UNIVERSITY OF NORTH CAROLINA AT WILMINGTON INTERCOLLEGIATE ATHLETICS PROGRAM

advertisement

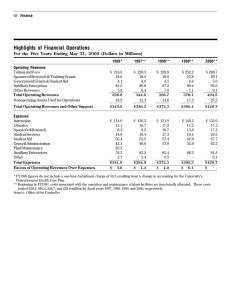

UNIVERSITY OF NORTH CAROLINA AT WILMINGTON INTERCOLLEGIATE ATHLETICS PROGRAM INDEPENDENT ACCOUNTANTS’ REPORT ON THE APPLICATION OF AGREED-UPON PROCEDURES FOR THE YEAR ENDED JUNE 30, 2014 UNIVERSITY OF NORTH CAROLINA AT WILMINGTON INTERCOLLEGIATE ATHLETICS PROGRAM TABLE OF CONTENTS JUNE 30, 2014 Page(s) Independent Accountants’ Report on the Application of Agreed-Upon Procedures 1 – 12 Exhibits Exhibit I – Statement of Revenues and Expenses Exhibit II – Notes to Statement of Revenues and Expenses 13 14 INDEPENDENT ACCOUNTANTS’ REPORT ON THE APPLICATION OF AGREED-UPON PROCEDURES Dr. William A. Sederburg, Chancellor, University of North Carolina at Wilmington: We have performed the procedures enumerated below, which were agreed to by the Chancellor of the University of North Carolina at Wilmington (the University), solely to assist the University in evaluating whether the accompanying statement of revenues and expenses (Exhibit I) of the University of North Carolina at Wilmington Intercollegiate Athletics Program (the Program) is in compliance with the National Collegiate Athletic Program (NCAA) Bylaw 3.2.4.16 for the year ended June 30, 2014. The University’s management is responsible for the statement of revenues and expenses (the Statement) and the statement’s compliance with those requirements. This agreed-upon procedures engagement was conducted in accordance with attestation standards established by the American Institute of Certified Public Accountants. The sufficiency of these procedures is solely the responsibility of those parties specified in this report. Consequently, we make no representation regarding the sufficiency of the procedures described below either for the purpose for which this report has been requested or for any other purpose. Exceptions totaling the lesser of $25,000 or 10% of the line item total to which an agreed-upon procedure has been applied to, other than exceptions related to internal control procedures of the Program, for which there are no thresholds, have been reported. The procedures that we performed and our findings are as follows: Agreed-Upon Procedures Related to the Statement of Revenues and Expenses Procedure Finding All Revenue Categories 1. Compare and agree each operating revenue category reported in the statement during the reporting period to supporting schedules provided by the Program. No exceptions noted. 2. Compare and agree a sample of operating revenue receipts obtained from the above operating revenue supporting schedules to adequate supporting documentation. No exceptions noted. 3. Compare each major revenue account to prior period amounts and budget estimates. Obtain and document an understanding of any significant variations. No exceptions noted and amounts and explanations for variations from the prior period and the budget are reasonable. -1- Procedure Finding Ticket Sales 1. Compare tickets sold during the reporting period, complimentary tickets provided during the reporting period and unsold tickets to the related revenue reported by the Program in the statement and the related attendance figures. No exceptions noted. 2. Recalculate totals. No exceptions noted. Student Fees 1. Compare and agree student fees reported by the Program in the statement for the reporting to student enrollments during the same reporting period. We were able to reconcile student fees reported by the Program to student enrollment data provided by the University within approximately $74,000 or 0.97%. We noted that regular differences occur primarily due to refunds of athletic fees for dropped classes where the timing of such refunds may fall in a different fiscal year. 2. Obtain and document an understanding of the institution's methodology for allocating student fees to intercollegiate athletics programs. An understanding of the institution’s methodology was gained, and we noted that the allocation was in accordance with the University’s methodology. 3. Recalculate totals. No exceptions noted. Guarantees 1. Select a sample of settlement reports for away games during the reporting period and agree each selection to the Program's general ledger and/or the statement. No exceptions noted. 2. Select a sample of contractual agreements pertaining to revenues derived from guaranteed contests during the reporting period and compare and agree each selection to the Program's general ledger and/or the statement. No exceptions noted. 3. Recalculate totals. No exceptions noted. Contributions 1. Compare each major revenue account to prior period amounts and budget estimates. Obtain and document an understanding of any significant variations. -2- No exceptions noted and amounts and explanations for variations from the prior period and the budget are reasonable. Procedure Finding 2. For any contributions of moneys, goods or services received directly by an intercollegiate athletics program from any affiliated or outside organization, agency or group of individuals (two or more) not included above (e.g., contributions by corporate sponsors) that constitutes 10 percent or more of all contributions received for intercollegiate athletics during the reporting period shall obtain and review supporting documentation for each contribution. No exceptions noted. Compensation and Benefits Provided by a Third-Party 1. Obtain the summary of revenues from affiliated and outside organizations (the "Summary") as of the end of the reporting period from the Program. As there was no third party support for the year ended June 30, 2014, procedure was not performed. 2. Select a sample of funds from the Summary and compare and agree each selection to supporting documentation, the Program's general ledger and/or the Summary. As there was no third party support for the year ended June 30, 2014, procedure was not performed. 3. Recalculate totals. As there was no third party support for the year ended June 30, 2014, procedure was not performed. 4. If the third party was audited by independent auditors, obtain the related independent auditors' report. As there was no third party support for the year ended June 30, 2014, procedure was not performed. Direct State or Other Governmental Support 1. Compare direct state or other governmental support recorded by the Program during the reporting period with state appropriations, institutional authorizations and/or other corroborative supporting documentation. As there was no direct state or other governmental support for the year ended June 30, 2014, procedure was not performed. 2. Recalculate totals. As there was no direct state or other governmental support for the year ended June 30, 2014, procedure was not performed. Direct Institutional Support 1. Compare the direct institutional support recorded by the Program during the reporting period with state appropriations, institutional authorizations and/or other corroborative supporting documentation. No exceptions noted. 2. Recalculate totals. No exceptions noted. Indirect Facilities and Administrative Support 1. Compare the indirect facilities and administrative support recorded by the Program during the reporting period with state appropriations, institutional authorizations and/or other corroborative supporting documentation. -3- As there was no indirect facilities and administrative support for the year ended June 30, 2014, procedure was not performed. Procedure Finding 2. Recalculate totals. As there was no indirect facilities and administrative support for the year ended June 30, 2014, procedure was not performed. NCAA/Conference Distributions Including All Tournament Revenues 1. Obtain and inspect agreements related to the Program’s participation in revenues from tournaments during the reporting period to gain an understanding of the relevant terms and conditions. Agreements were obtained and an understanding of the relevant terms and conditions was gained. 2. Compare and agree the related revenues to the Program's general ledger, and/or the statement. No exceptions noted. 3. Recalculate totals. No exceptions noted. Broadcast, Television, Radio and Internet Rights 1. Obtain and inspect agreements related to the Program's participation in revenues from broadcast, television, radio and internet rights to gain an understanding of the relevant terms and conditions. As there were no broadcast, television, radio and internet rights revenues for the year ended June 30, 2014, this procedure was not performed. 2. Compare and agree related revenues to the Program's general ledger, and/or the statement. As there were no broadcast, television, radio and internet rights revenues for the year ended June 30, 2014, this procedure was not performed. 3. Recalculate totals. As there were no broadcast, television, radio and internet rights revenues for the year ended June 30, 2014, this procedure was not performed. Program Sales, Concessions, Novelty Sales and Parking 1. Perform minimum agreed-upon procedures referenced for all revenue categories (see procedures 1 through 3 under “All Revenue Categories” on page 1). No exceptions noted. 2. Recalculate totals. No exceptions noted. Royalties, Advertisements and Sponsorships 1. Obtain and inspect agreements related to the Program's participation in revenues from royalties, advertisements and sponsorships during the reporting period to gain an understanding of the relevant terms and conditions. -4- Agreements were obtained and an understanding of the relevant terms and conditions was gained. Procedure Finding 2. Compare and agree the related revenues to the Program's general ledger, and/or the statement. No exceptions noted. 3. Recalculate totals. No exceptions noted. Sports Camp Revenues 1. Inspect sports camp contract(s) between the Program and person(s) conducting institutional sports camps or clinics during the reporting period to obtain an understanding of the Program's methodology for recording revenues from sports camps. No exceptions noted and the methodology was determined to be appropriate. 2. Obtain schedules of camp participants. Schedules obtained. 3. Select a sample of individual camp participant cash receipts from the schedule of sports camp participants and agree each selection to the Program's general ledger, and/or the statement. No exceptions noted. 4. Recalculate totals. No exceptions noted. of participants were Endowment and Investment Income 1. Obtain and inspect endowment agreements (if any) to gain an understanding of the relevant terms and conditions. The Program does not hold any endowments. All endowments on behalf of athletics are held by the University of North Carolina at Wilmington. 2. Compare and agree the classification and use of endowment and investment income reported in the statement during the reporting period to the uses of income defined within the related endowment agreement. The Program does not hold any endowments. All endowments on behalf of athletics are held by the University of North Carolina at Wilmington. An analysis of investment income was performed and no exceptions were noted. 3. Recalculate totals. No exceptions noted. Other 1. Perform minimum agreed-upon procedures referenced for all revenue categories (see Procedures 1 through 3 under “All Revenue Categories” on page 1). No exceptions noted and amounts and explanations for variations from the prior period and the budget are reasonable. 2. Recalculate totals. No exceptions noted. -5- Procedure Finding All Expense Categories 1. Compare and agree each expense category reported in the statement during the reporting period to supporting schedules provided by the institution. No exceptions noted. 2. Compare and agree a sample of expenses obtained from the above operating expense supporting schedules to adequate supporting documentation. No exceptions noted. 3. Compare and agree each major expense account to prior-period amounts and budget estimates. Obtain and document an understanding of any significant variations. No exceptions noted and amounts and explanations for variations from the prior period and the budget are reasonable. Athletic Student Aid 1. Select a sample of students from the listing of institutional student aid recipients during the reporting period. A sample of ten student aid recipients was selected. 2. Obtain individual student-account detail for each selection and compare total aid allocated from the related aid award letter to the student's account. No exceptions noted. 3. Recalculate totals. No exceptions noted. Guarantees 1. Obtain and inspect home-game settlement reports prepared by the Program during the reporting period and agree related expenses to the Program's general ledger and/or the statement. No exceptions noted. 2. Obtain and inspect contractual agreements pertaining to expenses recorded by the Program from guaranteed contests during the reporting period. Contractual agreements were obtained and inspected. 3. Compare and agree related amounts expensed by the Program to the Program's general ledger and/or the statement. No exceptions noted. 4. Recalculate totals. No exceptions noted. Coaching Salaries, Benefits, and Bonuses Paid by the University and Related Entities 1. Obtain and inspect a listing of coaches employed by the Program and related entities during the reporting period. A listing of all coaches employed by the Program was obtained. 2. Select a sample of coaches' contracts that must include men's and women's basketball from the above listing. A sample of six coaches was selected, including men’s and women’s basketball head coaches. -6- Procedure Finding 3. Compare and agree the financial terms and conditions of each selection to the related coaching salaries, benefits, and bonuses recorded by the Program and related entities in the statement during the reporting period. No exceptions noted. 4. Obtain and inspect W-2s, 1099s, etc. for each selection. This procedure is not relevant to the statement of revenues and expenses, as the statement of revenues and expenses is prepared on a fiscal year basis, whereas W-2s and 1099s are prepared on a calendar year basis. As an alternative procedure, we traced and agreed compensation paid for the sample selected to the University’s payroll system. No exceptions noted. 5. Compare and agree related W-2s, 1099s, etc. to the related coaching salaries, benefits and bonuses paid by the Program and related entities expense recorded by the Program in the statement during the reporting period. This procedure is not relevant to the statement of revenues and expenses, as the statement of revenues and expenses is prepared on a fiscal year basis, whereas W-2s and 1099s are prepared on a calendar year basis. As an alternative procedure, we traced and agreed compensation paid for the sample selected to the University’s payroll system. No exceptions noted. 6. Recalculate totals. No exceptions noted. Coaching Other Compensation and Benefits Paid by a Third-Party 1. Obtain and inspect a listing of coaches employed by third parties during the reporting period. As there were no third party benefits or other compensation expenses for the year ended June 30, 2014, procedure was not performed. 2. Compare and agree the financial terms and conditions of each selection to the related coaching other compensation and benefits paid by a third party and recorded by the Program in the statement during the reporting period. As there were no third party benefits or other compensation expenses for the year ended June 30, 2014, procedure was not performed. 3. Obtain and inspect W-2s, 1099s, etc. for each selection. As there were no third party benefits or other compensation expenses for the year ended June 30, 2014, procedure was not performed. 4. Compare and agree related W-2s, 1099s, etc. to the coaching other compensation and benefits paid by a third party expenses recorded by the Program in the statement during the reporting period. As there were no third party benefits or other compensation expenses for the year ended June 30, 2014, procedure was not performed. 5. Recalculate totals. As there were no third party benefits or other compensation expenses for the year ended June 30, 2014, procedure was not performed. -7- Procedure Finding Support Staff/Administrative Salaries, Benefits Bonuses Paid by the University and Related Entities and 1. Select a sample of support staff/administrative personnel employed by the Program and related entities during the reporting period. A sample of staff/administrative selected. five support personnel was 2. Obtain and inspect W-2s, 1099s, etc. for each selection. This procedure is not relevant to the statement of revenues and expenses, as the statement of revenues and expenses is prepared on a fiscal year basis, whereas W-2s and 1099s are prepared on a calendar year basis. As an alternative procedure, we traced and agreed compensation paid for the sample selected to the University’s payroll system. No exceptions noted. 3. Compare and agree related W-2s, 1099s, etc. to the related support staff/administrative salaries, benefits and bonuses paid by the Program and related entities expense recorded by the Program in the statement during the reporting period. This procedure is not relevant to the statement of revenues and expenses, as the statement of revenues and expenses is prepared on a fiscal year basis, whereas W-2s and 1099s are prepared on a calendar year basis. As an alternative procedure, we traced and agreed compensation paid for the sample selected to the University’s payroll system. No exceptions noted. 4. Recalculate totals. No exceptions noted. Support Staff/Administrative Other Compensation and Benefits Paid by a Third-Party 1. Select a sample of support staff/administrative personnel employed by the third parties during the reporting period. As there were no third party benefits or other compensation expenses for the year ended June 30, 2014, procedure was not performed. 2. Obtain and inspect W-2s, 1099s, etc. for each selection. As there were no third party benefits or other compensation expenses for the year ended June 30, 2014, procedure was not performed. 3. Compare and agree related W-2s, 1099s, etc. to the related support staff/administrative other compensation and benefits expense recorded by the Program in the statement during the reporting period. As there were no third party benefits or other compensation expenses for the year ended June 30, 2014, procedure was not performed. 4. Recalculate totals. As there were no third party benefits or other compensation expenses for the year ended June 30, 2014, procedure was not performed. -8- Procedure Finding Severance Payments 1. Select a sample of employees receiving severance payments by the Program during the reporting period and agree each severance payment to the related termination letter or employment contract. A sample of employees receiving severance payments was selected. 2. Recalculate totals. No exceptions noted. Recruiting 1. Obtain and document an understanding of the Program's recruiting expense policies. We obtained and documented an understanding of the Program’s recruiting expense policies. 2. Compare and agree to existing institutional and NCAArelated policies. No exceptions noted and policies are consistent with institutional and NCAA-related policies. Team Travel 1. Obtain and document an understanding of the Program's team travel policies. We obtained and documented an understanding of the Program’s team travel policies. 2. Compare and agree to existing institutional and NCAArelated policies. No exceptions noted and policies are consistent with institutional and NCAA-related policies. Equipment, Uniforms and Supplies 1. Perform minimum agreed-upon procedures referenced for all expense categories (see procedures 1 through 3 under “All Expense Categories” on page 6). No exceptions noted and amounts and explanations for variations from the prior period and the budget are reasonable. 2. Recalculate totals. No exceptions noted. Game Expenses 1. Perform minimum agreed-upon procedures referenced for all expense categories (see procedures 1 through 3 under “All Expense Categories” on page 6). No exceptions noted and amounts and explanations for variations from the prior period and the budget are reasonable. 2. Recalculate totals. No exceptions noted. Fund Raising, Marketing and Promotion 1. Perform minimum agreed-upon procedures referenced for all expense categories (see procedures 1 through 3 under “All Expense Categories” on page 6). No exceptions noted and amounts and explanations for variations from the prior period and the budget are reasonable. 2. Recalculate totals. No exceptions noted. -9- Procedure Finding Sports Camp Expenses 1. Perform minimum agreed-upon procedures referenced for all expense categories (see procedures 1 through 3 under “All Expense Categories” on page 6). As there were no sports camp expenses for the year ended June 30, 2014, procedure was not performed. 2. Recalculate totals. As there were no sports camp expenses for the year ended June 30, 2014, procedure was not performed. Direct Facilities, Maintenance and Rental 1. Perform minimum agreed-upon procedures referenced for all expense categories (see procedures 1 through 3 under “All Expense Categories” on page 6). No exceptions noted and amounts and explanations for variations from the prior period and the budget are reasonable. 2. Recalculate totals. No exceptions noted. Spirit Groups 1. Perform minimum agreed-upon procedures referenced for all expense categories (see procedures 1 through 3 under “All Expense Categories” on page 6). No exceptions noted and amounts and explanations for variations from the prior period and the budget are reasonable. 2. Recalculate totals. No exceptions noted. Indirect Facilities and Administrative Support 1. Obtain and document an understanding of the Program's methodology for allocating indirect facilities support. As there was no indirect facilities and administrative support for the year ended June 30, 2014, procedure was not performed. 2. Sum the indirect facilities support and indirect institutional support totals reported by the Program in the statement. As there was no indirect facilities and administrative support for the year ended June 30, 2014, procedure was not performed. 3. Compare and agree indirect facilities and administrative support reported by the Program in the statement to the corresponding revenue category reported by the Program in the statement. As there was no indirect facilities and administrative support for the year ended June 30, 2014, procedure was not performed. 4. Recalculate totals. As there was no indirect facilities and administrative support for the year ended June 30, 2014, procedure was not performed. - 10 - Procedure Finding Medical Expenses and Medical Insurance 1. Perform minimum agreed-upon procedures referenced for all expense categories (see procedures 1 through 3 under “All Expense Categories” on page 6). No exceptions noted and amounts and explanations for variations from the prior period and the budget are reasonable. 2. Recalculate totals. No exceptions noted. Memberships and Dues 1. Perform minimum agreed-upon procedures referenced for all expense categories (see procedures 1 through 3 under “All Expense Categories” on page 6). No exceptions noted and amounts and explanations for variations from the prior period and the budget are reasonable. 2. Recalculate totals. No exceptions noted. Other Operating Expenses and Transfers to Institution 1. Perform minimum agreed-upon procedures referenced for all expense categories (see procedures 1 through 3 under “All Expense Categories” on page 6). No exceptions noted and amounts and explanations for variations from the prior period and the budget are reasonable. 2. Recalculate totals. No exceptions noted. Agreed-Upon Procedures Related to Affiliated and Outside Organizations Procedure 1. The Program shall identify all intercollegiate athletics-related affiliated and outside organizations and obtain those organizations’ statements for the reporting period. Once the Program has made these statements available, the independent accountant shall agree the amounts reported in the statement to the organization’s general ledger or, alternatively, confirm revenues and expenses directly with a responsible official of the organization. In addition, the Program shall prepare a summary of revenues and expenses for or on behalf of intercollegiate athletics programs affiliated and outside organizations to be included with the agreed-upon procedures report. Finding The Program identified the UNCW Student Aid Association, Inc. (the Association) as the only outside organization making expenditures for, or on behalf of the Program or its employees. The University and the Association serves as the official legal conduits for the acceptance, investment, and distribution of private gifts in support of the activities and programs of the Program. Expenditures for, or on behalf of the Program or its employees are made directly from the University and the Association. - 11 - We obtained the statement of activities of the University athletic endowments and the Association accounts held for the Program for the year ended June 30, 2014, which represents revenues and expenditures on behalf of the Program. This information was obtained by direct confirmation with the University and the Association. The following is a summary of the statement of activities for the year: University of North Carolina at Wilmington* Endowment net position, beginning of year $ 6,115,670 UNCW Student Aid Association, Inc. $ 650,886 Changes in beginning net position 108,295 Increases in net position 817,077 1,447,549 Decreases in net position (210,799) (1,298,365) Change in net position Endowment net position, end of year - 714,573 $ 6,830,243 149,184 $ 800,070 * These figures represent the portion of endowment net assets held by The University of North Carolina at Wilmington designated to benefit the area of Athletics. Procedure 1. The independent accountant shall obtain and review the audited financial statements of the organization and any additional reports regarding internal control matters if the organization is audited independent of the agreed-upon procedures required by NCAA legislation. The Program’s independent accountant shall also inquire of institutional and outside organization management as to corrective action taken in response to comments concerning internal control structure (if any). Finding We obtained and read the audited financial statements of the Association for the year ended June 30, 2014, and the related management letters. The results of this procedure disclosed that the independent auditors expressed an unmodified opinion on the financial statements of the Association. The independent auditors noted no material weaknesses in the Association’s internal control. We were not engaged to, and did not, conduct an examination, the objective of which would be the expression of an opinion on the compliance of the accompanying statement of revenues and expenses (Exhibit I) of the University and the accompanying notes to the statement of revenues and expenses (Exhibit II). Accordingly, we do not express such an opinion. Had we performed additional procedures, other matters might have come to our attention that would have been reported to you. This report is intended solely for the information and use of the management of the University, the Program, the University of North Carolina at Wilmington Board of Trustees, the University of North Carolina Board of Governors, and the National Collegiate Athletic Association, and is not intended to be and should not be used by anyone other than these specified parties. Gainesville, Florida December 23, 2014 - 12 - Exhibit I UNIVERSITY OF NORTH CAROLINA AT WILMINGTON INTERCOLLEGIATE ATHLETICS PROGRAM STATEMENT OF REVENUES AND EXPENSES FOR THE YEAR ENDED JUNE 30, 2014 (UNAUDITED - SEE ACCOMPANYING INDEPENDENT ACCOUNTANTS' REPORT ON THE APPLICATION OF AGREED-UPON PROCEDURES) Men's Basketball Revenues 1 Ticket sales 2 Student fees 3 Guarantees 4 Contributions 5 Compensation and benefits provided by a third-party 6 Direct state or other government support 7 Direct institutional support 8 Indirect facilities and administrative support 9 NCAA and conference distributions, including all tournament revenues 10 Broadcast, television, radio and internet rights 11 Program sales, concessions, novelty sales and parking 12 Royalties, advertisements and sponsorships 13 Sports camp revenues 14 Endowment and investment income 15 Other 16 Total operating revenues Expenses 17 Athletics student aid 18 Guarantees 19 Coaching salaries, benefits and bonuses paid by the university and related entities 20 Coaching other compensation and benefits paid by a third-party 21 Support staff and administrative salaries, benefits and bonuses paid by the university and related entities 22 Support staff and administrative other compensation paid by a third-party 23 Severance payments 24 Recruiting 25 Team travel 26 Equipment, uniforms and supplies 27 Game expenses 28 Fund raising, marketing and promotion 29 Sports camp expenses 30 Direct facilities, maintenance and rental 31 Spirit groups 32 Indirect facilities and administrative support 33 Medical expenses and medical insurance 34 Memberships and dues 35 Other operating expenses 36 Total operating expenses 37 Transfers to institution 38 Total expenses Excess (deficiency) of revenues over (under) expenses $ 232,433 392,500 66,842 163,598 - Women's Basketball $ 6,787 35,000 41,710 Other Sports $ 70,113 13,000 453,755 Nonprogram Specific $ 4,761 7,637,608 640,765 Total $ 314,094 7,637,608 440,500 1,203,072 - 6,062 - 986,087 - 1,155,747 - - 56,000 - 661,574 - 717,574 - 856 327,583 34,000 168,813 10,462,047 5,856 330,543 3,740 240,768 218,872 12,268,374 46,810 600 902,783 29,015 112,512 5,000 2,960 3,740 130,943 49,459 791,032 401,985 7,500 319,735 2,000 1,769,605 2,000 - 2,491,325 11,500 950,483 397,451 1,295,734 - 2,643,668 - - - - - 100,683 137,121 42,456 2,214,968 2,495,228 903,889 29,610 183,503 6,983 121,839 5,120 280 88,626 2,800,501 2,800,501 35,161 175,356 5,433 92,969 4,222 800 59,702 1,229,950 1,229,950 60,625 730,384 91,088 319,805 3,540 288,282 10,582 147,759 4,761,860 4,761,860 117,709 172,338 331,467 255,851 36,359 26,615 99,729 63,431 240,437 3,558,904 3,558,904 903,889 125,396 1,089,243 221,213 706,951 335,007 553,475 36,359 26,615 99,729 75,093 536,524 12,351,215 12,351,215 $ (1,897,718) - 13 - $ (1,117,438) $ (3,970,828) $ 6,903,143 $ (82,841) Exhibit II UNIVERSITY OF NORTH CAROLINA AT WILMINGTON INTERCOLLEGIATE ATHLETICS PROGRAM NOTES TO STATEMENT OF REVENUES AND EXPENSES FOR THE YEAR ENDED JUNE 30, 2014 (UNAUDITED – SEE ACCOMPANYING INDEPENDENT ACCOUNTANTS’ REPORT ON THE APPLICATION OF AGREED-UPON PROCEDURES) (1) Basis of Accounting: The statement of revenues and expenses of the University of North Carolina at Wilmington Intercollegiate Athletics Program (the Program) has been prepared using the accrual basis of accounting except whereas noted below. Under this method, revenues are recorded when earned and expenses are recognized when they are incurred. The statement of revenues and expenses includes adjustments to a liability for compensated absences. Employees earn the right to be compensated during absences for annual leave (i.e. personal leave) and sick leave pursuant to §126-8, North Carolina General Statutes. The Program has recorded an accrual for the liability associated with the employee’s right to receive compensation for future absences in preparing the statement of revenues and expenses. (2) Capital Assets: Capital asset purchases of the Program are recorded as expenditures when incurred, as capital assets are recorded in the property funds of the University, and are not recorded as assets in the Program’s accounting records. As such, no depreciation expense is recorded in the Program’s accounting records. Capital asset activity for the year ended June 30, 2014, was as follows: Beginning Balance Capital assets being depreciated, net of accumulated depreciation: Buildings Athletic Equipment Total capital assets being depreciated, net of accumulated depreciation (3) Restatement of Beginning Balance Beginning Balance as Restated Additions Decreases Current Year Depreciation $ 6,893,568 $ 1,063,489 $ 6,893,568 (281,583) 781,906 $ 88,842 $ - $ (287,357) $ 6,606,211 (40,855) 829,893 $ 7,957,057 $ (281,583) $ 7,675,474 $ 88,842 $ - $ (328,212) $ 7,436,104 Contributions: The University and the Association serve as the official legal conduit for the acceptance, investment, and distribution of private gifts in support of the activities and programs of the Program. Contributions of $1,203,072 were recognized from the University and the Association for the year ended June 30, 2014, and have been included in the accompanying statement of revenues and expenses. Contributions received from the University and the Association were the only contributions exceeding 10% of total contributions, as reported in the statement of revenues and expenses, for the year ended June 30, 2014. (4) Ending Balance Surplus/Deficit Allocations: The Program is allowed to carry forward all available funds at the end of each fiscal year to the next fiscal year. Deficits are funded by the Program to the extent there are sufficient net assets available. - 14 -