

⇒ observational equivalence

Angeletos, Collard, Dellas

Quantifying Confidence

8 / 29

ξt as a belief enrichment

DSGE models vs “beauty contests”:

behavior depends on beliefs of many endogenous outcomes (prices,

wages, sales...) in many dates

ξt = disciplined, parsimonious, and tractable belief enrichment

research task: understand observable implications & quantify

Angeletos, Collard, Dellas

Quantifying Confidence

9 / 29

Methodological Contribution

tractability, tractability, tractability....

take the limit as σ → 0 ⇒

I

no learning, no Kalman filter

I

no cross-sectional heterogeneity, no Krusell-Smith

I

ξt is sufficient statistic for gap between higher- and first-order beliefs

⇒ small state spaces!

solution almost as in representative-agent models

Angeletos, Collard, Dellas

Quantifying Confidence

10 / 29

Recursive equilibrium

recursive equilibrium = PBE among fictitious local planners

key objects: G, P, V1 , V2

I

G = aggregate policy rule for capital:

Kt+1 = G(At , ξt , Kt )

I

P = local beliefs about prices (demand):

I

V1 , V2 = value functions of local planner in stages 1, 2

p̂it = P(xit , ξt , Kt )

heterogeneous priors → tractable fixed point

→ solution “almost” as in representative-agent models

Angeletos, Collard, Dellas

Quantifying Confidence

11 / 29

Recursive equilibrium

stage-1 problem:

V1 (k; x, ξ, K ) = max V2 (m̂; x, ξ, K ) −

n

s.t.

1

1+ν

1+ν n

m̂ = p̂ ŷ + (1 − δ)k

ŷ = xk θ n1−θ

p̂ = P(x, ξ, K )

stage-2 problem:

R

V2 (m; A, ξ, K ) = max{c,k 0 } U(c) + β V1 (k 0 ; A0 , ξ 0 , K 0 )df (A0 , ξ

s.t.

c + k0 = m

K 0 = G(A, ξ, K )

n(k, x, ξ, K ) & g(m, A, ξ, K )= policy rules for (n, k)

y(x, A, ξ, K ) = output implied by policy rules

Angeletos, Collard, Dellas

Quantifying Confidence

12 / 29

Recursive equilibrium

belief consistency:

P(x, ξ, K ) =

y(x + ξ, x, ξ, K )

y(x, x, ξ, K )

aggregation:

X

G(A, ξ, K ) = g y(A, A, ξ, K ) + (1 − δ)K ; A, ξ, K

bottom line: tractable fixed-point problem

Angeletos, Collard, Dellas

Quantifying Confidence

13 / 29

Log-linear solution

original model:

(Ct , It , Nt ; Kt+1 ) = Γk · Kt + Γa · At + Γξ · ξt

belief-augmented model:

(Ct , It , Nt ; Kt+1 ) = Γk · Kt + Γa · At + Γξ · ξt

generalization to arbitrary linear DSGE models (see Appendix) →

simulate/calibrate/estimate as in standard DSGE models

Angeletos, Collard, Dellas

Quantifying Confidence

14 / 29

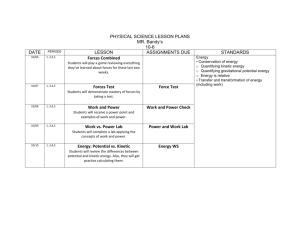

Calibration

fix all familiar params to conventional values

Parameter

Role

Value

β

δ

ν

α

ψ

Discount Rate

Depreciation Rate

Inverse Elasticity of Labor Supply

Capital Share in Production

Inverse Elasticity of Utilization

0.990

0.015

0.500

0.300

0.300

fix persistence of belief shock to ρ = .75

choose σa and σξ so as to match of BC volatilities of Y , H, I , C

Angeletos, Collard, Dellas

Quantifying Confidence

15 / 29

Observable implications: IRFs to confidence shock

Output

% deviation

2

Productivity

0.5

1.5

Consumption

0.2

0.15

1

0

1.5

1

2

0.5

0.05

0

0

-0.5

0

10

Quarters

20

Hours Worked

2

4

0.1

0.5

Investment

6

0

0

0

10

Quarters

20

0

10

Quarters

20

0

10

Quarters

20

0

10

Quarters

20

co-movement patterns very different from

I

I

I

investment- or consumption-specific shocks

news or noise shocks

any shock that works through TFP (e.g., uncertainty shocks)

similar to monetary shock in NK, but w/o inflation

Angeletos, Collard, Dellas

Quantifying Confidence

16 / 29

Pony Race: Confidence Shocks vs NK Demand Shocks

NK with TFP plus...

Data

Our RBC

stddev(y )

stddev(h)

stddev(c)

stddev(i)

1.42

1.56

0.76

5.43

corr(c, y )

corr(i, y )

corr(h, y )

corr(c, h)

corr(i, h)

corr(c, i)

corr(y , y /h)

corr(h, y /h)

corr(y , sr )

corr(h, sr )

I shock

C shock

News

Monetary

1.42

1.52

0.76

5.66

1.24

1.18

0.86

7.03

1.15

0.97

0.95

7.04

1.29

1.02

0.84

7.24

1.37

1.44

0.77

6.20

0.85

0.94

0.88

0.84

0.82

0.74

0.77

0.92

0.85

0.34

0.99

0.47

0.42

0.82

0.80

-0.19

1.00

-0.17

0.37

0.75

0.77

-0.29

1.00

-0.33

0.43

0.84

0.86

-0.07

1.00

-0.13

0.73

0.90

0.84

0.24

0.99

0.35

0.08

-0.41

0.82

0.47

0.15

-0.37

0.85

0.47

0.37

-0.24

0.92

0.52

0.54

-0.10

0.92

0.49

0.61

0.13

0.94

0.65

0.20

-0.36

0.94

0.61

Angeletos, Collard, Dellas

Quantifying Confidence

17 / 29

Take-home lesson (so far)

a simple formalization of non-monetary demand shocks

superior performance within “textbook” models

key to quantitative success:

I

waves of optimism/pessimism about “demand” in the short run

I

disconnect from TFP and labor productivity

Angeletos, Collard, Dellas

Quantifying Confidence

18 / 29

Extensions

medium-scale DSGE → robustness and structural estimation

multiple shocks → multiple competing mechanisms

I

I

I

I

I

I

permanent and transitory TFP shock

permanent and transitory investment-specific shock

news about future productivity

discount-factor shock

fiscal shock

monetary shock

also: IAC and HP → endogenous persistence, plus help NK

two versions: flexible vs sticky prices

Angeletos, Collard, Dellas

Quantifying Confidence

19 / 29

Observable Implications

Output

1

Consumption

0.5

0.8

0.4

0.6

0.3

0.4

0.2

0.2

0.1

0

10

Quarters

20

1

1

0.5

0

0

-1

0

10

Quarters

20

Hours Worked

1.5

2

0

0

Investment

3

-0.5

0

10

Quarters

20

Inflation Rate

0.08

Nom. Interest Rate

2

0.06

0

0.04

-2

0.02

-4

0

-6

-0.02

0

10

Quarters

Flexible Prices (RBC)

20

-8

0

10

Quarters

20

0

10

Quarters

20

Sticky Prices (NK)

similar effects in RBC vs NK, or in textbook vs medium-scale models

important: that’s NOT the case for other shocks/mechanisms

Angeletos, Collard, Dellas

Quantifying Confidence

20 / 29

Estimated Contribution

despite multiple competing forces, estimation attributes more than

half of the observed business cycles to “confidence”

contribution to volatility (6-32 quarters)

Flexible Prices

Sticky Prices

Y

C

I

h

π

R

50.98

47.73

43.72

40.89

54.63

44.24

76.04

65.66

0.00

11.95

99.15

32.64

contribution to covariances (6-32 quarters)

Flexible

Sticky

(Y , h)

(Y , I )

(Y , C )

(h, I )

(h, C )

(I , C )

75.80

68.53

60.06

53.23

56.34

58.40

75.67

62.64

96.53

106.30

84.75

107.41

Angeletos, Collard, Dellas

Quantifying Confidence

21 / 29

What Is Aggregate Demand?

posterior odds of competing models:

RBC <<< NK << RBC with confidence

interpretation: a potent theory of AD (even) w/o nominal rigidity

Angeletos, Collard, Dellas

Quantifying Confidence

22 / 29

Complementary Empirical Work (Angeletos-Collard-Dellas)

Angeletos, Collard, Dellas

Quantifying Confidence

23 / 29

Complementary Empirical Work (Angeletos-Collard-Dellas)

bypass any particular model or any structural VARs

“anatomy” of comovement

I

construct factors designed to capture volatility of certain variables

I

inspect comovement patterns across variables and/or frequencies

Angeletos, Collard, Dellas

Quantifying Confidence

23 / 29

Complementary Empirical Work (Angeletos-Collard-Dellas)

bypass any particular model or any structural VARs

“anatomy” of comovement

I

construct factors designed to capture volatility of certain variables

I

inspect comovement patterns across variables and/or frequencies

Angeletos, Collard, Dellas

Quantifying Confidence

23 / 29

Complementary Empirical Work (Angeletos-Collard-Dellas)

bypass any particular model or any structural VARs

“anatomy” of comovement

I

construct factors designed to capture volatility of certain variables

I

inspect comovement patterns across variables and/or frequencies

show that this anatomy points towards shocks/mechanisms that are

I

highly transitory

I

disconnected from both productivity and inflation

I

unlike usual suspects

Angeletos, Collard, Dellas

Quantifying Confidence

23 / 29

Identifying a “Business Cycle Factor”

1

VAR/VECM on

{Y , H, I , C , PI /PC , π, R, G , ...}

with 2 unit-root components

2

“business cycle factor” = combination of VAR innovations that

maximizes band-pass volatility of Y and/or (H, I ) at 6-32 quarters

Angeletos, Collard, Dellas

Quantifying Confidence

24 / 29

Factor: Variance Contribution

Y

Baseline, with permanent

6–32 quarters

49.62

32–80 quarters 21.49

80–∞ quarters

0.00

Angeletos, Collard, Dellas

I

h

C

components excluded

55.70 49.22 24.34

28.52 28.19

8.89

0.00

3.37

0.00

Quantifying Confidence

Y /h

Pi

π

R

15.03

6.44

0.00

5.92

4.24

0.00

17.74

14.63

2.08

31.33

31.38

5.15

25 / 29

Factor: Variance Contribution

Y

Y /h

Pi

π

R

components excluded

55.70 49.22 24.34

28.52 28.19

8.89

0.00

3.37

0.00

15.03

6.44

0.00

5.92

4.24

0.00

17.74

14.63

2.08

31.33

31.38

5.15

Variant, with permanent components included

6–32 quarters

47.97 55.87 58.97 21.45

32–80 quarters 17.27 25.01 26.55

9.46

80–∞ quarters

6.67

6.67

7.26

6.66

23.23

12.89

6.67

4.96

6.22

6.62

15.87

15.86

6.68

44.39

43.44

9.52

Baseline, with permanent

6–32 quarters

49.62

32–80 quarters 21.49

80–∞ quarters

0.00

Angeletos, Collard, Dellas

I

h

C

Quantifying Confidence

25 / 29

Factor: Comovement Patterns

Output

Consumption

Investment

0.5

2

0.5

0

0

0

-0.5

-2

-0.5

5

10

15

Quarters

Hours Worked

20

5

10

15

Quarters

Productivity

20

1

0

-0.5

0

0

-0.5

-0.5

-1

5

1

10

15

Quarters

Gov. Spending

10

15

Quarters

Rel. Price of Inv.

20

20

0.5

0.5

0.5

5

5

10

15

Quarters

Inflation Rate

20

0.2

0.2

0.5

0.1

0.1

0

0

0

-0.5

-0.1

-0.1

-0.2

5

10

15

Quarters

Nom. Int. Rate

20

5

10

15

Quarters

20

-0.2

-1

5

10

15

Quarters

baseline

Angeletos, Collard, Dellas

20

5

10

15

Quarters

20

variant

Quantifying Confidence

26 / 29

Model Counterpart?

has to be transitory

has to trigger strong comovement in (Y , H, I , C ),

without strong comovement in either (Y /H, TFP, Pi/PC ) or π

unlike any of the “usual suspects” in standard models

I

not technology

I

not news/noise

I

not financial or uncertainty shock that work through TFP

I

not I- or C-specific shocks

what can this be? “confidence”, or something else

Angeletos, Collard, Dellas

Quantifying Confidence

27 / 29

Confidence shock (model) vs factor (data)

4

Output

15

Investment

6

Hours Worked

Consumption

2

3

10

4

5

2

1.5

2

1

1

0.5

0

0

0

-5

-2

-10

-4

0

-0.5

-1

-1

-2

-3

-1.5

-2

-4

-15

1970 1980 1990 2000

-6

1970 1980 1990 2000

1970 1980 1990 2000

1970 1980 1990 2000

this explains why structural estimation favors confidence shock

evidence in favor of our theory and/or against standard theories

Angeletos, Collard, Dellas

Quantifying Confidence

28 / 29

Conclusion

Methodological contribution:

I

embed tractable higher-order beliefs in a large class of macro models

I

accommodate a certain relaxation of solution concept

Applied contribution:

I

reveal observable implications of HOB

I

accommodate waves of optimism and pessimism about SR

I

accommodate “aggregate demand” without sticky prices

I

explain multiple salient features of the data

Angeletos, Collard, Dellas

Quantifying Confidence

29 / 29