S . L C

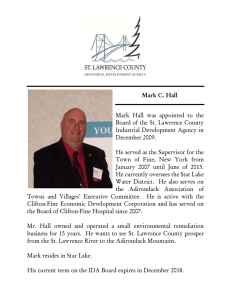

advertisement