Guidance for Improvements in Financial Controls March, 2012

advertisement

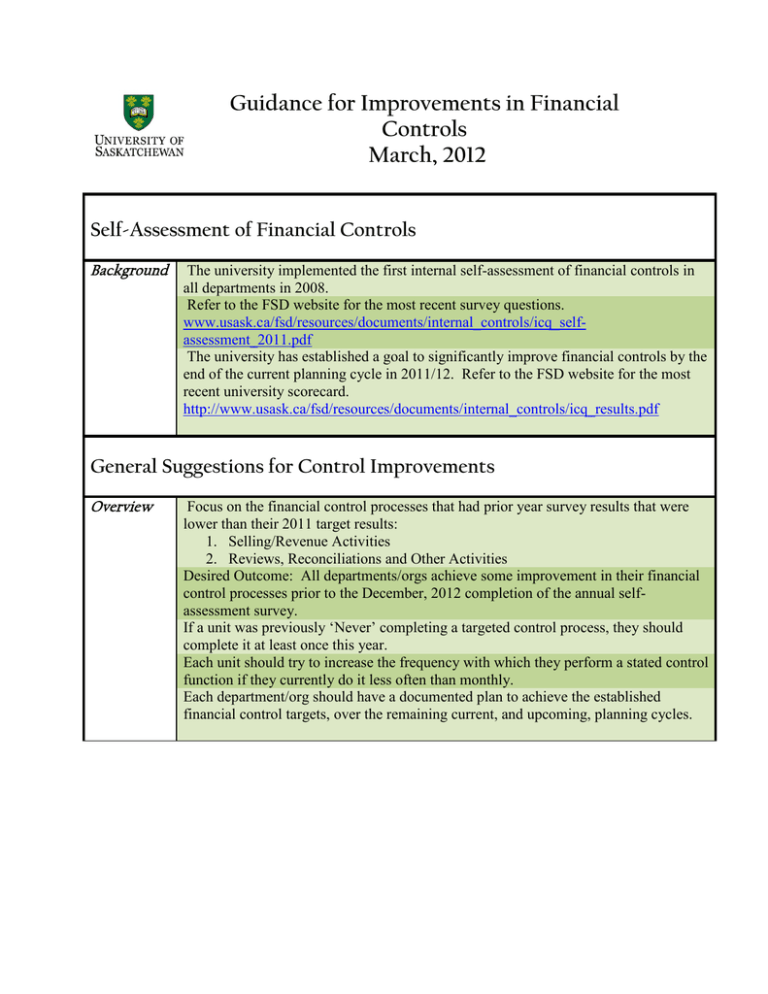

Guidance for Improvements in Financial Controls March, 2012 Self-Assessment of Financial Controls Background The university implemented the first internal self-assessment of financial controls in all departments in 2008. Refer to the FSD website for the most recent survey questions. www.usask.ca/fsd/resources/documents/internal_controls/icq_selfassessment_2011.pdf The university has established a goal to significantly improve financial controls by the end of the current planning cycle in 2011/12. Refer to the FSD website for the most recent university scorecard. http://www.usask.ca/fsd/resources/documents/internal_controls/icq_results.pdf General Suggestions for Control Improvements Overview Focus on the financial control processes that had prior year survey results that were lower than their 2011 target results: 1. Selling/Revenue Activities 2. Reviews, Reconciliations and Other Activities Desired Outcome: All departments/orgs achieve some improvement in their financial control processes prior to the December, 2012 completion of the annual selfassessment survey. If a unit was previously ‘Never’ completing a targeted control process, they should complete it at least once this year. Each unit should try to increase the frequency with which they perform a stated control function if they currently do it less often than monthly. Each department/org should have a documented plan to achieve the established financial control targets, over the remaining current, and upcoming, planning cycles. Specific Suggestions for Control Improvements ICQ#4Recording Sales Invoices in UniFi ICQ#8Procedure For Authorizing Credit to Customers ICQ#9External NonCash Sales Recorded as Accounts Receivable All sales invoices should be recorded in UniFi. Post all sales invoices to UniFi in a timely manner, ideally within one business day of the sales transaction date (the date that the applicable goods and/or services were provided to the customer). Existing customer credit authorization procedure should be documented in writing, whatever the current procedure is. Where procedure does not currently exist, develop a documented customer credit authorization procedure if you make sales to customers on credit. Prepare sales invoices for all completed customer sales orders. Refer to the university website for assistance on invoicing procedures: 1. External Sales Activity-Invoicing Procedures: www.usask.ca/fsd/resources/documents/external_sales_activity.pdf 2. University’s Accounts Receivable Invoice template and ‘Help’ commentary: www.usask.ca/fsd/resources/forms/ar_invoice_template.xls 3. Accounts Receivable Invoice Guidelines & Procedures: www.usask.ca/fsd/resources/guidelines/procedures/nonstudent_accounts_receivable_invoice_directions.php All non-cash sales invoices should be recorded to accounts receivable in UniFi, by journal voucher (see example below): C 1 1 1 1 1 F Your fund Your fund Your fund 100052 100134 O Your org Your org Your org Your org Your org A 11001 56001 56002 20101 20103 P Program Program Program Program Program Total Debit 1,100 Credit 1,100 1,100 500 500 50 50 Receivable Product Sale Service Sale GST collected PST collected Refer to FSD website for assistance in preparing a journal voucher in UniFi U of S - Financial Services Division - College/Depts/Research - UniFi - UniFi Manual ICQ#11-Aged Accounts Receivable Trial Balance prepared and reconciled to UniFi Prepare a monthly aged accounts receivable trial balance (see suggested format below): Customer Customer1 Customer2 Customer3 Total 0-30 Days 100.00 100.00 31-60 Days 850.00 61-90 Days 91-120 Days 120+ Days Total 85.00 50.00 35.00 1,178.69 950.00 1,228.69 120.00 935.00 85.00 1,178.69 2,298.69 ICQ#12Receipt of advance payments recorded as Deferred Revenue Reconcile/agree the month-end aged accounts receivable trial balance total to the month-end balance in the applicable UniFi fund account #11001. If this control procedure is being performed less frequently than monthly, begin to increase the frequency of completion on a monthly basis, prior to the end of the 2012-13 fiscal year. Definition: ‘Deferred Revenue’ represents monies received from customers for which the applicable work (sale of goods and/or services) has not been performed or provided prior to the date of receipt of the monies. It is recorded in a separate liability account as the university could be required to return the monies if it is unable to provide the customer with the goods and/or services. Cash receipts of this nature should be recorded on the Daily Cash Report as a credit to UniFi account # 22002 (Deferred Revenue) in the same fund as the revenue would be recorded. When the applicable goods and/or services are supplied to the external customer a journal voucher should be processed in UniFi to move the cash receipt from Deferred Revenue to the appropriate sales category. C 1 1 1 1 1 F Your fund Your fund Your fund 100052 100134 Total O Your org Your org Your org Your org Your org A 22002 56001 56002 20101 20103 P Program Program Program Program Program Debit 1,100 Credit 1,100 1,100 500 500 50 50 Deferred revenue Product Sale Service Sale GST collected PST collected ICQ#46Documented Unit-Specific Business Processes and Procedures Document all unit-specific business processes and procedures, and ensure that they are readily available to all unit staff for reference. Documented unit-specific processes and procedures may include: mail opening, daily cash report reconciliation, equipment inventory, invoicing, accounts receivable reconciliation, authorization of credit to external customers, monthly transaction review and reconciliation, month-end supervisory review, etc. If procedural documentation has not yet been developed in the unit, plan to document one specific process or procedure. Create a work plan to schedule the development and documentation of additional business processes and procedures, prior to the end of the 2012-13 fiscal year. ICQ#48Reconcile SubLedgers to UniFi Account Balances Prepare monthly reconciliations of all sub-ledger balances to the corresponding month-end fund balances in UniFi. This applies to all sub-ledgers including accounts receivable, property and equipment, inventories for resale, etc. If the sub-ledger reconciliations are being completed on a quarterly, semi-annual, or annual basis, develop a plan to progress towards performing them monthly. ICQ#49‘Budget vs. Actual’ Financial Reviews If the unit does not have a current process for performing ‘Budget vs. Actual’ financial reviews: 1. On a timely basis following each month-end close, download the unit’s Operating Statement report from FAST to Excel. 2. Revise the Excel worksheet to include a ‘Variance Explanation’ column, which will be used to document explanations of significant variances, on a ‘per account’ basis, between the ‘Actual YTD’ and ‘Annual Budget’ figures. ‘Budget vs. Actual’ financial analyses should be reviewed by the responsible department head/manager. If the reviews are currently performed less frequently than monthly, develop a plan to perform monthly financial reviews by the end of the 2012-13 fiscal year. ICQ #50All reviews and reconciliations of unit financial reports are documented in writing. Documentation Suggested documentation format options (one or more of the following): of Financial 1. Hard copy of the prepared/reviewed reconciliation or report. Reviews and 2. Email confirming the reviews performed. Reconciliations 3. Word or Excel document detailing the completed reviews and/or reconciliations. Appropriate documentation should include: 1. Name of preparer and reviewer. 2. Date review and/or reconciliation was completed. 3. Names of the reconciliations or reports that were prepared or reviewed. 4. Details of the review process. 5. Queries, Variances or irregularities identified during the review or reconciliation. 6. Details of subsequent corrective action taken. ICQ#55Supervisory Financial Reviews Recommend that College Dean or Unit Director perform documented monthly review of the following Crystal Reports, if the College/Unit does not currently have other appropriate financial review processes in place: 1. Report # 4990S-College/Unit Report of Financial Activity by Fund Roll Up by Department, OR 2. Report # 4992S-College/Unit Report of Revenue and Expense by Fund. 3. Report # 4423-Salary and Benefits. Recommend that College/Unit department heads perform documented monthly review of the following Crystal Reports, if the department does not currently have other appropriate review processes in place: 1. Report # 7328-Department Report of Revenues, Expenditures and Fund Balances by Fund Roll-Up. 2. Report # 4423-Department Salaries and Benefits (by employee). 3. Report # 3917-Year To Date Actuals by Financial Manager If these reviews are completed less frequently than monthly, develop a plan to implement monthly financial reviews by the end of the 2012-13 fiscal year. University Contact for Further Information Internal Controls and Process Improvement Support Greg Thorimbert Financial Analyst, Financial Reporting 966-2641 greg.thorimbert@usask.ca