E D U C A T I N G ... T F S

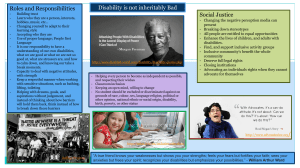

advertisement