40 BANCO DE PORTUGAL • Boletim Estatístico

advertisement

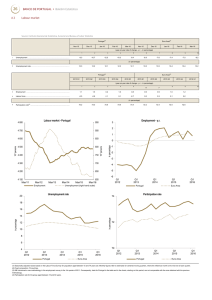

40 BANCO DE PORTUGAL • Boletim Estatístico A.10 Banking(1) interest rates - Loans and deposits(2) Source: Banco de Portugal and European Central Bank (with calculations by Banco de Portugal) Euro Area(3) Portugal Dec-14 Mar-15 Dec-15 Feb-16 Mar-16 Dec-14 Mar-15 Dec-15 Feb-16 Mar-16 (annualised agreed rates - aar - in percentage) 1 2 3 4 5 6 7 8 9 10 Non-financial corporations……………………………………………..…….……………………….……………………….……………………………. 4.09 4.07 2.98 3.45 Loans 1 2 Transactions up to and including 1 million euros ………………………………..………………………. 4.68 4.49 3.64 3 Transactions over 1 million euros ……………………………………………….……………………….……………………………. 3.48 3.51 2.40 3.10 2.15 2.05 1.85 1.76 1.79 3.70 3.55 3.08 2.91 2.60 2.64 2.56 3.08 2.44 1.86 1.74 1.59 1.40 1.46 Households: 4 Housing…………………………………………………………………………….…………………...………………………………………………………… 3.00 2.73 2.16 2.06 2.05 2.55 2.30 2.28 2.22 2.12 5 Consumption……………………………………………………………………………………………………………….…..……………………………. 8.61 8.44 7.70 7.66 7.59 6.00 6.03 5.74 5.97 5.87 6 Other purposes………………………………..………………………………………………………...……..…………………………………………. 4.45 4.83 4.32 4.69 4.71 2.67 2.70 2.47 2.52 2.48 Deposits 7 Non-financial corporations: with agreed maturity, up to 1 year …………...….……………………….………………………. 0.68 0.48 0.39 0.18 0.18 0.42 0.30 0.21 0.23 0.13 8 Households: with agreed maturity, up to 1 year…………………………….……………………….………………………. 1.26 0.92 0.53 0.49 0.47 0.97 0.90 0.65 0.61 0.61 6 6 5 5 in percentage 7 4 3 4 3 2 2 1 1 5 Jun/12 Sep/13 Dec/14 0 Mar/11 Mar/16 Portugal (<1 MEUR) Portugal (>1 MEUR) Euro Area (<1 MEUR) Euro Area (>1 MEUR) Deposits of non-financial corporations with agreed maturity (up to 1 year) - aar 5 4 3 3 2 1 Jun/12 Sep/13 Dec/14 Portugal 4 0 Mar/11 Loans to households (housing) - aar 8 7 0 Mar/11 in percentage Loans to non-financial corporations - aar in percentage in percentage 8 Mar/16 Euro Area Deposits of households with agreed maturity (up to 1 year) - aar 2 1 Jun/12 Portugal Sep/13 Euro Area Dec/14 Mar/16 ECB reference rate (4) 0 Mar/11 Jun/12 Portugal Sep/13 Dec/14 Euro Area (1) Includes the rates set by universal banks, savings banks and mutual agricultural credit banks which, along with money market funds, are the subsector of Other monetary financial institutions (OMFIs). (2) Banking interest rates on new loans and deposits of residents in the Euro Area. (3) Euro Area: changing composition. (4) Fixed rate (fixed rate tenders) or marginal rate (variable rate tenders) in Eurosystem main refinancing operations (end-of-month value). Mar/16 ECB reference rate (4)