June 28, 2007 TO: Academic Money Purchase Pension Plan Participants

advertisement

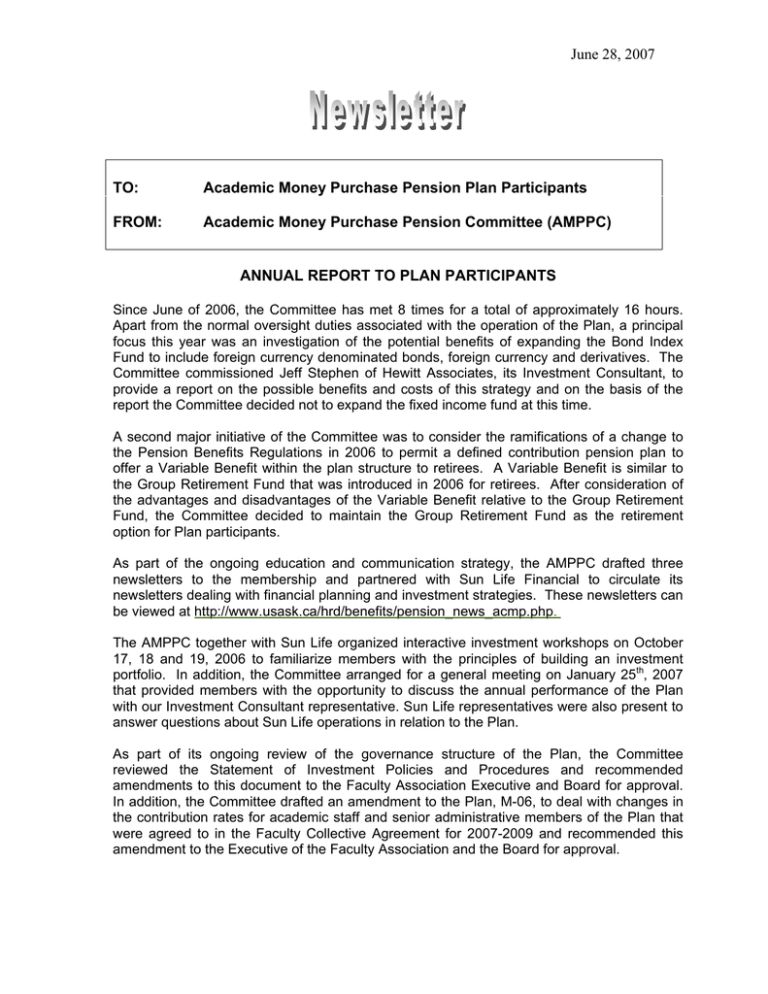

June 28, 2007 TO: Academic Money Purchase Pension Plan Participants FROM: Academic Money Purchase Pension Committee (AMPPC) ANNUAL REPORT TO PLAN PARTICIPANTS Since June of 2006, the Committee has met 8 times for a total of approximately 16 hours. Apart from the normal oversight duties associated with the operation of the Plan, a principal focus this year was an investigation of the potential benefits of expanding the Bond Index Fund to include foreign currency denominated bonds, foreign currency and derivatives. The Committee commissioned Jeff Stephen of Hewitt Associates, its Investment Consultant, to provide a report on the possible benefits and costs of this strategy and on the basis of the report the Committee decided not to expand the fixed income fund at this time. A second major initiative of the Committee was to consider the ramifications of a change to the Pension Benefits Regulations in 2006 to permit a defined contribution pension plan to offer a Variable Benefit within the plan structure to retirees. A Variable Benefit is similar to the Group Retirement Fund that was introduced in 2006 for retirees. After consideration of the advantages and disadvantages of the Variable Benefit relative to the Group Retirement Fund, the Committee decided to maintain the Group Retirement Fund as the retirement option for Plan participants. As part of the ongoing education and communication strategy, the AMPPC drafted three newsletters to the membership and partnered with Sun Life Financial to circulate its newsletters dealing with financial planning and investment strategies. These newsletters can be viewed at http://www.usask.ca/hrd/benefits/pension_news_acmp.php. The AMPPC together with Sun Life organized interactive investment workshops on October 17, 18 and 19, 2006 to familiarize members with the principles of building an investment portfolio. In addition, the Committee arranged for a general meeting on January 25th, 2007 that provided members with the opportunity to discuss the annual performance of the Plan with our Investment Consultant representative. Sun Life representatives were also present to answer questions about Sun Life operations in relation to the Plan. As part of its ongoing review of the governance structure of the Plan, the Committee reviewed the Statement of Investment Policies and Procedures and recommended amendments to this document to the Faculty Association Executive and Board for approval. In addition, the Committee drafted an amendment to the Plan, M-06, to deal with changes in the contribution rates for academic staff and senior administrative members of the Plan that were agreed to in the Faculty Collective Agreement for 2007-2009 and recommended this amendment to the Executive of the Faculty Association and the Board for approval. 2 Finally the AMPPC initiated an investigation of the desirability of changes to the Default Option of the Plan. Presently the Default Option for all participants is the Balanced Life Cycle Fund that has 60 percent of the Fund invested in equities. The Committee has commissioned the Investment Consultant to report on the advisability and feasibility of tailoring the Default Option to the working life of the participant, with exposure to equities highest at the date of employment and declining as the years to retirement decrease. Any recommendation the AMPPC might draft in the future regarding the Default Option would in due course be submitted to Plan members for ratification and, if ratified, to the Board for approval. Investment Performance of the Plan As Plan members have differing risk preferences, the Plan makes several investment options available to members. These options allow members to select segregated funds with a mix of underlying assets that meets their investment needs. The following is a summary of the Plan’s investment performance as at December 31, 2006: Fund Money Market Return Objective Bond Fund Return Objective Conservative Life Cycle Fund Return Objective Balanced Life Cycle Fund Return Objective Aggressive Life Cycle Fund Return Objective Canadian Equity Fund Return Objective U.S Equity Fund Return Objective International Equity Fund Return Objective 1 year 4 year 3.9% 4.0% 3.0% 2.9% 4.1% 4.1% 6.1% 6.1% 7.2% 7.1% 7.6% 7.7% 13.3% 13.2% 10.3% 10.9% 16.5% 16.4% 11.6% 12.5% 14.4% 17.3% 19.9% 20.5% 15.3% 15.4% 6.2% 6.3% 29.1% 25.9% 12.5% 15.2% The Sun Life website at https://www.sunnet.sunlife.com/member/signin/index.aspx? contains additional information about the Plan’s performance. Additionally, you can access the Plan’s financial statements at http://www.usask.ca/hrd/benefits/pension_plans.php. Respectively submitted by Robert F. Lucas, Chair Academic Money Purchase Pension Committee