Practice ENROLL TODAY! Presented by:

advertisement

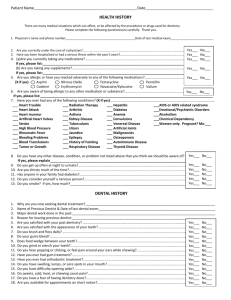

Presented by: CDSPI is a not-for-profit Canadian financial services organization whose members are the CDA and nine provincial dental associations and territories. CDSPI operates for the benefit of dental professionals and as such, is pleased to collaborate with accounting, legal, human resource and other business professionals to bring you this highly customized practice management program. Co-presented by: ENROLL TODAY! Name: _____________________________________ Please Circle: (D) (H) (T) (A) Address: City: _________________________ Province: _____ Postal Code: _____________ Email (Mandatory):________________________________ We respect your privacy and will not share your personal information with any outside source. Phone Number: ___________________________________ Practice Management Staff & Patient Communications Accounting, Legal & Tax Issues for Dental Professionals Financial Planning: Risk Management & Wealth Building CDSPI is providing for a 10% discount on this seminar. This program has been designed for dentists to enhance their knowledge and understanding of the business of dental practice ownership in the following areas: Effective Communication at Work LEARNING HIGHLIGHTS: ☐Dentist: $315 $283.50 + 5% taxes = $297.68 ☐Auxiliary: $157.50 $141.75 + 5% taxes = $148.84 CE Credits: 6.5 Fees include: continental breakfast, lunch, refreshments and snacks Dietary restrictions: ___________________________ • Understand the three major communication styles; • Develop techniques to communicate assertively; PAYMENT INFORMATION: Payable by Visa, Mastercard, or Cheque • Speak effectively when conversing about conflict; Name:_____________________________________ • Recognize the barriers that can get in the way of listening. Card #_____________________________________ PRESENTING EXPERT: Diane Knoll, Morneau Shepell Diane specializes in leadership and team development, emotional intelligence and personal performance. She brings many years of experience in analyzing, designing, and facilitating training and development programs. Diane has been coaching leaders, from front line to senior management, since 2007. Her career includes experience in the private and public sectors including education, finance, mining, program management, and leadership development and performance management. She is a graduate of the Royal Roads University Graduate Certificate in Executive Coaching and has achieved her professional coaching certification level (PCC) through the International Coaching Federation. She is a certified practitioner in the Myers Briggs Type Indicator (MBTI), Facet5, Emotional Intelligence and 360 feedback instruments. Expiry Date: ________________ Signature:___________________________________ Amount Authorized:___________________________ Make Cheque payable to: College of Dentistry University of Saskatchewan Mail Cheque To: Attn: Jason Korte 105 Wiggins Road Saskatoon, SK S7N 5E4 Fax application to: 306-966-5590 REGISTER ONLINE: http://www.usask.ca/dentistry/alumni/continuing-education.php The University Of Saskatchewan College Of Dentistry in collaboration with CDSPI, is pleased to offer a practice management seminar designed for dentists who own their own practice or associates who are considering becoming a practice owner. CDSPI has modeled this program around a panel of experts in specialized fields who will share their expertise and suggest best practices across a broad range of topics related to managing a dental practice effectively. SATURDAY, JUNE 4, 2016 8:30AM – 4PM University of Saskatchewan Leslie and Irene Dube Theatre (Room 1150) E Wing Health Sciences Building 107 Wiggins Road Saskatoon, Saskatchewan S7N 5E4 expanding their business. A trusted advisor, Jason works closely with clients to develop a process that will take them to the next level of their business. Accounting, Legal & Tax Issues for Dental Professionals Jason earned a Bachelor of Commerce degree from the University of Saskatchewan, has received his Chartered Accountant (CA) designation and is certified in Strategic Performance Management. Active in his profession, he also serves on the boards of both the Canadian Association of Family Enterprise (CAFÉ) and Farm in the Dell. LEARNING HIGHLIGHTS: This presentation will cover a number of accounting, legal, and tax issues of interest to dental professionals at all stages of their career. Topics to be covered include: • • • • • • • • Benefits of practicing through a professional corporation and the process of incorporation; Effective tax structures for practice through a professional corporations, including a discussion of holding corporations and family trusts; Associate fee sharing agreements - important clauses to consider from both the operator’s perspective and the associate’s perspective; Key considerations for the drafting of cost sharing agreements; Purchasing or selling a practice – tax & legal issues, including key clauses for both the vendor and the purchaser to consider; How to avoid being classified as a ‘personal services business’ for tax purposes; Best practices for records and documentation; and What to do if your practice is subject to an audit by the CRA. PRESENTING EXPERT: Erin Bokshowan is a lawyer with MacPherson Leslie & Tyerman LLP, and specializes in corporate law and tax law. Erin assists clients at all stages of the business cycle, from incorporation to winding-up, ensuring all transactions are undertaken in a taxefficient manner. She has a great deal of experience advising professionals, including dentists and orthodontists. She provides advice on the incorporation of professional corporations, the preparation of associate fee sharing agreements and cost sharing agreements, and the purchase and sale of dental and orthodontic practices. She also assists clients in general estate planning matters, including the preparation of wills, powers of attorney, and advance health care directives. PRESENTING EXPERT: Jason Watt, CA, is a Partner and Business Advisor within MNP’s Assurances Services team in the Saskatoon office. Jason offers customized assurance and business advisory services primarily to owner-managed businesses. He has extensive experience working with healthcare professionals, implementing tax-efficient structures with a focus on tax minimization, and creditor proofing aspects of his clients’ organizations. Jason takes pride in working with clients to help them overcome hurdles, meet tax compliance and achieve both their personal and business goals. Jason has over 20 years of experience providing practical options for his clients, whether he is engaged in the sale of a business, succession planning or PRESENTING EXPERT: Kurt Wintermute is the senior tax litigator and head of the tax litigation practice area at MLT LLP. Kurt has extensive experience representing corporate and individual clients before all levels of court and taxation agencies regarding federal and provincial tax issues. Kurt advises clients and litigates matters involving corporate and personal income tax, goods and services tax, voluntary disclosures, tax evasion, employment insurance, Canada Pension Plan and Customs issues, provincial sales tax, provincial royalties, and commodities tax. He has successfully challenged a number of Canada Revenue Agency and provincial tax reassessments, most recently involving Canadian residency issues and the Canada-U.S. treaty tie breaker rules, the GAAR and the kiddie tax, Saskatchewan mineral royalties, transfer pricing penalties, employee benefits and the deductibility of resource surcharges. Kurt has extensive experience in achieving cost-effective resolutions of tax disputes on behalf of clients with federal and provincial taxation agencies and before the Tax Court of Canada, Superior Courts of the Provinces and Appellate Courts. PRESENTING EXPERT: Susan Roberts, BA, FLMI, ACS, AIAA, CHS™ Vice-President, Insurance Advisory Services, CDSPI Susan joined CDSPI after graduating with a Bachelor of Arts degree from the University of Western Ontario. She leads a team of more than a dozen insurance advisors and insurance claims support staff. Susan has over 20 years of experience helping dental professionals with their insurance needs. She is licensed as a general insurance broker and life insurance agent and is the Deputy Principal Broker at CDSPI Advisory Services Inc. Susan is fluent in French and is licensed in Quebec as a Damage Insurance Broker and as a Financial Security Advisor and Advisor in Group-Insurance Plans. Patient Communications LEARNINGHIGHLIGHTS: • • • • Understand that there is more to communicating than talking What are barriers to effective communication Discuss ways to deliver information patients both in and outside of challenging situations Review some common scenarios and reflect/discuss how to communicate effectively within them PRESENTING EXPERT: Alyssa Hayes BDent, MSc, FRCD(C) Assistant Professor, Dental Public Heath University of Saskatchewan - College of Dentistry Financial Planning LEARNING HIGHLIGHTS: • • • • • How to develop a goals-based investment plan to achieve financial independence; Mitigating office and professional risks – what, when and how to use insurance to protect against the risk of a catastrophic loss; Navigating your way through investments, insurance and the business of ‘advice’; Strategies for income splitting and maximizing your income in a tax efficient manner; and How to safeguard your estate to ensure your assets are passed on to the people you care most about. PRESENTING EXPERT: Ron Haik, MBA, CFP®, FMA, FCSI®, CIWM®, TEP Vice President, Investment Advisory Services, CDSPI Ron has practiced in the financial services industry over 20 years. He gained a breadth of experience in a variety of roles, such as Financial Planner and Investment Advisor in the areas of domestic and offshore planning for the High Net Worth segment. As Vice-President of Investment Advisory Services, Ron leads a national team of Certified Financial Planner® (CFP®) professionals who serve the Canadian dental community. Ron holds an MBA with a double-major in finance and financial services from the Schulich School of Business. Alyssa Hayes is a Dental Public Health specialist. She is an Assistant Professor at the College of Dentistry, University of Saskatchewan. She completed her dental training in Sydney, Australia where she remained to work for several years prior to returning home to complete her specialty training at the University of Toronto. Dr. Hayes is currently the President of the Canadian Association of Public Health Dentistry and the North American co-chair for the Alliance for a Cavity-Free Future. FOR MORE INFORMATION CONTACT: Jason Korte Continuing Professional Education Coordinator College of Dentistry - University of Saskatchewan Phone Number: 306-966-5662