European Committee of Central Balance Sheet Offices Own Funds Working Group

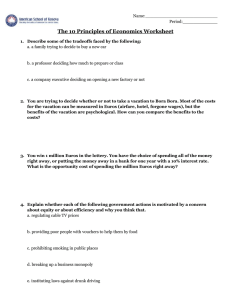

advertisement