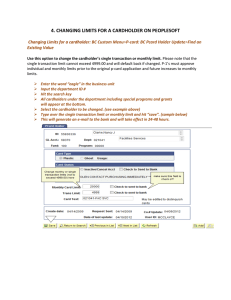

MONROE, LOUISIANA CORPORATE LIABILITY “LA CARTE” PURCHASING CARD AND CBA POLICY

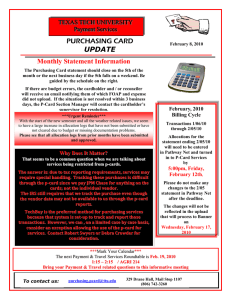

advertisement