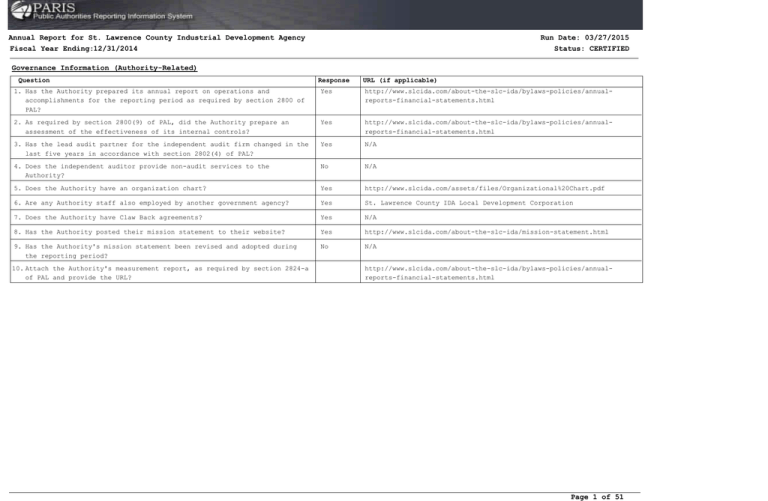

Annual Report for St. Lawrence County Industrial Development Agency

advertisement