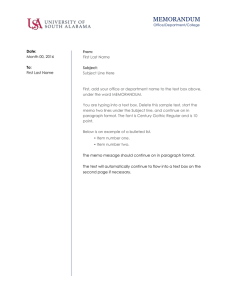

P M U

advertisement