At a Glance my money Stick to your plan

advertisement

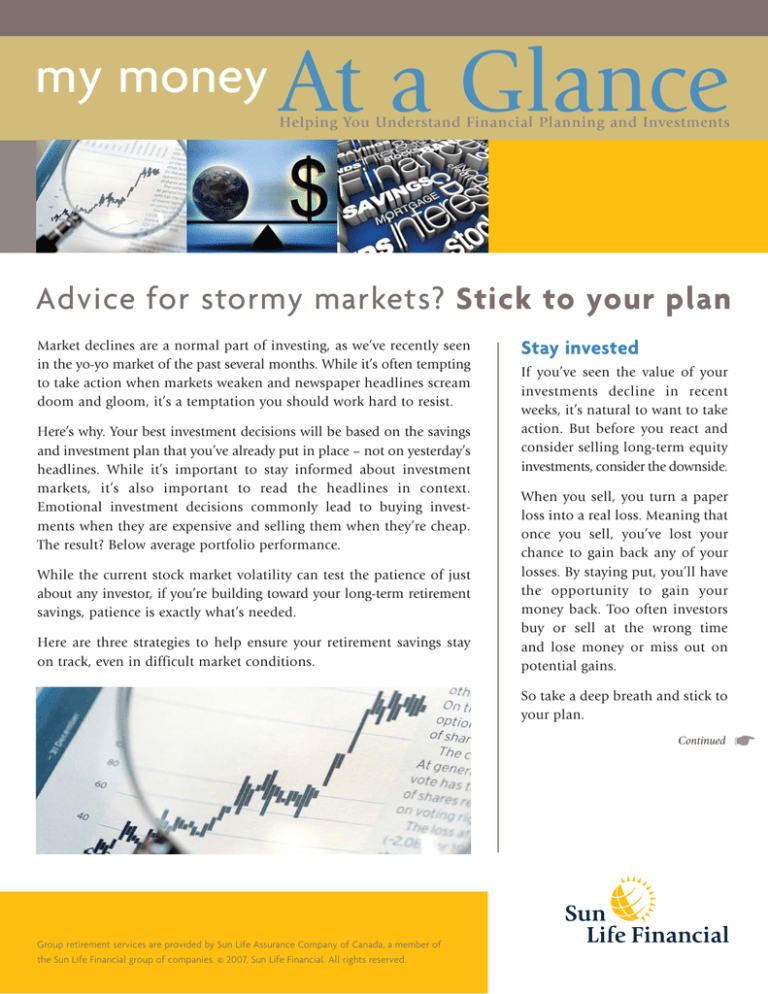

my money At a Glance Helping You Understand Financial Planning and Investments Advice for stormy markets? Stick to your plan Market declines are a normal part of investing, as we’ve recently seen in the yo-yo market of the past several months. While it’s often tempting to take action when markets weaken and newspaper headlines scream doom and gloom, it’s a temptation you should work hard to resist. Here’s why. Your best investment decisions will be based on the savings and investment plan that you’ve already put in place – not on yesterday’s headlines. While it’s important to stay informed about investment markets, it’s also important to read the headlines in context. Emotional investment decisions commonly lead to buying investments when they are expensive and selling them when they’re cheap. The result? Below average portfolio performance. While the current stock market volatility can test the patience of just about any investor, if you’re building toward your long-term retirement savings, patience is exactly what’s needed. Here are three strategies to help ensure your retirement savings stay on track, even in difficult market conditions. Stay invested If you’ve seen the value of your investments decline in recent weeks, it’s natural to want to take action. But before you react and consider selling long-term equity investments, consider the downside. When you sell, you turn a paper loss into a real loss. Meaning that once you sell, you’ve lost your chance to gain back any of your losses. By staying put, you’ll have the opportunity to gain your money back. Too often investors buy or sell at the wrong time and lose money or miss out on potential gains. So take a deep breath and stick to your plan. Continued Group retirement services are provided by Sun Life Assurance Company of Canada, a member of the Sun Life Financial group of companies. © 2007, Sun Life Financial. All rights reserved. ☛ For example, if the value of your equity fund investments decrease by 15% in a year, and your fixed income investments gain 5%, you need to rebalance your portfolio and increase your equity investments and decrease your fixed income investments to maintain your target asset mix. While it may seem strange to increase your equity investments in a difficult market, it can work to your advantage in the long run. Asset mix rebalancing forces you to buy in at market lows (when your equity percentage falls below target) and sell at market highs (when equity markets have risen in value faster than other asset classes). In addition to asset mix rebalancing, remember to review your asset mix strategy over time. While the strategy you’ve developed may be the right one for you today, it will gradually change over time, especially as you get closer to needing your savings in retirement. i As a group plan investor, you may already be making regular contributions to one or more plan accounts. If you are making regular contributions, keep up the good work. If you are not, there’s no better time to get started. Making small contributions on a regular basis is one of the best ways of managing short-term investment risk in an uncertain market. When you invest in a fund at regular intervals – each pay period for example – the unit price of the fund will be higher in some months, and lower in others. The average price you pay lies somewhere in the middle. Provided the investment gains value over the long term, you’ll profit from your purchases during the short-term price declines. Take a look at the chart showing the performance of the S&P/TSX Composite Index over the past 10 years. If you were making regular contributions to a Canadian equity fund during the market declines between 2000 and 2002, you can see how you profited as the index rose in more recent years. S&P/TSX Composite Index $2,600 $2,400 $1000 If the recent declines in equity markets persist, this could require you to rebalance your portfolio to ensure you’re investing according to your original investment strategy. Make regular investments over time Value of Rebalance to maintain your target asset mix $2,200 $2,000 $1,800 $1,600 $1,400 $1,200 $1,000 $800 Jun-97 Jun-98 Jun-99 Jun-00 Jun-01 Jun-02 Jun-03 Jun-04 Jun-05 Jun-06 Jun-07 Make sure you have a plan in place You may have already determined the savings and investment strategy that’s right for you, but if you haven’t done so, or it’s been a few years since you last looked at your plan, there are a number of online tools that can help you determine how much to save and how to invest your savings over time. Sign into Sun Life Financial’s Plan Member Services website to review some of the online tools available to you. It also a good idea to consult a financial advisor when making changes or updating your investment strategy. If you have a general question or suggestion about this newsletter, please send an e-mail to can_pencontrol@sunlife.com or write to my money At a Glance Newsletter, Group Retirement Services Marketing, Sun Life Financial, 225 King Street West, Toronto, ON M5V 3C5. This bulletin has been created exclusively for you. It addresses issues to help you with your financial planning and investments, and cannot be reproduced in whole or in part without the express permission of Sun Life Financial.